The Future Of ICOs In China.

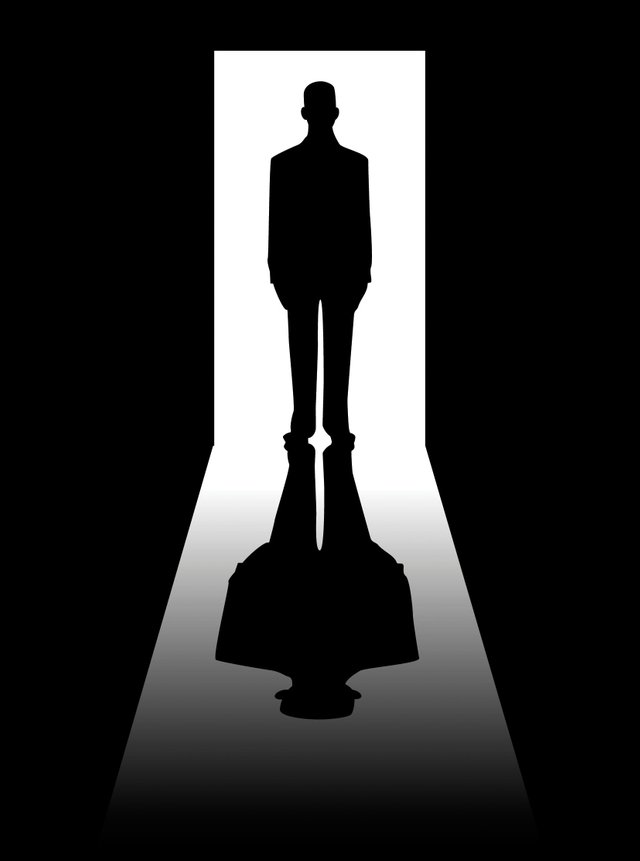

Chinese ICOs Move to the Shadows

China’s blanket ban on initial coin offerings may have made it illegal for startups to hold initial coin offerings (ICOs) and for investors to contribute to them, but it has not quashed excitement among investors for crypto token investments. Chinese ICOs continue to operate, but now they do so from the shadows. ICO investing seminars hosted in mainland China used to attract hundreds of investors. Concerned — at least purportedly — that the nascent funding model was being exploited to commit fraud, the People’s Bank of China (PBoC) declared the practice illegal and ordered the cessation of all Chinese ICOs. The PBoC also required startups who had previously completed ICOs to return all funds to contributors. Not long after, domestic bitcoin exchanges began “voluntarily” shutting down, citing the PBoC guidance on ICOs. But, as the Wall Street Journal reports, ICO investing seminars have not ceased on the mainland. They continue to operate in secret and target wealthy investors willing to meet investment minimums as high as $100,000. It’s impossible to measure the extent of these schemes, but anecdotal evidence suggests they remain quite common.

There is a huge amount of ICO ideas incoming from China. So any kind of ban related to ICO is unfortunate. However there are a lot of rumors that tell about unbanning of ICO in China.