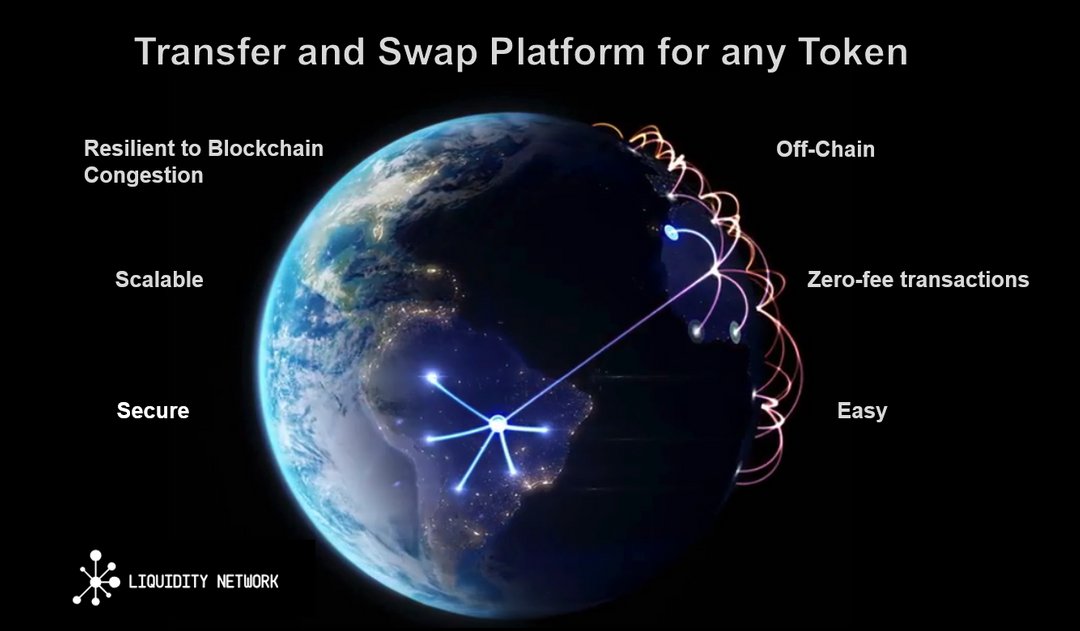

Liquidity Network - Transfer and Swap Platform for any Token

Introduction

Making an exchange has always been very important in the economy as we know it, at first it started with barter, you gave an object of importance to another person and that person gave you an object with importance for you, then came the exchange of coins and bills, you gave a certain amount of coins or bills and in exchange you received some valuable item, food or some necessary material, but since the invention of cryptocurrencies, mainly Bitcoin, it has always been necessary to manage some page or intermediary to make some exchange currency.

Before there were cryptocurrencies on many occasions to make an exchange needed an intermediary or custodian, who were responsible for managing the money of both parties to make such a transaction, then with the appearance of the chain of blocks have appeared accounting books decentralized, obtaining in this way financial transactions without any centralized intermediary.

After Bitcoin many cryptocurrencies have appeared following the Bitcoin code, with different modifications, up to now more than 1400 cryptocurrencies are estimated, and they continue to develop new cryptocurrencies, so the exchange between cryptocurrencies is of great importance today. It is increasingly common for companies and people to work with cryptocurrencies, because for many it is their weekly or monthly payment currency and even daily, so these people need to be in constant exchange between cryptocurrencies and also from cryptocurrencies to any currency they need, and these people or companies need to have a correct liquidity in their businesses to have the ease of converting their assets into another cryptocurrency or money.

Problem Overview

Despite the great impact that cryptocurrencies currently have and the massive adoption they have had, there are several problems that still exist around them, specifically in the area of exchanges due to the low number of transactions per second, as it is in the Bitcoin case that are 10 transactions per second being a relatively low number for the demand that exists and is that if you want to reach a higher adoption and confidence of cryptocurrencies you need a greater number of transactions per second, to achieve a higher scalability, adoption and solve all transactions that users want.

Also in the exchanges you can find funds from blocked users by the platform in charge of making the exchange, which creates inconvenience and inconvenience for the users, because in a system as volatile as cryptocurrencies are, it can not be arranged of cryptocurrencies can generate losses for the user, we also find very complicated designs to understand, where it becomes a difficult task to exchange cryptocurrencies.

