Whale Cash Incoming! LedgerX Now Licensed to Trade Crypto Derivatives

New York-based LedgerX has been licensed to sell cryptocurrency derivatives, by the US Commodity Futures Trading Commission. Paul Chou, CEO of LedgerX, made the announcement in a post on the company’s blog.

Derivatives Based On Any Crypto

LedgerX is now the first company in the United States to be licensed to sell derivative instruments with any type of cryptocurrency as the underlying asset. Derivative instruments frequently take the form of put or call options, but can also take the form of other conditional trade agreements, potentially very complex ones.

Creating a derivative market for cryptocurrency could potentially bring more stability to prices in the crypto space. The ability to hedge bets on crypto could also bring more institutional investors to the still-relatively-new asset class, along with plenty of institutional investment capital.

“Crucially, we believe derivatives on cryptocurrencies will be needed in the long term for people and institutions to manage the volatility around these conversions.”

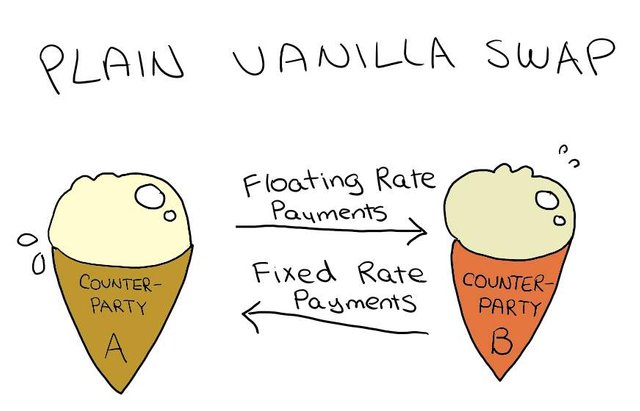

The first product LedgerX plans to offer is a simple day-ahead swap between bitcoin and dollars. The day-ahead swap allows customers to trade bitcoin for dollars (or dollars for bitcoin) today, at today's prices, then receive delivery the next day. More complex derivative contracts will be added in the future.

Fully Licensed NY Futures Exchange

Holding the first license of its kind, LedgerX hopes to serve as a model to the rest of the world. Naturally they mean that in the sense of being a good corporate actor, but LedgerX also hopes to serve as a regulatory model for other companies in the US and around the world.

The pursuit of federal approval and licensing was a conscious decision that the company has been pursuing for three years:

"We are not a money services business. We are a United States exchange and clearing house, which allows us to have a single federal regulator… The earliest bet LedgerX made at its founding was that a federal regulator in the United States would provide a critical foundation to allow real institutional involvement in cryptocurrencies."

The transparency and reporting requirements LedgerX faces could help pave the way for approval of a cryptocurrency ETF. The Winkelvoss brothers had their application for a bitcoin ETF denied, but among the reasons for denial was that there were not enough transparent, auditable markets for bitcoin. LedgerX’s derivative markets could help clear this hurdle.

Aiming at Institutional Investors

In a sign of the growth and expansion in cryptocurrency markets recently, LedgerX is aiming its derivative offerings at institutional investors.

Ye olde days

Growing involvement from large investors is a sign of how much the cryptocurrency markets have grown up in recent years and a sign of how much further they could still go. Institutional investors could be swayed to make the transition by having the ability to hold assets and hedge positions through a regulated entity with the necessary connections and expertise.

"We are a combined exchange and clearing house, which makes a big difference in integration ease, trade safety, and cost. The on-boarding process is significantly easier..."

LedgerX says it is already working with organizations managing more than $500 billion in assets. More capital is available, so far untapped. As a combination spot exchange and derivatives clearinghouse, LedgerX is in a position to make it much easier for that money to find its way into the crypto markets.

LedgerX already holds its license. The company will open its doors for trading in September 2017. If you have the skills to help them do that, they're hiring.

It is inevitable, cryptos are going mainstream. It is just a matter of time.