Oikos is a Tron Network-based chain-based produced asset giving platform.

.png)

Oikos is a Tron-based designed asset stage that gives an on-attach chance introduction to fiat financial norms, products, stocks, and records. The synth is reinforced by Oikos System Token (OKS), which is made sure about a shrewd understanding as assurance. The synthesizer tracks the expenses of various assets, along these lines allowing neighborhood customers of advanced types of cash and customers without records to lead P2C (dispersed understanding) trades on the Oikos exchange without liquidity restrictions.

Oikos claims its OKS tokens and follows a comparable framework, so these tokens must be blocked to make built assets. The framework is over-collateralized to go without taking a risk with the estimation of certain dull swans and the framework including liquidity.

Presently, we can see how decentralized account (Defi) on the Tron blockchain has broadened. Notwithstanding different things, the latest USD stablecoin gave a proof a few months earlier that the field is figuring out how to endeavor to welcome anyway numerous customers and originators as could be permitted to use the blockchain in the Defi field.

What is the Cardinal Target Of The association?

Oikos Money is an association that way to disentangle standard fiat cash and banking organizations issues by giving free fixed portion and save reserves mechanical assemblies with inborn motivator to appreciate trust issues and various other related issues and troubles today. Use fiat cash and banking things, Since it will enable associations to robotize and streamline systems to improve the lives of people the world over. Their inside correspondence serves to basically diminish costs and time. The association is moreover at risk for destroying the home credit of huge property or land property that banks generally require before contracts. She organized a stage (Synths Resource for) override this key limit.

The System Architecture Of The OIKOS Platform

• Throwing phonetic structure: The Oikos stage will on a very basic level jolt its OKS as an assurance by using the Oikos savvy understanding, thusly allowing OKS holders to cast Susd.

• Trade: This will oblige the methods basically connected with the brilliant understanding treatment of Synth Trade from Susd to Sbtc And so forth.

• Guarantee charges: As long as there is an exchange remembering a synthesizer for the Oikos stage, the Oikos contract is used, which will basically pull back about 0.3% of the specific cost and subsequently send it to the charge pool referenced by the OKS vendor.

• Consuming commitment: This is the cost required when the OKS seller needs to leave the framework or pay off past responsibilities and a while later open the sold OKS

• Obligation pool: generally invigorated when the OKS holder tosses or expends the synthesizer.

• Prophet: Decide the estimation of each and every built asset in the Oikos framework. The framework uses an estimation with different sources to push the worth grapple by cost to shape a hard and fast motivation for each preferred position.

Preferences of OIKOS Trade

Oikos Trade offers various preferences or better ones, confined to stage customers. Using the Oikos stage, you can in a general sense allocate exchange rates to assets through the worth information gave by Prophet, so you can use Oikos. Trade Dapps to change over, and can surrender limitless liquidity to the total whole of framework ensure, and the stage similarly screens zero slip And on-chain trades without assent.

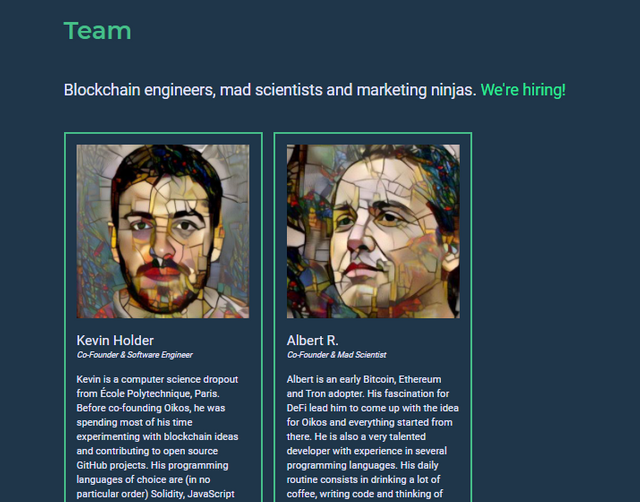

Team

Conclusion

This is the destiny of funds in the blockchain structure. In the OIKPPS biological system, when the customer coordinates a trade in the framework, scarcely any costs will be dispatched and a while later sent to the OKS holder, with the objective that the economy can persevere. Multi-money is the latest work on the framework.

Customers can pull back their charges in any apparent cash we support. Customers save the benefit to get charges after they have posted designed points of interest for (help make an economy that produces costs) and keep things under control for the full charge time period (starting at now 7 days). Underwriters are asked to keep up the extent of security (OKS) to assets so the points of interest accessible for use are ordinarily simply worth 20% of the estimation of the Oikos sort out tokens because over 20% of the home credit will be fined. This can cause an exceptional worth daze to OKS without sabotaging the estimation of the advantage.

For more information, kindly visit the links below:

Website: https://oikos.cash

Telegram: https://t.me/oikoscash

Exchange: https://oikos.exchange

Whitepaper: https://docs.oikos.cash/litepaper/

Github: https://github.com/orgs/oikos-cash/

Tweeter: https://twitter.com/oikos_cash

Bitcointalk username: Kikinet

Bitcointalk url: https://bitcointalk.org/index.php?action=profile;u=2451992;