7 Categories of Digital Assets

Cryptocurrencies are the most famous phenomenon of the decentralised world and for an outsider, they might be all there is to it. However, if you are an investor and/or enthusiast you need to educate yourself about all the different kinds of digital assets that blockchain has made possible. In fact, cryptocurrencies are just one of the seven different types of digital assets. They all serve different purposes and are all best suited for their own sub sectors. Let’s discuss the similarities and differences between these digital asset categories. By the time we are done, you will have a better understanding of how cryptocurrencies are different from these other categories of digital assets on the blockchain.

If you have any questions or comments, join our digital asset group here to continue discussing and learning about new digital assets — https://bit.ly/2DL0rL4

Cryptocurrencies

Cryptocurrencies are currently the face of blockchain and decentralised technologies. They are used to hold and transfer value. Designed to be used in a similar way to the traditional currencies. Cryptocurrencies grabbed a lot of attention in late 2017 when the champion of all cryptocurrencies, Bitcoin reached a value of nearly $20,000. Today, there are over 2000 different cryptocurrencies and that number continues to rise.

Platform Tokens

Platform tokens are another large crypto assets class. A prime example of a platform token is Ether of the Ethereum network. Based in Canada and hailed as the country’s most successful startup ever, Ethereum blockchain is the world’s largest crypto platform token. It is widely used in ICO’s to raise capital for new startups. Platform tokens are used to interact with the said platform. Platform tokens are designed to support decentralised apps that eliminate the need for intermediaries such as banks and financial institutions in every facet of the traditional economy. Other examples of platform tokens include EOS, NEO, Stellar, Cosmos, Aion and ICON. Platform tokens are believed to be responsible for building the backbone of the next era of the internet.

Utility Tokens

Even the seasoned enthusiasts often misuse the term ‘utility tokens’. A utility token is programmable digital assets that can be used within an application to obtain some form of services. For example: are you looking to utilize the aggregated power of the world’s smartphones? Golem is your go-to utility token. Golem is used by anyone who wants to run computations on this supercomputer built by combing millions of smartphones across the planet. The price to use this supercomputer is paid in the form of Golem tokens.

Security Tokens

Security tokens represent ownership or specific rights in an underlying investment. Anything that is considered a “security” falls under certain regulations and rules set by the SEC under the Securities Act. To determine what is or isn’t a security token, they are put through the Howey Test. Security tokens typically take the form of digital bonds, equities and other securities that trade peer-to-peer without relying on financial intermediaries. Security Token Offerings are starting to gain some traction. Secondary markets or exchanges for security tokens do not exist yet but are coming soon.

Natural Asset Tokens

Natural asset tokens are a representation of something tangible in the world. You can find blockchain based representations of Oil, Gold, and Carbon. They help merchants of these physical assets trade them with the same efficiency that crypto assets are traded. Removing the delays and intermediaries, international transactions are carried out in a matter of seconds without any intermediary required. The Royal Mint collaborated with Chicago Mercentile Exchange to create Royal Mint Gold. It is a natural asset token and it is used to trade real gold in the Royal Mint’s reserves. Many such examples of natural asset tokens can be found which are improving the way business is done all over the world.

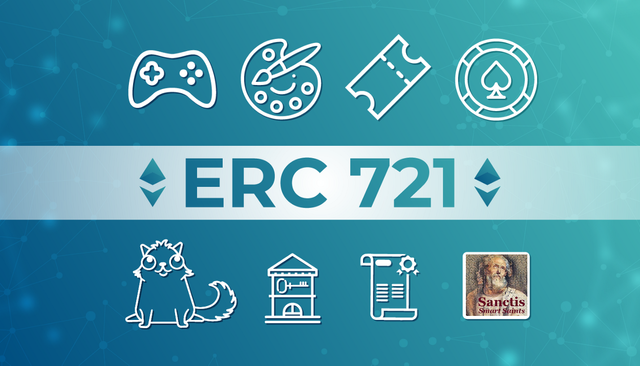

Crypto Collectables

Crypto collectables are similar to real-world collectables in the sense that they hold their value over long periods and can be used to hold value. There are several DApps out there, which use their own unique ways to hold and grow assets over time. Gaining in value allowing users to even turn profits. One example of such a DAPP is CryptoKitties. It is hosted on the Ethereum network and is known for almost crashing the Ethereum network because of the volume of transactions on its platform. Most crypto collectibles are built on the ERC721 Standard and are NFTs — Non Fungible Tokens. For a list of Top NFT Projects, see the following list: https://medium.com/@dam.gi/top-11-non-fungible-token-projects-35edcb7ce114

Stable Coins

There is a growing number of banks and exchanges offering their own crypto stable coin. These are classified as fiat backed crypto currencies or stable coins, the most famous of which is USDT. (also known as USD Tether). With stable coins, investors get the best of both worlds in the sense that they get the efficiency and transparency of a cryptocurrency with the stability and price reliability of a centralised government issued fiat currency. The value of a stable coin is always pegged or tethered to its real world counterparts. For a stable coin report issued by Digital Asset Management — see the following link — https://medium.com/@dam.gi/q3-2018-stable-coin-report-3824e5416a32

If you have any questions or comments, join our digital asset group here to continue discussing and learning about new digital assets — https://bit.ly/2DL0rL4

Thanks again,

DAM

Congratulations @rockchain! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!