And also to make contracts among other people that are visible to everyone in the chain of blocks, because something that characterizes blockchain is that every movement made is visible to everyone, something that can be problematic or annoying for some users, because when it is about a contract that you want to keep between two people only, being visible can be a problem.

Liquidity Network

"Is a non-custodial, financial intermediary offering and exchange services."

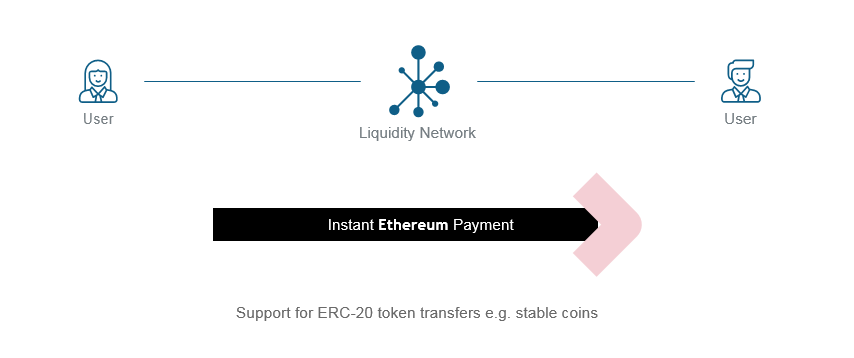

It is a Liquidity Network built on the chain of blocks of Ethereum, to become a company that users choose for their confidence, scalability and excellent performance when making exchanges. Liquidity Network has come to solve problems of speed and security, because currently the number of transactions per second that can be performed is low and it is insufficient to cover the demand that there is from the users, for this reason Liquidity Network has been commissioned to unite the best of two worlds because it takes advantage of the centralized computing power thus obtaining the speed of a centralized exchange and the decentralized blockchain system, having the security of a decentralized exchange.

The Liquidity Exchange

"Is a non-custodial off-chain exchange build on top of the Liquidity Network."

Liquidity Network is proud to present its innovative solution for non-custodian financial intermediaries, this will give full control to the users of their funds through the use of any intelligent contract in order to decentralize the ledger of the block chain. The exchange of liquidity is also designed to be free of custodians, so that exchanges can be made outside the block chain.

Liquidity Ecosystem

- Enabling Micro-payments and Small Value Transfer (SVT)

- Instant Payments and Exchange

- No rigid locked funds

- Simplicity

- Transparency

- Privacy

- Security

- No Custodian

- Flexible Fees

- Generic

- Peer Reviewed Research

These are the key points within the ecosystem of Liquidity Network, are those that create a difference within the platform, because they offer instant payment services, facilitating in this way the exchange of cryptocurrencies, because in such a volatile market exchanges of quick way you can avoid losses, in addition Liquidity Network there are no blockages of funds, so that users will not have problems by not being able to move their assets as there is no blockage in this platform of exchanges, also has the security of the chain of blocks and fees are paid by the sender or receiver. A point worth mentioning of Liquidity Network is that it is built in the chain of blocks of Ethereum and can be portable to any blockchain.

