WHY I BECAME BROKE..Measures we put that took many down

*BORROWING FOR BUSINESS

Never borrow money that accqires interest to start a business (except if you are paying for it through your salary); only borrow to grow your business. This is because business takes a long time to gain ground and begin making profit, yet most loans repayments have to be made within a month of taking the loan or even earlier. Therefore, never borrow money to start a business expecting that the business will generate income to pay back the borrowed money plus the interest.

.jpg)

source

*SPENDING IN ANTICIPATING

Never spend money you haven't received. Don't even promise someone money based on a promise you have from someone else. If someone tells you: "heartbitcoin, come to my office tomorrow at 9am and pick N100,000"don't go out to buy items on credit based on this promise, with the hope that you will pay off your creditor when the promised money comes; it may not come as promised and this will leave you in problems with your creditors.

source

*SAVE SOME EARNING

If you want to save, whenever you receive money, don’t start spending hoping that you’ll save what remains. Normally what remains is zero because as long as money to spend is available, the numerous things you can spend it on are also available. And things to spend on even incite their 'relatives' so that you spend even more than you had planned. When money to spend is not available, we naturally find a way of doing without it. That's why I've learnt to save in an INVESTMENT ACCOUNT. Once I send money there I assume I no longer have it. Before you spend any money, put your savings aside then spend what is left after saving.

Source.jpg)

*OPPORTUNITY

When you get an opportunity to meet a very wealthy person, never ask for money. Ask for ideas on how to make money. They may even choose to give you money on their own after seeing that your ideas are great, but let getting money from them never be your objective.

Source.jpg)

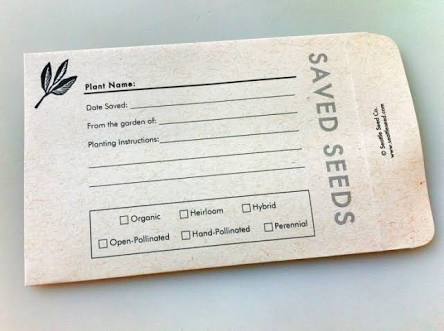

SAVING SEEDS

Keeping your seed instead of planting it. Many people stop at saving. It's very, very difficult to save and have all you need to maintain your lifestyle especially after retirement. When you save, your savings are seed; plant it. When you just keep the seed (saving money) some seeds begin to die (eaten by inflation and the like). That's why I recommend that you read about the different types of investment vehicles you can use to grow your savings. I am not necessarily talking about putting the money in a business, because you can easily lose money in business. I am talking about putting it in an investment.

Source.jpg)

*LENDING

Never lend someone money you are not willing to lose. By the time you lend someone money, be contented in your heart that should the person fail to pay, you will not die. You should not even lose that person's friendship if they fail to repay the money you lent them. If you feel the person might fail to pay you and this will not affect your relationship with them, then lend them money. If their failure to pay would make you hate this person’s entire clan, please advise the person to go to the bank.

Source

.jpg)

SHORTEE

Never append your signature to guarantee someone on a financial matter if you are not willing or able to pay the money on their behalf. Do I have to explain that one? No, it's self-explanator.

Source

*DISCIPLINE

Avoid keeping money you don't intend to use in the short-term within easy reach. For instance, don’t walk with N10,000 in your pocket when all you plan to do in a day costs N2,000. Like I mentioned in Money Mistake 3, there are always expenses available to gobble any money that is within reach, so if you don't want to lose it, put it away in a safe place.

Source.png)

*KEEPING SAFE

Avoid keeping money in inappropriate places e.g. in a nylon, under the pillow, in a pit, in the sitting room, in the bra, in a travel bag that you will place somewhere in a bus ... impulse buying is a devil that will keep you busy!

Source.jpg)

LAVISH SPENDING

Spending money on an item that you can do without (at least for the time framed). Recently. Bringing fiat out of my purse, before paying for something I ask myself: What would happen if I didn’t buy this? If I findout i can live without having that thing, ill move on with my life it wnt kill me nor hunt me

Source.jpg)

OVERZEALOUS

Paying an amount for something that's not the minimum you can get that same value for. In other words, buying a car at higher prise because of bent side mirrow why nt u buy lesser ne n fix d bend...that's a money mistake except for those who have achieved financial freedom.

Source

*GETTING NOTICED

Wanting to be the savior of the world by helping everyone in financial need. My sister, my brother, you are not Jesus. If you find it so hard to say no to a financial demand, you may think you are practising generosity when in actual sense you are committing (financial) suicide. We are not learning to be miserable here; we are learning to live within the boundaries of reality.

Source.jpg)

*CONSISTENCE SPENDING

Consistently spending all you earn or more than you earn. It's like having a drum where you have an inlet that's smaller than the outlet. It will never get full. And should the inlet ever reduce significantly the drum will run dry. If you do it the other way round and the inlet is bigger, it will get full and even overflow. Hence, we have to always ensure we are widening the inlet while narrowing the outlet – all the time. Your side hustle comes in handy!

Source

*DIVERSIFY

Thinking about short-term only and forgetting about long-term or thinking about the long-term and forgetting about the short-term. For instance, hearty was told that there's money in Land. She saved money over a long period of time and bought 30 acres of land. Now she has the land but she is always broke. She is always complaining. She's disgruntled and she doesn't seem to see herself earning from the land in the near future. Now, let's ask ourselves: Having 30 acres of land and no money to feed your family or take a child to hospital, is that wealth or poverty? I think she only looked at long-term needs and forgot that she has short-term needs that require money. What of those who find they are one paycheck away from salary? Are they thinking about the long-term needs?

source

*PONZI SCHEMES

Alot of you will agree to this that ponzi kills if not immediately it kills slowly ruin and turns you to a broke lad. I have engaged in many ponzi schemes but that was when i no nothing about blockchain technology. Here i am on steemit a blockchain forum doing my thing and earning on the blockchain. Isnt this owesome? Investment on Steem, bitcoin other valuable cryptocurrency ..Potential ICO (CGT)24th Sep https://cryptogene.co for details. Blockchain technology is making my life better. What about you?

Let’s take stock of our finances. How many mistakes are you guilty of? if i had known better would have used this in shaping up my life. I still breath thank God am alive

Have u read about this before?..if not, this is another opportunity for u

Do you now feel better-equipped to do better with these tips? Enjoy your day

Reference

Reference

Lending is Really True

They won't just Return

Spending on impulse or without a strict budget could land one in serious financial troubles too.

Our funds need to be budgeted and our budgets strictly adhered to.

Very useful write up @heartbitcoin

This is one of the things that I have learnt right from school. It can cost ones joy if not properly handled. Any thing that one will be apending his/her signature to must be something that he/she is able to defend. Thank you for this awesome post.

Spending when expecting some money is something i do a lot... Bad habit...lol

dnt anyymore

Upvoted..

Beautifully written, full of sense and wisdom.

This hit me hard nice one heart!

This is a must read.