A Brief History of US Offshore Oil Drilling

The BP Deepwater Horizon explosion in April 2010 occurred after a dramatic, three-decade-long reconfiguration of how the United States and several other nations drill for oil. Technology, law, and geology pushed oil exploration farther from U.S. shores, as land-based exploration became less fruitful, and the global demand for energy ramped up. Oil production off American coasts began well over a century ago, but the move into deepwater and ultra-deepwater is a relatively recent phenomenon. This post presents a brief history of offshore oil drilling based on a relevant staff working paper by the National Commission on the BP Deepwater Horizon oil spill.

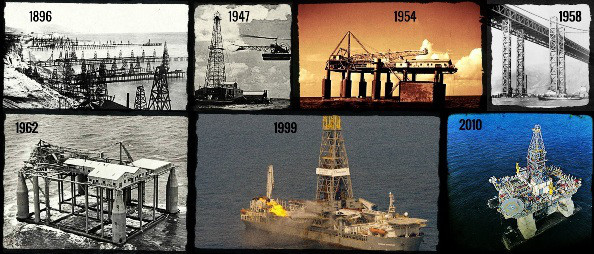

Offshore drilling for oil began off the coast of Summerfield, California, just south of Santa Barbara, in 1896. Closely resembling boardwalks in appearance, rows of narrow wooden piers extended up to 1,350 feet from the shoreline, their piles reaching 35 feet to the floor of the Pacific. Using the same techniques as then used on land, steel pipes were pounded 455 feet below the seabed. The hunt for oil ultimately produced only a modest yield. The field’s production peaked in 1902, and the wells were abandoned several years later. The project left behind a beach blackened by oil and marred by rotting piers and derricks, the latter providing ugly reminders of the pioneering effort that stood until a strong tidal wave wiped out the remaining structures in 1942.

Another offshore milestone was achieved in 1947, when Kerr-McGee Oil Industries drilled the first productive well beyond the sight of land, located 10.5 miles off the Louisiana coast, but still in water depths of only about 18 feet. By that time, drilling technology had advanced far beyond the methods used to dig the first wells in Summerfield. Sophisticated rotary rigs had replaced unidirectional pile drivers. Increasingly, firms chose steel over wooden drilling structures, recognizing the metal’s greater structural integrity for rigs and its lower costs over the life of the well. Offshore operators, such as Texaco and Shell, had recently pioneered “barge drilling,” the practice of towing small mobile platforms to new locations at the end of drilling jobs. As the oil companies grew more comfortable operating in the offshore environment, they adapted land-drilling methods – especially in the uniquely shallow continental shelf in the Gulf of Mexico.

Just as advances in technology opened up large swathes of the offshore to the possibility of drilling, a legal impasse of major proportions brought exploration and development to a virtual halt in 1950. Leases for subsea drilling were being offered by the States of California, Texas, and Louisiana, yet President Harry Truman had asserted exclusive federal jurisdiction over the entire continental shelf in 1945. The U.S. Supreme Court in 1947 and 1950 subsequently upheld Truman’s claim. 3 But because no then-existing federal law conferred authority on the Department of Interior to issue offshore leases, neither the federal government nor the states possessed power to authorize offshore drilling. When Congress proved unable to resolve the matter with new legislation, leasing on the continental shelf came to a virtual halt by the end of 1950.

General Dwight Eisenhower election led to the passage of the Submerged Lands Act of 1953, which gave states the right to lease up to three nautical miles from the coast. Some states could lease up to nine nautical miles, if justified by the boundaries documented when states entered the union or by a subsequent action by Congress. After lengthy battles in the courts, only Florida and Texas won the right to the nine-mile limit. Additionally, Eisenhower’s elevation to the presidency also helped facilitate the passage of the Outer Continental Shelf Lands Act (OCSLA) of 1953, which gave the federal government (Department of Interior) the authority to issue leases in coastal areas beyond state jurisdiction. The federally administrated area became known as the Outer Continental Shelf, or OCS. After the implementation of the OCSLA, leasing activity on federal submerged lands began in 1954.

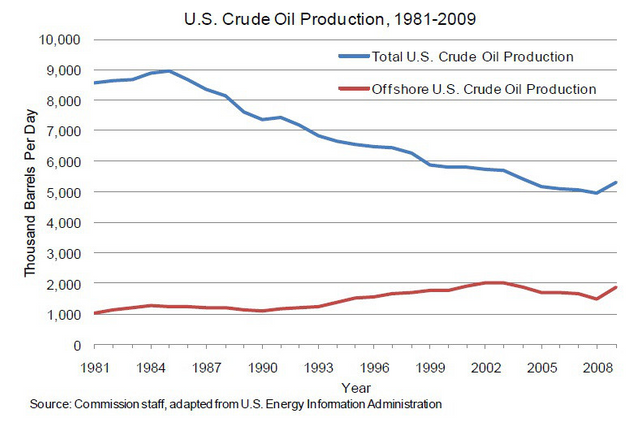

Offshore production of oil in 1954 stood at only 133,000 barrels of oil a day (2 percent of total U.S. production at that time). Offshore production rose steadily to reach 1.7 million barrels a day, roughly 20 percent of U.S. production, in 1971, when the industry was still recovering from a watershed event.