Low transaction costs - Off-Chain Hub

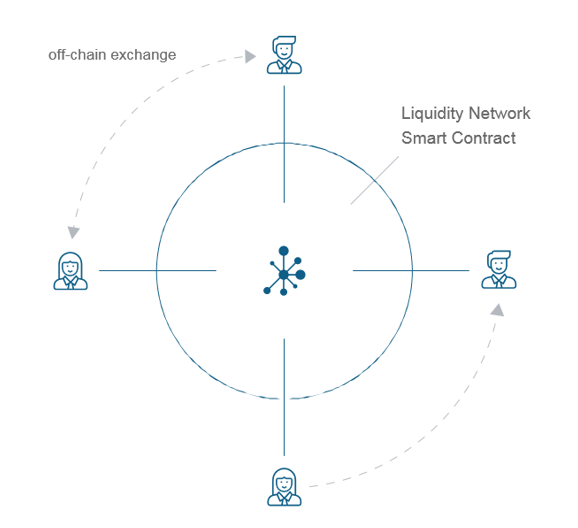

Architecture / Off-Chain

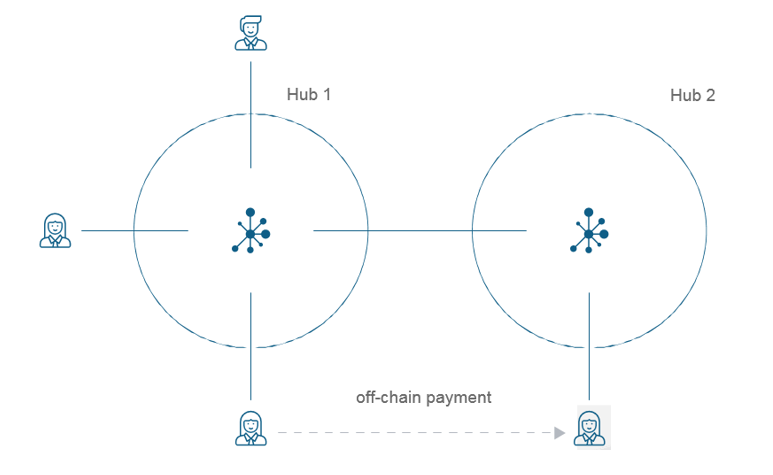

Liquidity Network focuses on the notion of universal hubs, and allows users to join a hub, as a Hub is the one that allows users to connect with each other, this within the architecture of Liquidity Network offers users a greater possibility of carrying out transactions with a greater number of users, with any other part of the hub immediately and this happens outside the chain of blocks, so that being out of the chain generates costs that are significantly lower than those normal transactions that happen within the chain, this is something of great value for users to be able to count on lower costs than what they are normally accustomed within the chain of blocks, but without leaving aside the security offered by the system decentralized of the blockchain because in Liquidity Network the decentralized transactions are an important factor.

This hub design is innovative in the market because user funds are now accessible to a large number of users within the hub, and equally offering the security of having funds far from the reach of other users through the decentralized protection offered by the chain of blocks. This design is currently implemented for Ethereum and a large number of users have access to payment processors.

Through the innovative architecture of Liquidity Network, they have been in charge of solving several points that we currently have and that were a problem when making exchanges and it turned out to be a problem for a greater adoption and scalability of cryptocurrencies, which are:

There are no rigid locked funds, users do not have to worry about their funds and thus have no losses in a market as volatile as the cryptocurrency, the user is the only one who can manage their funds.

Simple design and routing, ideal for those new users because it is not necessary to have a great knowledge of cryptography to be able to use this platform.

Establishment of free and instantaneous channel, it is almost immediately that when starting within this design you can begin to make the exchanges or contracts without any wait.

Non-custodial off-chain swaps, the best way to make contracts among other users privately and without custodians, only the user is able to manage their funds and also to be out of the chain the fees are lower than the contracts inside the chain.

Liquidity Network is not Centralized / (de-)centralization

"The Liquidity Network is designed to become a redundant and decentralized network of hubs."

There are three important points or questions to touch in this part, that any new user would like to know about the Liquidity Network in order to know them better, which are:

1.-Who is the owner of the funds? At all times the user will always be the only one in possession of their funds (with the private key), Liquidity Network will never be in contact or will have the funds of the users in power, which will prevent a freezing of the Liquidity Network and in addition no user will be able to have them, avoiding in this way any possible theft of users. No hub could steal user funds because "the hub is neither a bank nor a custodian, it is only the facilitator for the connection between users."

2.-How redundant is a system? Liquidity Network design seeks that a large number of hubs can be connected to a network of hubs in order to provide redundancy.

3.-Can a central entity censor? Hubs can make the decision not to forward payments, if that becomes the case then the user would only have to eliminate their funds from the hub's smart contract and join another hub.

