Recent Options Activity - Profit of $450

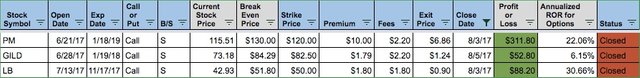

Last week, I took advantage of price drops and closed three covered calls. The calls were for Philip Morris, Gilead Sciences, and L Brands. All three contracts were profitable. I was tempted to let these expire, but all three had expiration dates that were more than 3-months out. A lot can happen in 3-months. So I chose to lock in profits and look for new trades.

Philip Morris was a long-term contract, expiring in 2019. I sold it when the stock was going way up. I figured the hype would settle and it has. I closed this and earned $311.80. The other two contracts were expiring in November of this year and January of 2018. I saw modest income of $52.80 from Gilead Sciences and $88.20 from L Brands. I'm confident that these two contracts would have expired worthless. But, I took the guaranteed profit now. Details of each trade below.

Philip Morris Covered Call

- Expiration Date: 01/18/2019

- Fees :$2.20

- Strike Price: $120

- Premium: $10

- Annualized ROR: 22.06%

- Realized Profit: $311.80

Gilead Sciences Covered Call

- Expiration Date: 01/19/2018

- Fees :$2.20

- Strike Price: $82.50

- Premium: $1.79

- Annualized ROR: 6.15%

- Realized Profit: $52.80

L Brands Covered Call

- Expiration Date: 11/17/2017

- Fees :$1.80

- Strike Price: $50

- Premium: $1.80

- Annualized ROR: 30.66%

- Realized Profit: $88.20

All told, I realized $452.80 in income on these three trades. So far for the month of August, I've made the same amount, $452.80 selling options. I expect to close a few more contracts before month end, that is if markets go the way I'm predicting. I also sold a new covered call against Philip Morris. The details of this trade are listed below.

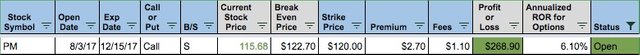

- Contract Length: 132 Days

- Opening Fees :$1.10

- Strike Price: $120.00

- Premium: $2.70

- Potential Annualized Rate of Return: 6.10%

- Expiration Date: 12/15/2017

- Potential Profit: $268.90

My realized revenue total from options this year is now $4,622. Check my options tracker to see a list of all open call and puts I have. I now have 11 open contracts, representing potential revenue of $3,113. Keep in mind that I rarely let contract expire. I usually close contracts when I have earned at least 50% of the total premium value. This is not a rule of mine, but I usually prefer to capture gains above 50%. You never know what markets will do and keeping 50% is better than losing shares due to market fluctuations.

How are your option trades going this month?