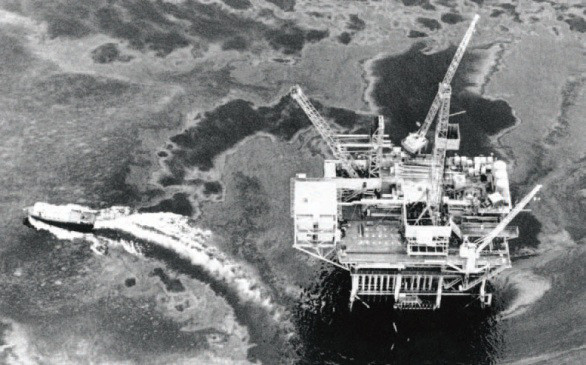

Two years earlier (Jan. 28, 1969), a blowout at a Union Oil Company well located in the Santa Barbara Channel had resulted in an 800-square-mile slick of oil that blackened an estimated 30 miles of Southern California beaches and soaked a substantial number of sea birds in the gooey mess. The blowout lasted 11 days and ultimately released approximately 80,000 barrels of oil. Before the BP Deepwater Horizon blowout, Santa Barbara stood as the greatest offshore drilling accident in American waters.

Although Santa Barbara is often remembered as an isolated incident, the next two years saw three more blowouts and one major fire on rigs off American shores. Though each individual incident was smaller than Santa Barbara, one blowout could not be contained for more than four and a half months, and the cumulative loss of oil – as reported by the oil companies – was greater than Santa Barbara.

The Santa Barbara incident had a rapid impact on federal environmental and regulatory policy. By the late summer of that year, the Department of Interior issued completely new regulations on OCS leasing and operations – the first update since the program’s start fifteen years earlier.

Although no other blowout in American waters reached the scale of the Santa Barbara incident, accidents at rigs in other counties reached magnitudes far surpassing the volumes of oil released at Santa Barbara. These occurred in the Persian Gulf (the Hasbah platform blowout) and the Niger Delta in 1980, and the North Sea and the Mexican waters of the Gulf of Mexico in 1979.

The Ixtoc I blowout off Mexico’s Bay of Campeche took nine months to cap and released an estimated 3.5 million barrels of oil.

In 1982, President Ronald Reagan’s Interior Secretary James Watt issued a five-year leasing plan for federal waters that greatly expanded the area available for leasing and quickened the pace of sales.

A collapse in world oil prices in the mid-1980s stalled the expansion of onshore and offshore drilling and struck a devastating blow to the economies of Louisiana and Texas. By 1990, offshore production stood at only 1.1 million barrels a day – just 5 percent more than a decade earlier.

The safety record in American waters improved during the decade, but in 1988, offshore drilling suffered another major calamity, this time in the North Sea. The Piper Alpha – a platform about 110 miles north-east of Aberdeen, Scotland, producing oil and gas — suffered two fires and an explosion leading to the death of 167 workers. It was the deadliest accident in oil rig history and, at the time, the insurance industry’s costliest man-made catastrophe.

The relatively stable levels of offshore production in the 1980s masked a major shift occurring in the Gulf of Mexico. The first discovery in deepwater (depths of 1,000 feet or more, though definitions vary) came at Shell Oil Company’s Cognac field in 1975. Technology had yet to evolve from shallow to deepwater, just as it took a while to develop from land to sea. Cognac adapted the fixed platform technology from shallow water, which proved economically impractical for moving much further from the coast.

Shell’s parallel deepwater work on its Augur (1987) and other sites discovered in the 1980s advanced the potential of deepwater more than Cognac. Augur used a tension leg (non-fixed) platform, which was better suited to deepwater conditions than fixed platforms. More importantly, geologists working on these sites came to better understand the deposition of the turbidite sands and the complex relationships to subsea salt.

While good wells on the shelf produced a few thousand barrels of oil a day, deepwater fields were developed with flow rates commonly exceeding 10,000 barrels per day.

Shell was not alone in making significant discoveries in the deepwater Gulf of Mexico in the 1980s. Other companies were gradually moving to deepwater as well.