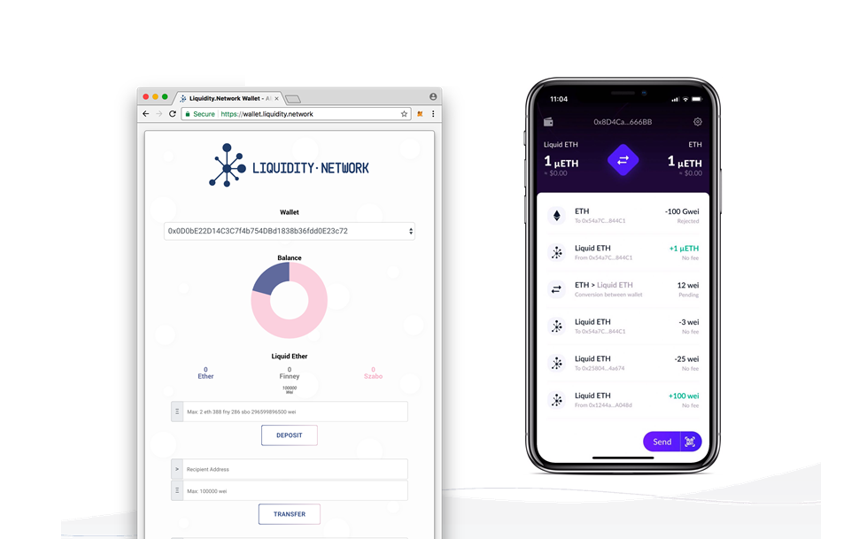

Web and Mobile Wallet

Liquidity Network Wallet - IOS

Liquidity Network Wallet - Android

Liquidity Network and its key components

Every great company has its unique characteristics that make them great and innovative and that lead them to be successful in the market, for Liquidity Network it is not the exception because it has two key components that make its design unique and create an ideal operation that is what is sought, these key components are Nocust and Revive.

Nocust

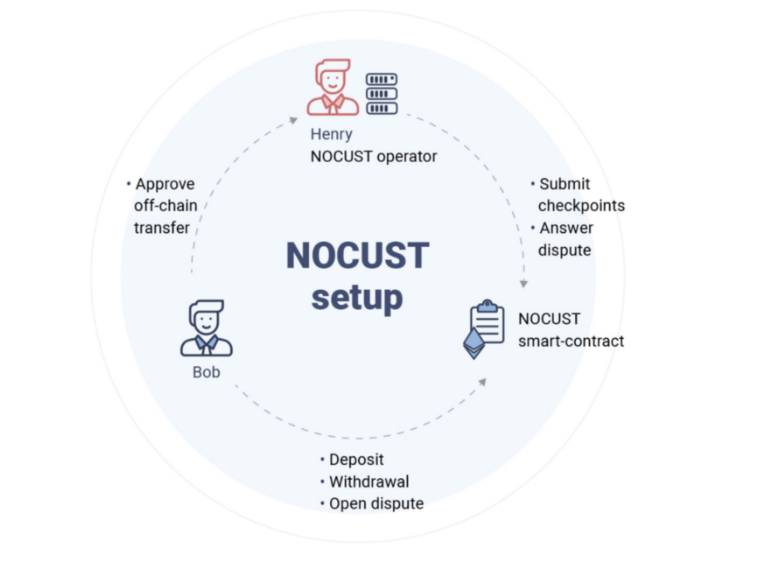

"NOCUST is a specification for secure N-party payment hubs with improved transaction utility, cheaper operational costs and leaner user enrollment."

How does Liquidity Network come to this tool? It was to solve the problem that was in the market to handle large transactions and micro-transactions, because in Bitcoin the user was the custodian of their funds instead of trusting a financial institution, but with the limitation of carrying out transactions in the chain blocks without permission because it caused high prices generating problems of agreements, for that reason Liquidity Network sought the solution for this problem and came to obtain financial intermediaries without custody and thus offer users the confidence and full control of their funds through the use of smart contracts to decentralize the blockchain ledger.

Nocust is a payment hub that allows non-custodial transactions outside the block chain, thus achieving an operation as if a custodian existed but with greater confidence for the user. In addition, less expensive transactions can be made through a Nocust Hub Off-Chain, allowing further transactions in a secure way in a single payment hub and in this way use payments freely among the members of the hub. Nocust hub can reduce the operating costs of hub payment channels, so that:

Liquidity Network offers with its Nocust the power to build an innovative payment hub to make payments outside the chain, where they present a scheme where they show the balances of the users.

If the payment hub is reliable, additional funds blocked by the user will not be necessary, Liquidity Network shows how it can be managed efficiently in bulk.

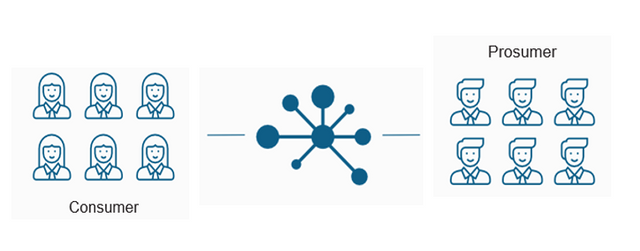

In the Liquidity Network Ecosystem, user funds that have been placed within a payment hub can be used to make any payment to another member of the payment hub.

Users within a payment hub securely keep custody of their funds.

