Theta Decay Rate and best time to sell options.

I watched a good video on the TastyTrade YouTube channel about rate of Theta decay as it relates to time yo place a trade, meaning sell a singular option or put on a spread trade.

I earned my Options Trading Certifates at the TastyTrade Dojo or school. One of their rules is to put on trades at 35-50 days until expiration. This rule is left over from their staff trader days, when they just followed dogma. The great thing about watching them. Ow is they test the dogma with math and databases and while they like to be proven right, they seem to really enjoy proving old rules are wrong and embrace why that makes their financial education network different from their competition.

Do in this video they actually show that they were in the tight range hut now they understand why that broad range worked. They learned using the wonderful database software which exists now and found that they were two trading ranges 30-40 & 40-50 which were perhaps the best time frame to trade in the zero to 100 day life of most options.

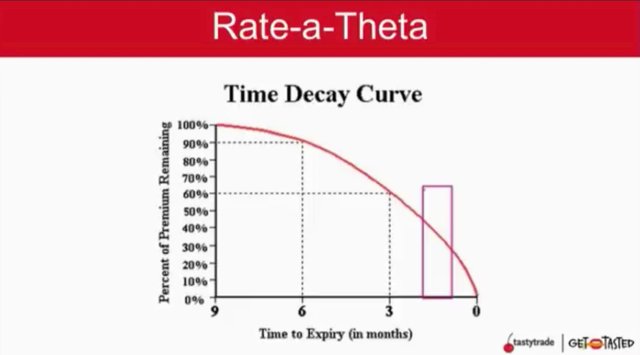

This graph below is the famous equity options decay curve, which shows the greatest rate of decay is between 30-50 days.

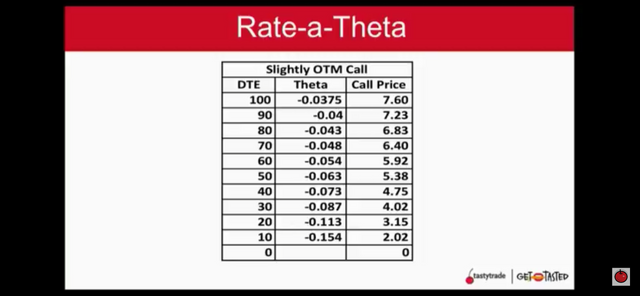

This chart:

Shows the option price of a strike at 100 days down to zero days. It also shows the rate of Theta decay and the option premium.

This allows us to determine which ten day period in the window of ; 0-100 days, has the best rate of option price decay and the largest premium. This allows us to get the biggest benefit or premium versus risk or maximum loss, by picking the period with rapid option premium deterioration.

The 40-50 day slot features a 63 cent drop in premium price and a high rate of decay 0,063 per day. The 30-40 day time slot features a 73 cent drop in premium and a high rate 0.073 per day rate of theta decay. These two time periods show high premiums 3-4$ highest rate of decay before premiums get to small to balance risk.

The video goes more into detailed explanation if your new to the concept of theta decay in defined risk trades.

I rate it a 4.5/5.0.