Advances in exploring the deepwater of the Gulf of Mexico relied in large part on improvements in seismic technology. Between 1985 and 1997, the offshore exploratory success rate for the major U.S. companies increased from 36 percent to 51 percent.

Propelled by advances in rig technology and seismology and a better understanding of the potential of turbidite reservoirs, offshore production in 1991 started a string of thirteen consecutive years of increased production, which by 2002 topped 2 million barrels per day. Since onshore production continued to decline during this period, the share of offshore in total domestic supply took on increasing importance.

The move to deepwater was not gradual, as companies quickly leapfrogged each other to go deeper and deeper for new oil and gas. (See Fig. 3 below.) The move into the deepwater was a rare, dramatic era in American energy history, comparable in some ways to the early emergence of civilian nuclear power and the opening of drilling in Prudhoe Bay Alaska and subsequent rapid construction of a 600-mile pipeline through permafrost.

The Outer Continental Shelf Deep Water Royalty Relief Act of 1995 provided additional impetus to accelerated drilling in the Gulf.

Hurricanes and the cycles of the oil and gas industry led to a 30 percent drop in offshore oil production from 2003 to 2008, to approximately 1.4 million barrels a day. Within the industry, however, this drop was viewed as a pause rather than a new trend. In 2008 alone, exploration efforts resulted in fifteen new discoveries. In 2008-2009, new lease sales opened up areas that had been closed to drilling for twenty years. To find new resources, drillers continued to go further and further offshore.

The boom in offshore drilling has produced considerable revenue for the federal government, most coming from the Gulf of Mexico. In recent years, the leasing and royalty programs have yielded about $6 billion to $18 billion a year, the higher-end figures coming at the time of big lucrative lease sales.

The share of deepwater production in the current U.S. and world energy mix understates its importance for the future, at least as it was understood before the BP Deepwater Horizon accident. With high per-capita energy demands in the developed economies and dramatically rising levels of consumption in emerging economies, most experts project the world’s appetite for oil and other fuels to grow for the foreseeable future. The role of deepwater oil and gas in providing that energy is also likely to grow.

The Gulf of Mexico has been only a part of the global offshore boom. Substantial exploration and development has also taken place off the coasts of Brazil and the West Africa. Interest in other, more challenging areas has been growing. Oil companies are looking to expand American production into new offshore areas, particularly Alaska and Virginia. Russian oil and gas companies are reviewing plans to develop areas in the Arctic, while Norway and Canada are assessing similar projects.

There are two key hurdles to new ultra-deepwater drilling:

Oil companies must be willing to invest substantial amounts of capital on generally challenging projects.

They must identify sites with significant resources and very high potential flow rates to justify such large capital expenditures.

The average size of a new deepwater discovery in 2009 was about 150 million barrels of oil equivalent compared with an onshore average of only 25 million barrels.

The BP Deepwater Horizon oil spill is appropriately requiring a dramatic reassessment of the risks associated with offshore drilling. Before April 20, many believed that drilling might be safer in deep than in shallow waters due to the following:

Deepwater rigs worked farther off the coast and so it would take longer for spilt oil to reach shore, giving more time for intervention to protect the coast.

The companies working in the deeper waters were seen as the “big guys” who utilized more advanced technologies than the smaller firms working near the coast, which presumably made them more adept at handling challenging conditions.

Of course the dramatic event of the deepwater horizon accident showed that this was not the case. Another problem for appropriate risk assessment was the failure to adequately consider published data on recurring problems in offshore drilling. These included powerful “kicks” of unexpected pressures that sometimes led to a loss of well control, failing blowout preventer systems, and the drilling of relief wells — the last lines of defense for a troublesome well. These problems were not great considering the large number of wells around the world and were usually more minor as threats than they sounded. However, these issues, known to petroleum engineers, did demonstrate that wells do not perform in a flawless manner.

Working further below the surface of the ocean creates myriad problems after a loss of well control or a blow out. Containment problems become much more challenging and real-time decisions become more difficult when so little is known about the deep ocean. Up to the BP Deepwater Horizon accident, little attention was devoted to containment of a blown out well in the deepwater, largely because its occurrence was considered so unlikely.

Perhaps the greatest risk factor was the very feature that made the deepwater boom so big in the first place. The prodigious flow rates in the deepwater help create “elephants,” industry slang for wells whose production is considered especially high by historic standards. Such fields have very high daily output and good overall economics. But in cases of an uncontrolled blowout, high flow rate becomes the enemy as great volumes of oil and gas are spewed into the environment.

Source: National Commission on the BP Deepwater Horizon Oil Spill

upvote for me please? https://steemit.com/news/@bible.com/2sysip