Maintain control of private keys

With Nocust and Liquidity Network it is possible for the user to keep their own key safe and in this way the same user to be their own custodian. With the payment hubs based on Nocust, the user has the power to carry out transactions outside the block chain, thus having the advantage of having an immediate transaction confirmation, and reducing the load on the block chain and being able to scale to billions of transactions per second.

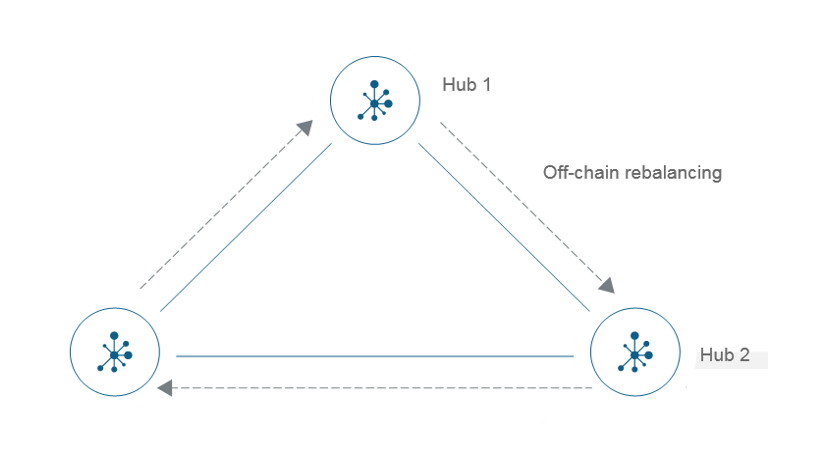

Revive: Rebalancing Ou-Blockchain Payment Networks

Liquidity Network has been in charge of presenting the first solution that allows users in a network of channels to rebalance securely channels outside the block chain, because through Revive the user is able to supply their funds without have to leave the channel, thus avoiding the need to return to the block chain and save high costs in the rates within the chain, being in this way more scalable and lower cost, in addition Liquidity Network offers a test of implementation and evaluation for the Ethereum network. This is the first rebalancing scheme for payment networks outside the block chain that exists today, with Liquidity Network being an innovator in the market.

Revive has been in charge of contributing to the market the following characteristics:

For Liquidity Network, "Revive is the first rebalancing scheme for payment channels." This gives users the option to be more versatile when working with their channels, offering them the ease of using another of their channels to rebalance a specific channel having a better performance.

Revive also offers an incentive for those participants who are honest, because for those users the rebalance with Revive is free, increasing in some way the scalability of the transactions in the block chain.

Channels and payment networks

The channels facilitate making a payment, because it is only necessary to establish the payment channel between pairs between two parties, maintaining and updating it privately, saving the need to write these transactions in the chain of blocks, but guaranteeing that users can spend only legitimate amounts and the state of the payment channel is written in the blockchain global ledger when it wishes, and also with this system is not necessary the direct service of blockchain miners, which facilitates the use of transactions with low rates, this system is highly innovative in the market because it saves users time, which in a system as volatile as the cryptocurrency is very important, as they would not have to waste time going to the chain of blocks to reestablish the channel and you can save high fees when performing these operations.

