ZeroHedge: With "Stock Valuations At Extremes" Goldman's Clients Are Asking Just One Question

When just ten days ago Goldman warned that over the "next few months" stocks will suffer a sharp slump, one of our more cynical reactions was that this was the all clear sign for stocks to surge to new record highs. And, in the aftermath of last week's main event, namely the speculation that Japan would unleash helicopter money with Ben Bernanke's blessings, they did just that. But while fading Goldman is nothing new, it happened at a very good time: indeed, the S&P 500 surged to a new record high of 2164 this week while the 10-year US Treasury yield touched an all-time low of 1.37%.

As a result Goldman, and especially its clients, are stumped. As chief equity strategist David Kostin admits, they have one burning question. As Kostin puts it, they "are struggling to reconcile how extreme valuations of both assets can co-exist."

In defending his recently bearish calls, Kostin writes that "Risk-on has been the clear mantra since the post-Brexit low. But sentiment can reverse quickly."

Putting the recent market move in context, Goldman says that its "year-end target remains 2100" and still expects a major swoon lower: "the path will include a 5%-10% drawdown during the next few months sparked by rising US and global political uncertainty, negative EPS revisions, decelerating buybacks, and overly-dovish policy expectations for the Fed given wage inflation trends."

That said it appears that Goldman's clients, at least those who listened to Kostin and shorted into last week's rally, are getting rowdy and are countering with reasons why the rally should continue. From Kostin:

"Relatively light positioning remains the most bullish argument for tactical equity upside, in our view. . Client discussions reveal low portfolio risk coupled with concern that the rally lasts. Most investors have been skeptical of the valuation expansion and have not participated in the 8% rebound from the post-Brexit low on June 27. Upside call buying has been a popular strategy to insure against upside risk.

The Goldman strategist adds that the most common bullish argument cited by clients for a continuation of the equity rally is that low interest rates support higher stock prices. "Extended periods of falling bond yields have typically been associated with rising P/E multiples." However, he adds, "the S&P 500 forward P/E has already expanded by 70% during the past five years, exceeding all other expansion cycles except 1984-1987 (up 111%) and 1994-1999 (up 115%). Both prior extreme P/E multiple expansion cycles ended poorly for equity investors."

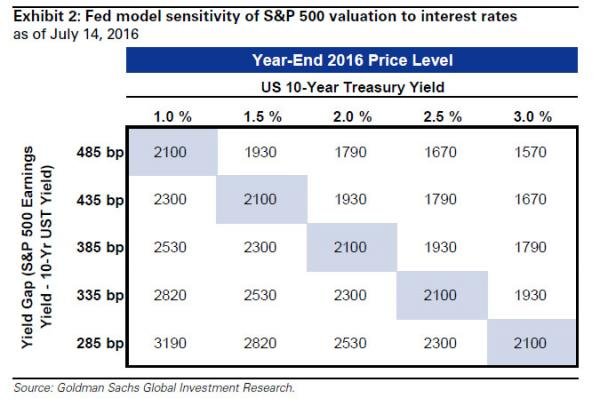

Bullish investors argue that sustained low rates will support P/E multiples of 20x or more. The Fed Model relates the earnings yield (5.7%) to the Treasury yield (1.5%). The current 420 bp yield gap is near the 10-year average. Exhibit 2 shows the sensitivity of this model. Assuming a steady bond yield, reversion to the 35-year average gap of 250 bp implies a S&P 500 year-end level of 3075 while the 5-year average gap implies 1900.

So are stocks going to 3,190, or even stayin at the current level of just shy of 2,200? Once again, an oddly bearish Goldman steps in, and pour cold water on the bulls' parade.

Here are Goldman's five reasons why it disagrees with this argument for further P/E expansion:

- Valuations are already at historical extremes. The S&P 500 trades at a forward P/E of 17.6x, ranking in the 89th percentile since 1976. At 18.4x, the median constituent ranks in the 99th percentile. Most other metrics such as P/B, EV/EBITDA, and EV/Sales paint a similar picture. These valuations are only justifiable because of the historically low interest rate environment.

- Zero profit growth is not consistent with high stock valuations. Sluggish global growth and low inflation along with negative interest rate policies in Europe and Asia have led to record low US bond yields. Consistent with this backdrop, 2Q results will show the seventh consecutive quarter of declining year/year operating EPS (-3%, but +1% ex-Energy). Despite near-record margins, adjusted S&P 500 EPS have been flat for three straight years.

- Many Financials will have lower profits if low interest rates persist. Historically low yields squeeze the net interest income of banks and make liabilities harder to meet for insurance companies. Our Bank equity research team this week cut their EPS forecasts by 5%-7%. The fall in Treasury yields explains most of the cut. For the aggregate S&P 500, a 50 bp drop in the 10- year yield cuts EPS by $0.25. The headwind consists of a $0.50/share cut to Financials sector EPS partially offset by a boost to the rest of the index.

- Low rates will also detract from earnings by increasing the value of current pension liabilities through lower discount rates. The impact of pensions on S&P 500 earnings was last felt in 2012, when the pensions of three firms - T, VZ, and UPS - combined to subtract nearly $2 from S&P 500 EPS at the end of the year. We estimate that pensions could cause a $2 hit on S&P 500 operating EPS this year if rates remain low. Although many analysts and investors will "look through" these charges, they are yet another wedge in the growing rift between GAAP and non-GAAP EPS.

- The fall in US unemployment hints at wage inflation. The GS wage tracker is now at 2.9%. Higher labor costs suggests lower margins and equity valuations. As inflation expectations climb, the risk exists that the Fed tightens sooner than the market expects and bond yields may also rise. Higher bond yields and a narrowing ERP are consistent with our 2100 target.

While the cynics in us will say that Goldman's continued bearishness is merely grounds for the rally to continue even higher, the reality is that on this one, Goldman is right: if fundamentals matters. Which, with the vastly new paradigm of "helicopter money" on the horizon is a very big if. In fact, one can make the argument that with monetary paradrops, not even a surge in yields - as the market starts to price in the hyperinflationary endgame of the "helicopter" - will dent equities, whose multiples will get even more detached from any historical precedent.

For those readers who still do care about fundamentals, here is the bottom lin:

The S&P 500 trades at a forward P/E of 17.6x, ranking in the 89th percentile since 1976. At 18.4x, the median constituent ranks in the 99th percentile. Most other metrics such as P/B, EV/EBITDA, and EV/Sales paint a similar picture. These valuations are only justifiable because of the historically low interest rate environment.

Then again, this has been the case for a long time; why should it change? Kostin says that "sentiment can reverse quickly", although one wonders what would catalyze that: after all we just saw that the central banks' response to BIS criticism of being too activist was another global coordinated bailout of capital markets. Instead, the better trade here remains Michael Hartnett's favorite "barbell" trade - positioning for either of both extreme outcomes now that everyone is "all in" - either roaring inflation, as central banks simply can and will print as much as is needed, or devastating deflation. The "muddle through" is about to end.