DIGITEX FUTURES EXCHANGE– THE GAME CHANGER

First of all, you cannot talk about Digitex without first talking about Futures Markets. So, let’s begin by answering the question, “What is Futures markets?”

According to Wikipedia:

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts; that is, a contract to buy specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures markets provide partial income risk insurance to producers whose output is risky, but very effective insurance to commodity stockholders at remarkably low cost.

Despite the low costs, transaction fees are still significant on high volume, low profit margin futures trading strategies. They act as a constraint on the potential liquidity of futures markets by converting marginally profitable strategies into losing strategies after deducting commissions. These crippling commissions can easily make an otherwise profitable trader break-even or even a losing trader.

This is where Digitex Futures Exchange comes in.

Digitex is the first, commission free Futures Exchange on the blockchain. That’s a game changer. How can an exchange be free and still remain operational? How does it offset its maintenance cost? There is no way of answering these questions without touching upon the distinctive features of Digitex that set it apart from other exchanges.

• Zero Trading fees

Digitex will be using its own native cryptocurrency called DGTX token. So, instead of charging traders transaction fees, Digitex mints new tokens. This token will be used in all transactions in the exchange - profits, losses, margin requirements and account balances. This implies that traders must own DGTX tokens to participate in the commission-free, trustless markets on Digitex. Now, bearing in mind that traders would appreciate trading in futures markets without having to pay commissions, there will be a continuous influx of traders to the exchange, thereby ensuring continuous demand for DGTX tokens from traders. This enables the exchange to replace revenue generation from transaction fees by creating and selling a small number of new DGTX tokens each year.

• Decentralized Governance

This brand new revenue model imposes a small inflationary cost on all token holders on the understanding that commission-free and liquid markets will create demand for the DGTX token from traders that is greater than the inflationary cost of funding the exchange. But the traders get to decide on how many new DGTX tokens are issued and when, in order to cover the operational costs of running the exchange. This ensures that Digitex is well funded and operational.

• Decentralized Accounts

One of the pitfalls of futures markets is the holding of accounts’ balances by the exchange. This means that the exchange can access and modify traders’ accounts which can result to loss of money in the occasion of a hack. Digitex overcomes this hurdle by introducing Plasma protocol. Here, all account balances are held by a decentralized, independent smart contract on the Ethereum blockchain, not by the exchange. So, instead of depositing DGTX tokens by sending them to the exchange, traders will lock up an amount of DGTX tokens into a Plasma sidechain and that is their available to trade balance. In this way the trader keeps control of his/her account.

Other features of Digitex include the following:

• Large tick size

• Advanced technology

• Complete privacy

• Enhanced liquidity by using automated market makers

• Off-chain negotiations and on-chain settlements

• High leverage futures trading

• No auto deleveraging

For more information on the unique features of Digitex, go their website.

Normally, transaction commissions which break even or even turn to loss otherwise profitable trades, has a way of discouraging traders from trading more. Now, when a trader losses a trade, he/she does not only worry about the loss incurred in the trade, but also the transaction commission. This further restricts traders from investing more and taking risks. This also discourages small players (low-risk traders) in the futures markets into extinction and dissuades potential crypto traders from entering the futures market, thereby limiting the market to only big-time players.

Now, apart from the glaring fact that a zero commission exchange benefits traders enormously, Digitex offers a platform that not only facilitates commission-free trading, but also employs new revenue models and technologies to give her traders an exciting trading experience. So, the traders are able to maximize their profit margins without fear of commissions being deducted from their profits. This also reduces the dread of incurring market losses which usually comes with added transaction cost. This encourages them to invest more, emboldens small players in the market and also facilitates the influx of potential traders, both big players and small players, into the futures market even as they explore other provisions of the exchange.

To top it all, Digitex not only provides zero commission exchange and find a way of turning transaction fees to value adding utility by minting new tokens (DGTX tokens), it also uses decentralized governance by blockchain to give her traders power to democratically decide how many new DGTX tokens are issued and when, to cover the operational cost incurred. This means that the traders literally runs the exchange. And when traders have this kind of privilege, they will have more confidence in the exchange and will be able to invest and trade without fear.

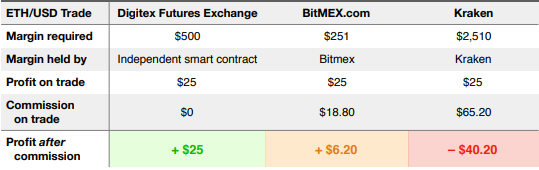

For Instance, consider the scenario below.

Source: Digitex WhitePaper, page 23

The above table shows an ETH/USD Trade on Digitex, BitMex.com and Kraken

On Digitex, Mr. John needs initial margin requirement of 5,000 DGTX ($500) to enter a trade. Account balance is held by an independent smart contract, not by the exchange. The profit from the transaction will yield $25, and since Digitex charges zero transactions fees on all trades, the profit after commission is deducted remains $25.

