Bitcoin Cash Price Makes Push for $3,000 as Wider Market Stumbles

Bitcoin Cash Price Makes Run at $3,000

Much like the older sibling it forked away from at the beginning of August, bitcoin cash has seen its market share drop during the early days of 2018.

After entering January controlling approximately seven percent of the cryptocurrency market cap, bitcoin cash has seen its share drop by one-tenth to 6.3 percent as other altcoins — most notably ethereum — have surged to all-time highs.

This week, however, bitcoin cash embarked on a rally of its own in a bid to leap above the $3,000 barrier after sinking below it last week. There was no clear trigger for the run, although the coin likely benefited from a report that mining pool BitClub Network — a small pool that currently accounts for about 2.5 percent of the bitcoin hashrate — would begin issuing payouts in BCH form while continuing to mine the BTC chain.

Nevertheless, the fourth-largest cryptocurrency came close to achieving its goal, leaping from a low of $2,280 to a high of $2,988 on Jan. 10 — an intraday climb of 31 percent.

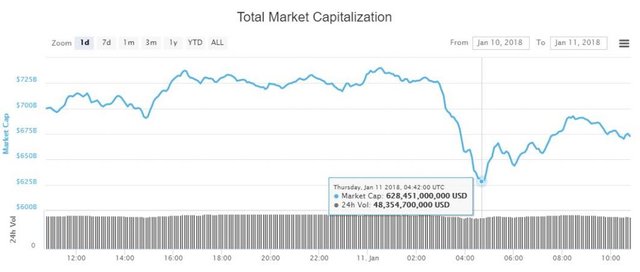

Unfortunately for investors, the rally hit a wall, in part due to conflicting reports that South Korea was planning to pursue a blanket ban on cryptocurrency trading. While the president’s office ultimately issued a statement denying that the ban was a finalized decision, the initial report took the wind out of bitcoin cash’s sails, as Korea represents one of the coin’s largest markets.

Unfortunately for investors, the rally hit a wall, in part due to conflicting reports that South Korea was planning to pursue a blanket ban on cryptocurrency trading. While the president’s office ultimately issued a statement denying that the ban was a finalized decision, the initial report took the wind out of bitcoin cash’s sails, as Korea represents one of the coin’s largest markets.

At present, Seoul-based Bithumb’s BCH/KRW trading pair constituted bitcoin cash’s second-largest market, as well as its highest-volume fiat trading pair. Consequently, it should come as no surprise that the bitcoin cash price careened back down as low as $2,330 before beginning a cautious recovery along with the rest of the cryptocurrency markets.

At the time of writing, the bitcoin cash price was trading at $2,633 on Bitfinex, which represented a minor 24-hour decline but a 15 percent increase from its Wednesday low. Bitcoin cash’s market cap is currently $44.5 billion, which places it $34.6 billion behind third-ranked ripple.