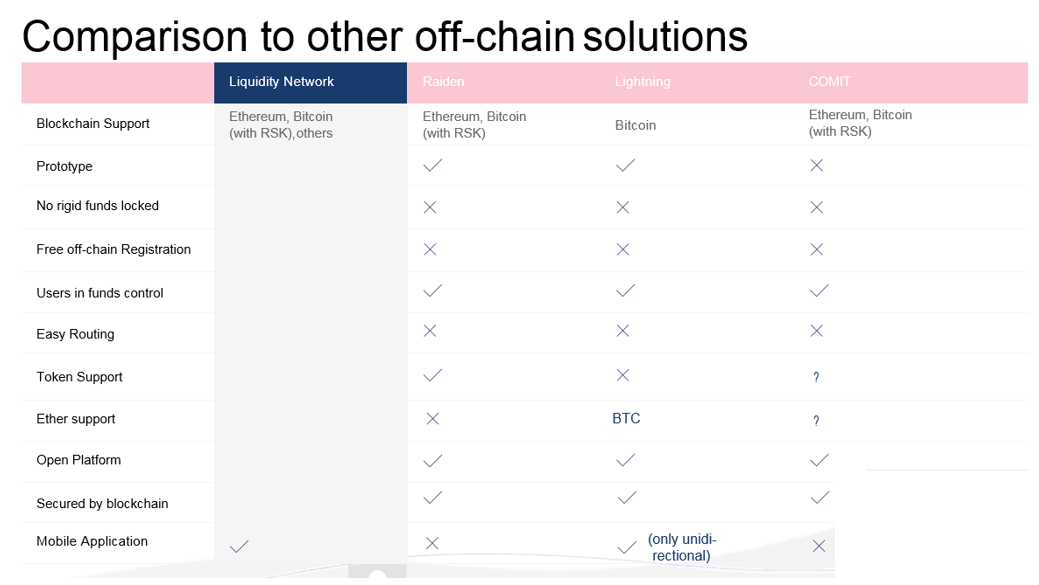

Designs of existing payment networks

Duplex micropayment channels, "support routed payments that can be confirmed without confirmation delay."

Lightning, is similar to the double micropayment channels. Something very important to emphasize in Lightning is that they promote the punishment to obtain in this way an honest behavior on the part of the users and for those who do not comply with an honest behavior, those who do have it can claim the funds of the dishonest of the channel in question.

Raiden, they plan to use the same proposed concept of Lightning Network, but in the chain of blocks of Ethereum, and it is estimated that the costs would be much lower in Raiden as opposed to using the chain of Ethereum.

Sprites, are payment channels designed for Ethereum, this channel aims to minimize the most unfavorable costs of indirect payments to be made outside the chain of blocks.