On the other hand, Mr. James on BitMex needs initial margin requirement of $251 to enter a trade. Account balance is held by BitMex. The profit from the transaction is $25, and since BitMex charges transaction fee of $18.80, the profit after commission is deducted is $6.20.

On Kraken, Mr. Ken needs initial margin requirement of $2,510 to enter a trade. Account balance is held by Kraken. The profit from the transaction is $25, and since Kraken charges transaction fee of $65.20, the profit after commission is deducted is –$40.20. Mr. Ken incurred a loss.

The difference that Digitex makes in futures markets is very glaring from the above instance. Mr. John who has the advantage of decentralized account, which means that the exchange can’t deduct transaction fees, will be more motivated to invest more than his counterparts.

It gets more exciting.

According to Dave Reiter, a proprietary trader:

Adam Todd and his team will go down in the history books for being the first ever commission-free futures exchange.

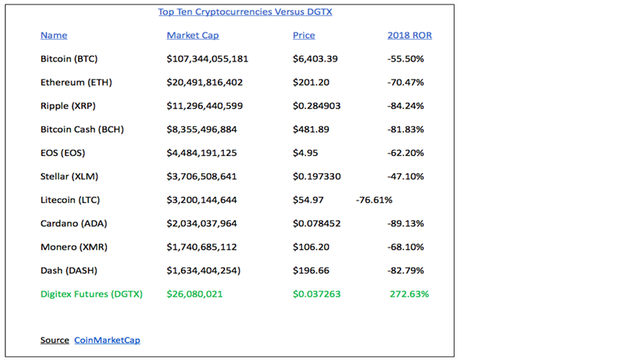

How is that possible? There is no way of predicting how far Digitex without first reviewing futures markets in 2018. Below is a table of top ten cryptocurrencies in comparison to DGTX.

Source: Digitex Blog

From the data in the table above, it can be deduced that DGTX beat all the top ten currencies in ROR in 2018. With such a strong and hopeful start, we can only expect better in the years to come.

Another important factor to consider in the prediction of how Digitex will fare in the nearest future is Momentum Traders. Momentum Traders are traders that take advantage of short-term price action in a stock. Momentum traders can buy and sell a stock the same day as far as the stock has high percentage or volume.

Now, when these momentum traders entered bitcoin in 2017, the price of bitcoin exploded and has since continued soaring. These traders play important role in expanding the liquidity of an exchange. From recent activities in Digitex, it can be speculated that momentum traders are taking position in the exchange. On September 8, 2018, $646,203 worth of DGTX tokens were traded according to data provided by CoinMarketCap. Once these momentum traders take position in Digitex, the price level will explode and keep soaring, there will be increased liquidity and Digitex will keep seeing better years.

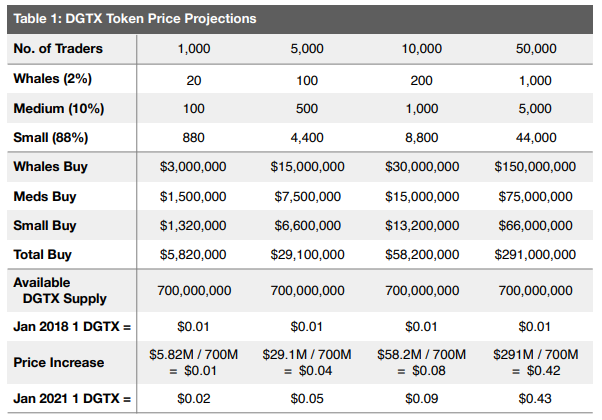

The table below shows a projection of the price of DGTX tokens:

Source: Digitex WhitPaper, Page 8

For 2019 precisely, prices are expected to increase as Adam Todd and his team put finishing touches to Digitex Futures Exchange to get it ready for launch in 2019. In 2020 and 2021, Digitex will keep increasing as traders rush to the new exchange. However, in 2021, as Digitex starts revenue generating token issuance to cover the cost of operation, the price level of DGTX will be affected but then will be negligible given the continuous influx of traders on the exchange.

I strongly believe that Digitex Futures Exchange is the new dawn the world of cryptocurrency has been waiting for. I believe Digitex will dominate in Futures Markets.

digitex2018

https://steemit.com/crypto/@originalworks/1250-steem-sponsored-writing-contest-digitex

digitextwitter

https://twitter.com/uzywhyte2/status/1041550618660417541

For more information and resources:

Wikipedia

Digitex Website

Digitex Blog

Digitex WhitePaper

To participate in the contest:

https://steemit.com/crypto/@originalworks/1250-steem-sponsored-writing-contest-digitex

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!

Congratulations @uzywhyte! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOP