Kal’s MTF OBV Haar in PineScript

Kal’s Multi-Time Frame On Balance Volume Haar, also known as Kal’s MTF OBV Haar is a method/study for finding trending volume levels on stocks, indexes and cryptocurrencies using OBV, CMF and CCI over different time-frames (10m, 1H, 4H, 1D, 1W, 1M).

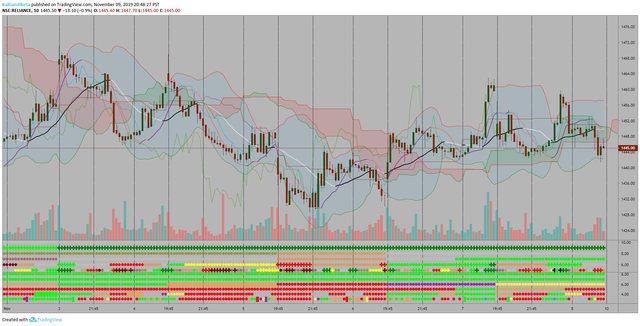

Upon adding to the 10-min chart, the sample Image in Tradingview looks as follows:

Note: Kal's MTF OBV Haar is the lower Plot. The upper plot is Kal's MTF ADX Rangoli Roller( ([https://www.tradingview.com/script/zbjpdcvd-Kal-s-MTF-ADX-Rangoli-Roller)] )

Kal’s MTF OBV Haar is made for Stocks/Cryptocurrencies/Forex. The input parameters may be fine-tuned for different types of assets and in those assets, it may be fine-tuned for different ticker symbols.

- For cryptocurrencies, one week is 7 periods, two weeks is 14 periods

- For stocks, one week is 5 periods, two weeks is 10 periods

For the study of stocks, I used

- 9-period EMA over OBV for time-frames (10m, 1H, 4H, D)

- 4-period EMA over OBV for time-frames (W, M)

For the study of crypto-currencies, I would update EMAs as follows:

- 13-period EMA over OBV for time-frames (10m, 1H, 4H, D)

- 6-period EMA over OBV for time-frames (W, M)

Description:

In the study plot, the lowest row is 10m, row above is 1H, row above is 4H, then 1D, then 1W and highest row is 1M. (In a Tradingview chart, you may change different time periods to observe each row of MTF OBV HAAR with corresponding price bars.)

- Lime( Bright Green) dot implies Trending Uptrend for that time-frame

- Red dot implies Trending Downward for that time-frame

It’s best to wait and research for possibility of trend reversal during the following dots/bricks:

- Silver dot implies indecisive up

- Orange dot implies indecisive downtrend

- Lime Brick implies CCI is near Zero line( between 15 and 0)

- Red Brick implies CCI is near Zero line( between -15 and 0)

- Purple dot implies CCI zero rejection to possibly/probably continue trend UP

- Yellow dot implies CCI zero rejection to possibly/probably continue trend Down

- Aqua dot implies that trend is overbought or oversold. This dot usually happens between red dots or green dots.

Therefore, it’s best to wait for pull-back especially in lower time frames.

I am a disabled man. Therefore, I am not able to write in detail here today. More Details will follow as time permits. Please let me know if I am missing anything…

Legal Disclaimer: I published here so I get replies from fellow viewers to educate myself and for my daily expenses. Hence, if anyone uses this script for making their decisions, I am not responsible for any failures incurred.

Safe Trading!

Kal Gandikota

PS: If you found this script interesting and edifying please follow and upvote.

PS2: Please kindly donate for my daily expenses (atleast as you would on streets) at the following addresses:

- BTC Wallet: 1NeDC1GvpFa49DFLuT1v28ohFjqtoWXNQ5

- ETH Wallet: 0x35e557F39A998e7d35dD27c6720C3553e1c65053

- NEO Wallet: AUdiNJDW7boeUyYYNhX86p2T8eWwuELSGr

PS3: For more information on OBV, CCI and CMF, please search internet or here yourself.

PS4: This study is intended for research in creating automated Python Trading Systems using Pandas(https://steemit.com/python/@chipmaker/how-to-find-guidance-on-building-python-based-cryptocurrency-trading-bots).

Test this code out free in the pine editor by creating a free account on https://www.tradingview.com. More details follow as time permits!

//BEGIN============================================

///////////////////////////////////////////////////////////////////////

//@version=4

//Author: KAL GANDIKOTA

// Kal’s Multi-Time Frame On Balance Volume Haar(Kal’s MTF OBV Haar)

// is a method/study for finding trending volume levels

// on stocks, indexes and cryptocurrencies using OBV, CMF and CCI

// over different time-frames (10m, 1H, 4H, 1D, 1W, 1M).

//

// Copyright (C) NOV 2019 KAL GANDIKOTA

//

// This program is free software: you can redistribute it and/or modify

// it under the terms of the GNU General Public License as published by

// the Free Software Foundation, either version 3 of the License, or

// (at your option) any later version.

//

// This program is distributed in the hope that it will be useful,

// but WITHOUT ANY WARRANTY; without even the implied warranty of

// MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE. See the

// GNU General Public License for more details.

//

// You should have received a copy of the GNU General Public License

// along with this program. If not, see <http://www.gnu.org/licenses/>.

//

// Please Kindly Donate for my Daily Expenses and Greater Works Than These

//

// BTC Wallet: 1NeDC1GvpFa49DFLuT1v28ohFjqtoWXNQ5

// ETH Wallet: 0x35e557F39A998e7d35dD27c6720C3553e1c65053

// NEO Wallet: AUdiNJDW7boeUyYYNhX86p2T8eWwuELSGr

// SteemID: chipmaker

//https://www.twitter.com/chipmaker_tweet

//https://steemit.com/@chipmaker

///////////////////////////////////////////////////////////////////////

study("Kal's MTF OBV HAAR", shorttitle="MTF_OBV_HAAR")

lengthema = input(9, title="Length of OBV EMA1 Signal Line")

lengthema2 = input(4, title="Length of OBV EMA2 Signal Line")

src = input(close, title="bar price type for OBV[close, hlc3, hl2, ....]", type=input.source)

cci1_length = input(10, minval=1, title="CCI1 Length")

cci_threshold = 0

cci_OBLevel = input(100, title="CCI Overbought Threshold")

cci_OSLevel = input(-100, title="CCI Oversold Threshold")

CMF_length = input(10, minval=1, title="CMF Length")

cmf_ob_threshold = input(0.6, title="CMF Overbought Cutoff", type=input.float)

cmf_os_threshold = input(-0.6, title="CMF Oversold Cutoff", type=input.float)

//OBV Function

obv(src) =>

change_1 = change(src)

cum(change(src) > 0 ? volume : change_1 < 0 ? -volume : 0 * volume)

//CMF Function

cmf(length) =>

ad = close == high and close == low or high == low ? 0 :

(2 * close - low - high) / (high - low) * volume

mf = sum(ad, length) / sum(volume, length)

mf

//calculate OBV

o = obv(src)

//Calculate CCI

c1 = cci(src, cci1_length)

//Calculate CMF

cmf1 = cmf(CMF_length)

//OBV EMA Overlay

obv_ema = ema(o, lengthema)

obv_ema2 = ema(o, lengthema2)

//CCI conditions

uzr = crossover(c1[1], cci_threshold) and crossunder(c1, cci_threshold)

dzr = crossunder(c1[1], cci_threshold) and crossover(c1, cci_threshold)

cNearZ = c1 > -15 and c1 < 15

//cmf conditions

cmf_corners = cmf1 > cmf_ob_threshold or cmf1 < cmf_os_threshold

//##### HAAR items color Selection #####

f_obv_ema_cmf_cci_color(o, obv_ema, Dcolor1, Ucolor1, cmf_corners, c, uzr, dzr) =>

obv_ema_up = (obv_ema > obv_ema[1])

obv_ema_dn = (obv_ema < obv_ema[1])

oabove = (o > obv_ema)

obelow = (o < obv_ema)

color_1 = color.new(color.purple, 0)

color_2 = color.new(color.silver, 30)

color_3 = color.new(color.yellow, 0)

color_4 = color.new(color.orange, 50)

obv_ema_fc = (obv_ema_up or oabove) ? (dzr ? color_1 : (c > 0) ? Ucolor1 : color_2) :

(obv_ema_dn or obelow) ? (uzr ? color_3 : (c < 0) ? Dcolor1 : color_4) :

color.blue

color_5 = color.new(color.aqua, 0)

obv_ema_cmf_fc = cmf_corners ? color_5 : obv_ema_fc

obv_ema_cmf_fc

obv1_fc = f_obv_ema_cmf_cci_color(o, obv_ema, #FF0000, #00FF00, cmf_corners, c1, uzr, dzr)

obv2_fc = f_obv_ema_cmf_cci_color(o, obv_ema2, #FF0000, #00FF00, cmf_corners, c1, uzr, dzr)

//##### Time Frame Adjustments #####

//obv1_finalcolor = security(syminfo.tickerid, "1", obv1_fc, lookahead=barmerge.lookahead_on)

//obv5_finalcolor = security(syminfo.tickerid, "5", obv1_fc, lookahead=barmerge.lookahead_on)

obv15_finalcolor = security(syminfo.tickerid, "10", obv1_fc, lookahead=barmerge.lookahead_on)

obv60_finalcolor = security(syminfo.tickerid, "60", obv1_fc, lookahead=barmerge.lookahead_on)

obv240_finalcolor = security(syminfo.tickerid, "240", obv1_fc, lookahead=barmerge.lookahead_on)

obvD_finalcolor = security(syminfo.tickerid, "D", obv1_fc, lookahead=barmerge.lookahead_on)

obvW_finalcolor = security(syminfo.tickerid,"W", obv2_fc, lookahead=barmerge.lookahead_on)

obvM_finalcolor = security(syminfo.tickerid,"M", obv2_fc, lookahead=barmerge.lookahead_on)

//cNearZ_1m = security(syminfo.tickerid, "1", cNearZ, lookahead=barmerge.lookahead_on)

//cNearZ_5m = security(syminfo.tickerid, "5", cNearZ, lookahead=barmerge.lookahead_on)

cNearZ_15m = security(syminfo.tickerid, "10", cNearZ, lookahead=barmerge.lookahead_on)

cNearZ_60m = security(syminfo.tickerid, "60", cNearZ, lookahead=barmerge.lookahead_on)

cNearZ_240m = security(syminfo.tickerid, "240", cNearZ, lookahead=barmerge.lookahead_on)

cNearZ_D = security(syminfo.tickerid, "D", cNearZ, lookahead=barmerge.lookahead_on)

cNearZ_W = security(syminfo.tickerid, "W", cNearZ, lookahead=barmerge.lookahead_on)

cNearZ_M = security(syminfo.tickerid, "M", cNearZ, lookahead=barmerge.lookahead_on)

//#####PLOTS#####

//plot1 = plot(cNearZ ? na : 1, color=obv1_finalcolor, style=plot.style_circles, linewidth=4, transp=0)

//plot5 = plot(cNearZ_5m ? na : 2, color=obv5_finalcolor, style=plot.style_circles, linewidth=4, transp=0)

plot15 = plot(cNearZ_15m ? na : 3, color=obv15_finalcolor, style=plot.style_circles, linewidth=4, transp=0)

plot60 = plot(cNearZ_60m ? na : 4, color=obv60_finalcolor, style=plot.style_circles, linewidth=4, transp=0)

plot240 = plot(cNearZ_240m ? na : 5, color=obv240_finalcolor, style=plot.style_circles, linewidth=4, transp=0)

plotD = plot(cNearZ_D ? na : 6, color=obvD_finalcolor, style=plot.style_circles, linewidth=4, transp=0)

plotW = plot(cNearZ_W ? na : 7, color=obvW_finalcolor, style=plot.style_circles, linewidth=4, transp=0)

plotM = plot(cNearZ_M ? na : 8, color=obvM_finalcolor, style=plot.style_circles, linewidth=4, transp=0)

//plot1_col = plot(cNearZ ? 1.5 : na, color=obv1_finalcolor, style=plot.style_columns, linewidth=4, transp=0, histbase=0.5)

//plot5_col = plot(cNearZ_5m ? 2.5 : na, color=obv5_finalcolor, style=plot.style_columns, linewidth=4, transp=0, histbase=1.5)

plot15_col = plot(cNearZ_15m ? 3.5 : na, color=obv15_finalcolor, style=plot.style_columns, linewidth=4, transp=0, histbase=2.5)

plot60_col = plot(cNearZ_60m ? 4.5 : na, color=obv60_finalcolor, style=plot.style_columns, linewidth=4, transp=0, histbase=3.5)

plot240_col = plot(cNearZ_240m ? 5.5 : na, color=obv240_finalcolor, style=plot.style_columns, linewidth=4, transp=0, histbase=4.5)

plotD_col = plot(cNearZ_D ? 6.5 : na, color=obvD_finalcolor, style=plot.style_columns, linewidth=4, transp=0, histbase=5.5)

plotW_col = plot(cNearZ_W ? 7.5 : na, color=obvW_finalcolor, style=plot.style_columns, linewidth=4, transp=0, histbase=6.5)

plotM_col = plot(cNearZ_M ? 8.5 : na, color=obvM_finalcolor, style=plot.style_columns, linewidth=4, transp=0, histbase=7.5)

//END============================================

Congratulations @chipmaker! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!