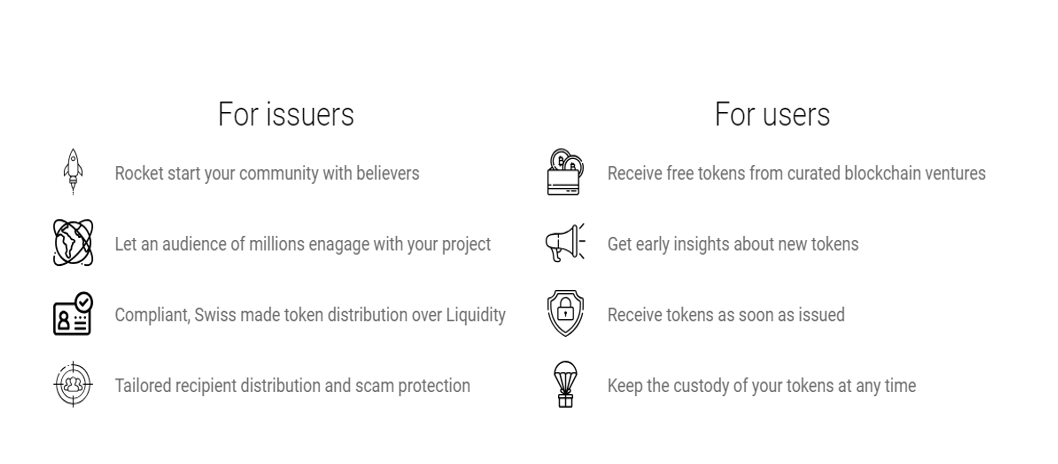

Airdrop powered by Liquidity

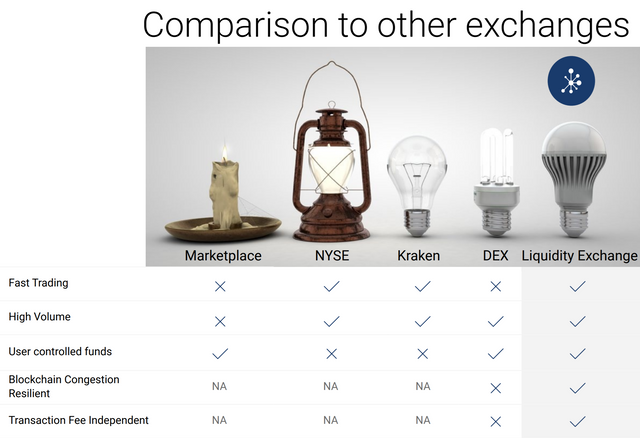

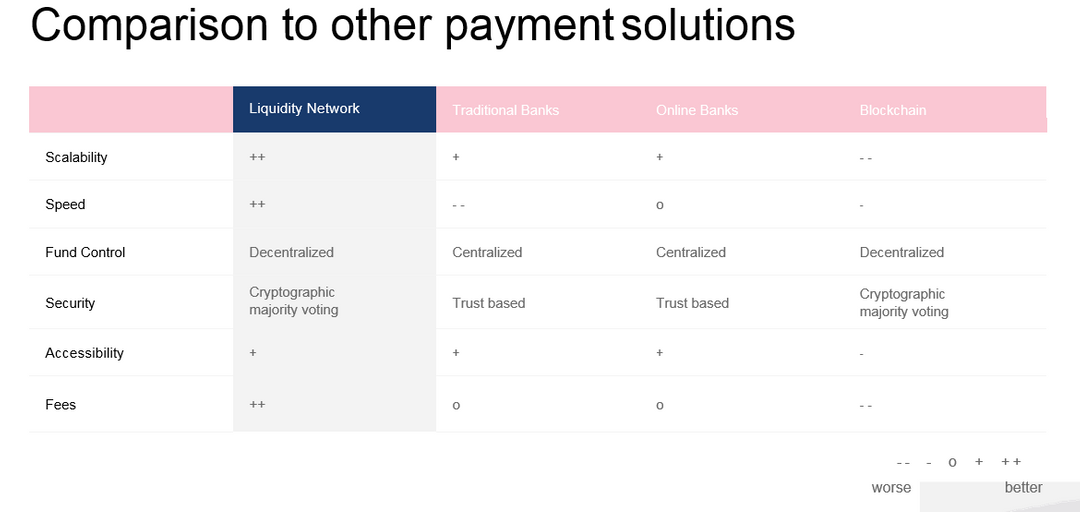

Comparison to other exchanges

With the appearance of cryptocurrencies, many changes have been experienced, mainly in the adoption of cryptocurrencies and the need to carry out transactions and exchanges with the crypts that are managed, whether they are the main ones and of greater value, even the smallest and smallest ones value but of equal importance in the market and for users, but there are many platforms that do not offer the best service currently, because we found a low number of transactions per second and with the need to register everything in the blockchain, and many of these platforms are custodians and even freeze user funds causing problems.

In Liquidity Network this is not a problem, because they have been responsible for solving the low number of transactions per second by uniting the centralized computing power and the decentralized nature of blockchain, having the best of both worlds, speed and security. And in Liquidity Network the user is their own custodian and without having the worry that their funds are frozen, because only the user has control of the funds.

Why choose Liquidity Network?

As mentioned in the previous point, Liquidity Network has been responsible for solving a large number of problems that the user usually finds today, not to mention its two biggest key points which are Nocust and Revive, who help to drive Liquidity Network to become a big player in the market and a very innovative company, because being able to carry out transactions outside the block chain for greater speed and low costs while maintaining the decentralized security of blockchain personally seems to me a great point in favor and with Its Revive algorithm that allows hubs to rebalance the out-of-chain payment channels has everything to be taken into account from now on.

Liquidity Network - Token (LQD)

The token that Liquidity Network will issue will be an ERC20 token called LQD which will be used as an integral part of the ecosystem outside the chain, but this token is not an obligation for use within the ecosystem, this token allows the user to pay for additional services such as for example, channel monitoring, but any user is free to provide services in their own cryptocurrencies of choice. The LQD token would enter the scene mainly when the platform grows in the market, because it would be a greater number of users that would enter the platform and use the services of Liquidity Network and these could provide their services in exchange for the LQD token.

Case of use

Jane is an investor of cryptocurrencies, uses different pages where she invests in cryptocurrencies or sells them, many times she needs to exchange a cryptocurrency for others because it is the one she needs for the pages in which she invests, everything depends on how volatile is the market, but usually has problems with the exchange platforms that she uses, because of the few transactions that they execute and because of the slowness of these and without having to have custodians and someone else can manage their funds, which makes her nervous in case some theft happens.

But a friend of Jane tells him about a new platform that has been responsible for solving these problems, which is Liquidity Network that together with its innovative Nucost system these problems for which Jane suffered are things of the past.

Liquidity Network with its Nucost tool allows Jane to carry out transactions outside the block chain, without any custody and being the only one that has the authority over its funds, removing a burden from it and relaxing it knowing that its funds will always be safe , through this system and the Liquidity Network, Jane was able to carry out her transactions without any problem and with all the confidence possible, which is why since then Jane only uses Liquidity Network.

Use case — Money transfer

Use case — Purchase

Use case — IoT Sensors

Conclusion

This publication that I have presented has been to let you know about this innovative platform, which is Liquidity Network, and how through the content presented in this publication you can know what Liquidity Network is, its main characteristics and the visions that this platform has, and that without a doubt the Liquidity Network will impact the current market.

