This is what Asia's middle class is buying

Asia’s middle class is booming.

people all across emerging Asia are earning more money. Think tank Brookings Institute forecasts that by 2030, two-thirds of the global middle class will be living in Asia.

And these people are going to spend – a lot.

Chinese consumption alone is set to rise by 55 percent – to reach US$6.5 trillion – by 2020. And Indian consumption is set to grow to US$4 trillion by 2025.

By 2030, Asia as a whole will account for nearly 60 percent of global middle-class consumption. To put that in perspective: In 2010, North America and Europe accounted for about 60 percent of the world’s middle-class consumption.

But this new middle class won’t just be buying things like TVs, clothes and cars… they’re increasingly buying services like healthcare, travel and education.

So what will be the biggest beneficiaries of this boom?

Private healthcare

Right now, the Chinese government provides some form of health insurance to almost all of its 1.4 billion citizens. But public healthcare is a mess. There are simply too many patients for the poorly paid public doctors to care for. As a result, lines are long, and standards of care are poor for most Chinese citizens.

Now, with more money, the middle class is demanding better healthcare. McKinsey & Company estimates that, driven by the middle class, private healthcare spending in China will grow to US$1 trillion by 2020, up from just over US$350 billion in 2011.

So as China’s middle class grows, more and more people are prepared to spend their hard-earned cash on better medical care.

But it’s not just China. Investment firm KKR says Vietnam, Indonesia and India will all see their private healthcare spending increase as well.

Leisure activities

Leisure activities are another big area the middle class will spend its money on.

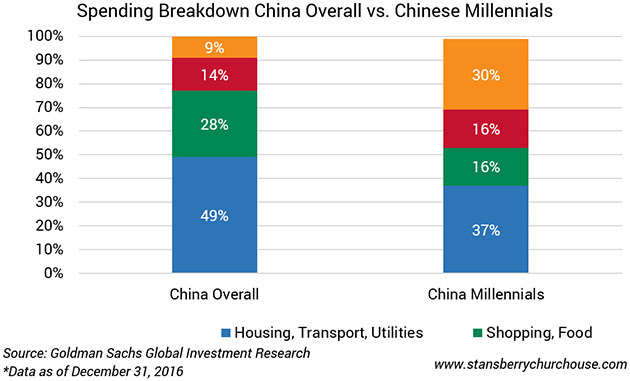

As you can see in the chart below, Chinese millennials spend 30 percent of their income on leisure activities. (Chinese millennials are expected to account for 53 percent of total Chinese consumption in 2020, up from 45 percent today. So what they buy matters.) Meanwhile, they spend just 16 percent of their income on “things”.

Travel

There’s enormous pent-up demand for travel throughout emerging Asia… and in China in particular.

It’s similar to the pent-up demand that I remember seeing first-hand in Russia in the 1990s.

For decades, citizens of the former Soviet Union hadn’t been allowed to travel, except in very special circumstances.

After the end of the Soviet Union in 1991, travel restrictions were eased. But it wasn’t until the economy stabilised years later (and commodity prices rose), and people began to have more money, that international travel took off. Eventually, the then-emerging Russian middle class started to fly to European destinations on holiday – rather than to miserable tourist-style resorts in Russia and the former Soviet Union, which had been the extent of vacation options for their parents. Today, you’ll hear Russian spoken in tourist spots all over the world.

And similarly, almost anywhere in the world – from Auckland to Paris to Buenos Aires – there are a lot more Chinese and Indians than you would have seen a few years ago. These millions of new tourists are changing the global travel industry.

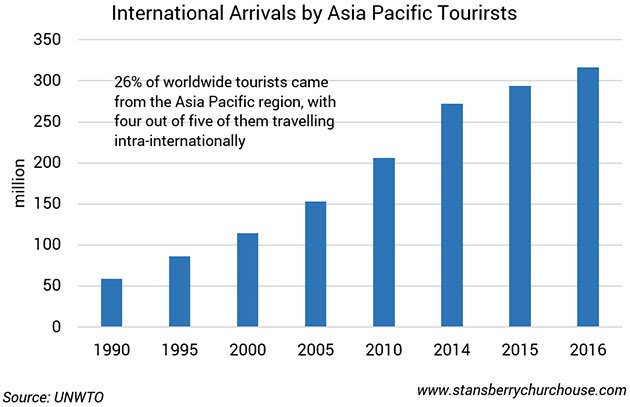

As you can see in the chart below, the number of Asian tourists has grown rapidly over the past few years. Today, nearly 26 percent of the world’s tourists are from the Asia Pacific region.

By 2024, China is set to pass the U.S. to become the world’s largest aviation market by passengers. And Chinese air passenger traffic will double to 927 million passengers a year by 2025 (compared to the U.S.’s 904 million by 2025). By 2035, the number will hit 1.3 billion.

Meanwhile, India is predicted to become the world’s third-largest aviation market by 2032. Indian air passenger traffic is expected to increase to 500 million passengers a year over the next 10 to 15 years.

In other words, tourism in China and India is booming.

These are just some of the industries set to profit from a rising global middle class

As the world’s middle class grows – along with their disposable incomes – consumers will buy things at a rate never seen before. Smart investors know that this is the type of trend that can make them life-changing amounts of money if they invest properly.

If you want to get in on this trend early, we’ve uncovered several ways to profit from the middle-class boom.

And it couldn’t be simpler to invest. Each of these investments trade on major exchanges. That means you’ll likely be able to buy them from the brokerage account you already have.