OPENLEVERAGE: QUESTIONS & ANSWERS

Disclaimer: This article is not an investment advice but only for information use with intention to guide the readers on what need to be known about OPENLEVERAGE within the confines of the information available to me as of the time of writing the piece.

WHAT IS OPENLEVERAGE?

To begin with, OpenLeverage is a decentralized lending and margin trading protocol built for EVM-compatible blockchain. It is a permissionless margin trading protocol which enables traders to long or short any pair on many DEXs efficiently and securely. The permissionless nature of Decentralized Finance allows any tokens to be listed and traded with rapid growth in liquidity and volume. But users today are still difficult to find permissionless markets when looking for leverage trading. This difficulty is one of the reason OPENLEVERAGE comes into being.

Binance, for example, a centralized exchange, among other exchanges are under immense regulatory pressure and are costly to make any market due to their self-centered business model. Existing Decentralized Leverage Trading Protocols provide only minimal pairs and market depth and cannot scale to meet demand from rapid market development.

To truly build DeFi’s vision of global financial access, there needs to be a decentralized, permissionless, scalable, secure leverage trading facility that serves the long tail and fast-growing DeFi market.

OpenLeverage Protocol is developing to create an entirely permissionless decentralized margin trading infrastructure. Therefore, no permission is be needed to create a margin trading market for any pair whatsoever. This is critical to the core mission of the development team in the protocol design.

WHAT ARE CORE FEATURES OF OPENLEVERAGE

- Margin Trading with Liquidity on DEXes like Uniswap, Pancakeswap, and more others, hence connecting traders to trade with the most liquid decentralized markets.

- Risk Isolation Lending Pools, which have two separate pools for each pair, and different risk and interest rate parameters for each pool, which allows lenders to invest according to the risk-reward ratio.

- Risk Calculation with a Real-time AMM Price, which calculates collateral ratio with real-time AMM pricing for any pair available from any particular DEX.

- 2 Phases Liquidations, which forces a liquidation to be completed in two mutually dissimilar transactions to avoid flash loan attacks and cascading liquidation events.

- LToken, an interest rate bearing token for each lending pool, allows tokenomics integration with projects.

- Unique OLE Token, a governance token, minted by protocol usage which allows holders to vote or stake to get rewards and protocol privileges.

- An intuitive and user-friendly UI (User Interface) designed for decentralized margin trading.

WHAT ARE THE CUTTING EDGE ADVANTAGES IN OPENLEVERAGE

Let me establish here that OpenLeverage is the most scalable margin trading protocol by design as it offers a lot more than can be listed here, advantages over other protocols as it delivers its core mission earlier mentioned.

- You can create lending pools for any trading pair available on a DEX, with default interest rate and risk parameters, which the community can change via the governance process.

- Lenders can earn higher yields by depositing assets into the lending pools, earning interest from borrowed assets, receiving OLE rewards, or receiving rewards by re-staking their LTokens to join other projects’ reward programs.

- Traders can borrow and trade all with one click in a single transaction.

- Projects can integrate with the OpenLeverage protocol to facilitate leverage trading on specific trading pairs by integrating LToken.

- Liquidators can trigger liquidations to earn rewards based on gas prices if the trade’s collateral ratio falls below the market limit.

HOW TO USE OPENLEVERAGE?

With the above list advantages, you need to know HOW-TO to make the most of the protocol and all it can offer. Let me start this way;

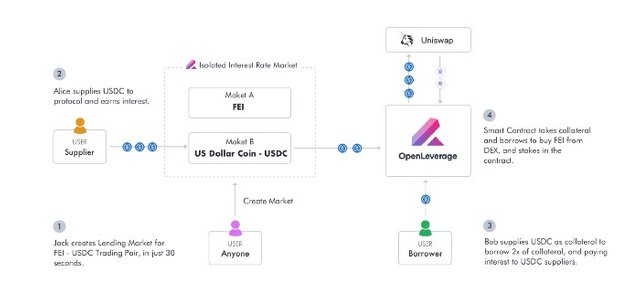

You can create lending pools for a specific pair on a particular DEX. For example, you might be interested in doing leverage trading on the FEI/USDC pair, so you create two lending pools for the FEI/USDC pair of Uniswap.

See the picture here

Next, a user can provide liquidity in the FEI → USDC pool, which means providing FEI to be borrowed to buy USDC. Or users can choose to provide liquidity in the USDC → FEI pool instead. Lenders will receive variable interest based on the pool’s utilization. This is similar to how the Compound protocol works.

Traders (you) can choose to borrow from either pool to swap to another token to take a leveraged position. In this example, the trader borrows USDC by putting down the same amount of USDC as collateral to make a 2X margin trade, swapped into FEI position with the liquidity pools of Uniswap, and locked in the smart contract. By taking advantage of liquidity on a DEX, we don’t have to create separate liquidity or an order book for leverage trading.

Once the trader closes the position, the protocol swaps the FEI position back to USDC by repaying the loan with interest, which returns the deposit plus or minus any profit or loss back to the trader.

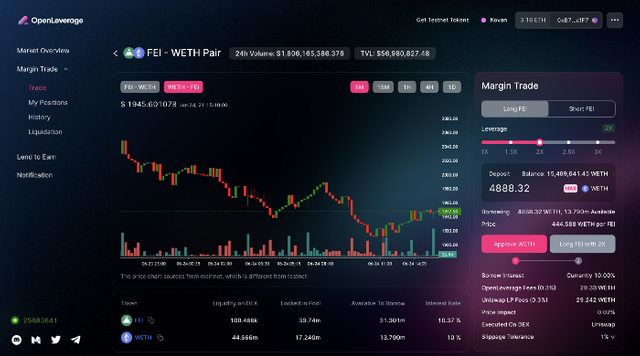

Look at the picture below

In Conclusion, please check out on the project website and social media platforms for updates and news as no Admin or team will DM you privately requesting you for money or to buy $OLE token, be guided.

📍 Our product:

Official Website - https://openleverage.finance/

Testnet dApp - https://kovan.openleverage.finance/app

👥 Socials:

Telegram - https://t.me/openleverage

Discord - https://discord.gg/mjHGdqKB3y

Twitter - https://twitter.com/OpenLeverage

Reddit - https://reddit.com/r/OpenLeverage

Medium - https://medium.com/@OpenLeverage

Github - https://github.com/jimmy-openlev/openleverage