And it is that Liquidity Network offers the solution for many problems that we find today when making exchanges, either as the low number of transactions per second, the freezing of funds or custodians, of having to have a third party in the exchange, because with its key components which are Nocust and Revive are its innovations that help solve these problems, there is no doubt that Liquidity Network will have a great impact on the market and will be of great innovation for the blockchain system and of exchanges.

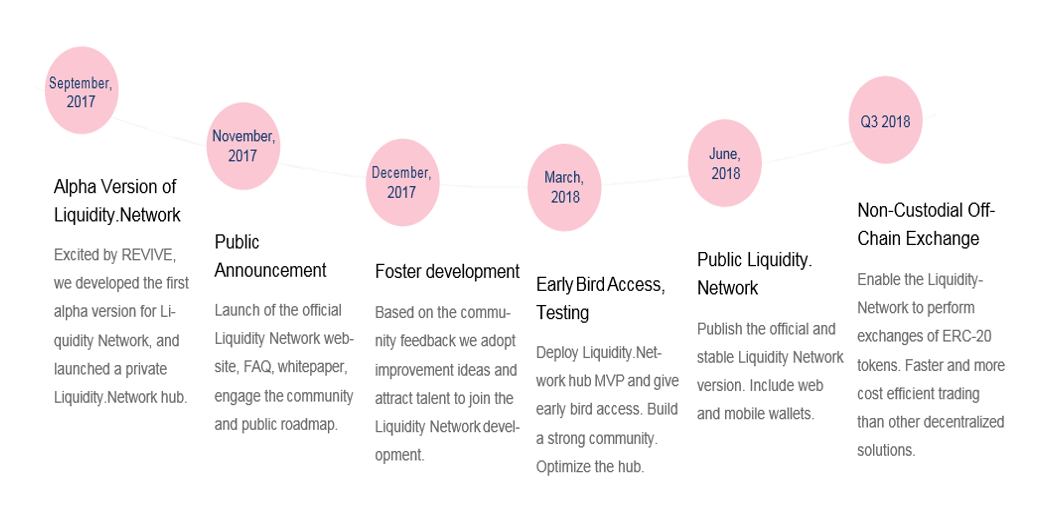

RoadMap

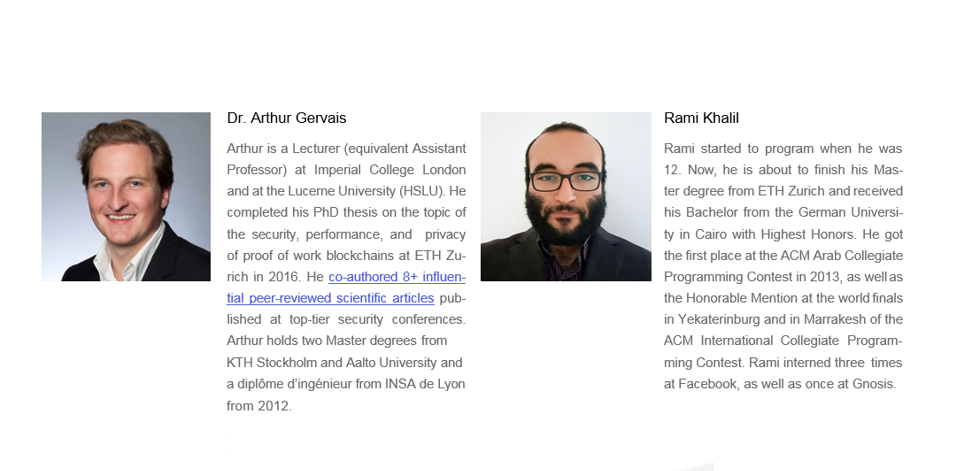

Team - Liquidity Network

Watch this video for more information

My Presentation

More Information and Resources

- Liquidity Network Website

- Liquidity Network Wallet

- Liquidity Network WhitePaper

- Liquidity Network NOCUST Paper

- Liquidity Network REVIVE Paper

- Liquidity Network Apple App Store (IOS)

- Liquidity Network Google Play Store (Android)

- Liquidity Network Telegram Group

- Liquidity Network Telegram Announcement

- Liquidity Network Twitter

- Liquidity Network Github

- Liquidity Network Blog

This contest is offered by @OriginalWorks if you want to participate go to:

Click HereTwitter Bonus

Click Herelqdtwitter2019

lqd2019

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by deyvich from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

Congratulations @deyvich! You received a personal award!

Click here to view your Board