OPENLEVERAGE VERSUS "OTHER" DECENTRALIZED LEVERAGE TRADING PROTOCOL

Keywords:

DEXes (Decentralized Exchanges)

DeFi (Decentralized Finance)

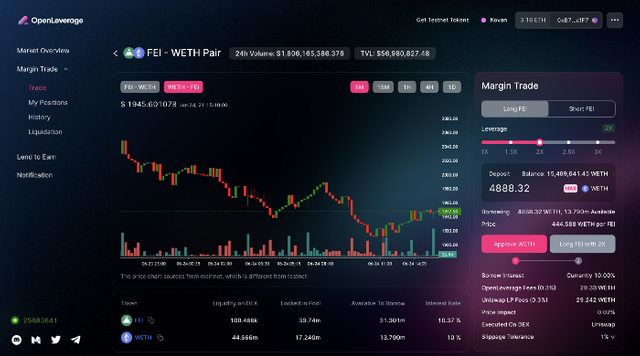

As a good way to start, let me describe in brief what OpenLeverage is- OpenLeverage is a permissionless margin trading protocol with aggregated DEX Liquidity, enabling traders to be long or short any trading pair on DEXs efficiently and securely. without limits as provided by other decentralized leverage trading protocols. I can call OpenLeverage a permissionless money market designed for margin trading, with an open technical and financial structure integrating with the global DeFi ecosystem.

I want to compare decentralized leverage trading protocol with Openleverage in order to narrow down this piece. But first, let me discuss here that, The permissionless nature of DeFi allows any tokens to be listed and traded with rapid growth in liquidity and volume. But most users and traders finds it pretty difficult today to find permissionless markets when looking for leverage trading. This is a critical view that Openleverage determine to solve.

We have lots of DeFi leverage trading protocol like Uniswap, DYDX, Binance and others but let us narrow it down for easy penetration.

For Example, Binance, being the biggest leveraged trading protocol in the world, makes markets accessible and available to public investors because of their business model believed to be inherently selfish. This happens in the way where digital assets are made to pay extremely high amount in BNB or others to get their project token listed. They do that because of the largeness of community subscribers, investors that they have. That was while I called them selfish in their business model. That isn't a guarantee that the project token won't fail for intrinsic and extrinsic issues along the trading period on Binance, neither is there any support from the latter to cushion the effect. That is serious matter, that demands attention of the public what is the way out of this challenge.

OPENLEVERAGE, on the other hand allows traders and users to long or short any pair on many DEXes efficiently and securely at the relatively affordable cost. With OpenLeverage, you don't need any permission to create a margin trading market for any pair whatsoever. This is the core point that brings about the uniqueness of OpenLeverage.

OpenLeverege intends to support margin trading for tokens natively trading on DEX, which are fast growing and long-tailed market. Imagine a token with huge community support and OpenLeverage allows the community to speculate or hedge risk with permissionless margin trade from day 1. DYDX V2 is a perpetual swap protocol running with separated order book and oracle from the spot market. It’s more likely to support mainstream pairs.

What About Interest Rate on Loan/Borrow?

First understand that each pool has a kinked interest model that defines interest rates based on the law of supply and demand. Following Compound’s design, interest rates should increase as a function of demand; when demand is low, interest rates should be low, and vise versa when demand is high. Interest parameters are isolated from each pool and can be adjusted by governance processes to keep the interest rate competitive from the market.

In conclusion, decentralized leveraged trading gets better with OpenLeverage than the others, considering all the factors listed above with also the advantage of the Ethereum Push Notification Service (EPNS).

Socials:

Website - https://openleverage.finance/

Telegram - https://t.me/openleverage

Discord - https://discord.gg/mjHGdqKB3y

Twitter - https://twitter.com/OpenLeverage

Reddit - https://reddit.com/r/OpenLeverage

Medium - https://medium.com/@OpenLeverage

Github - https://github.com/jimmy-openlev/openleverage