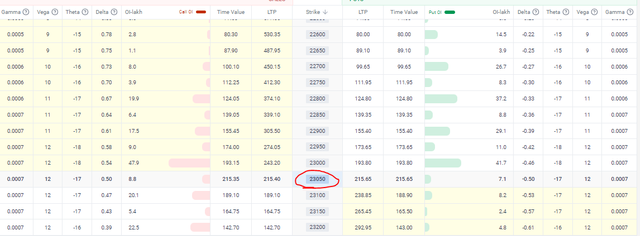

Option chain as of 07 June

Option chain as of 07 June

here is the option chain analysis of Nifty 50 for the date 07 June 2024:

Open Interest (OI):

Call Options: The highest open interest is observed at the strike price of 23000, followed by 22800 and 22700.

Put Options: The highest open interest is observed at the strike price of 22500, followed by 21500 and 22400.

Volume:

Call Options: Significant trading volume is seen at the strike prices of 23000, 22800, and 22700.

Put Options: Significant trading volume is seen at the strike prices of 22500, 21500, and 22400.

Implied Volatility (IV):

The implied volatility for the at-the-money (ATM) options is around 36.6%.

Put-Call Ratio (PCR):

The put-call ratio can be calculated by dividing the total open interest of put options by the total open interest of call options. A high PCR indicates bearish sentiment, while a low PCR indicates bullish sentiment.