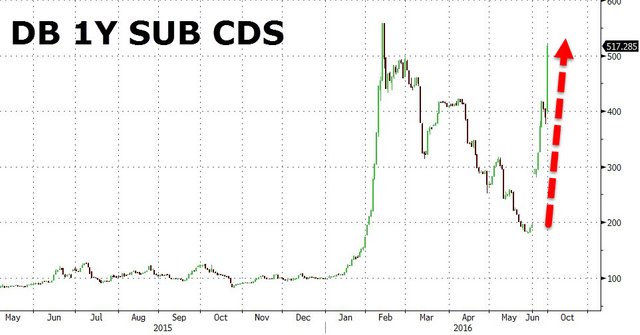

Deutsche Bank Yield Curve Inverts As Counterparty Risk Hedging Spikes (basically; bets the bank will fail rise)

"If you are a leveraged fund with client relationships with Deutsche Bank, you have a number of options including: 1) Reduce excess cash (already saw yesterday as hedge funds begin run), 2) Demand tri-party arrangements (i.e. force DB to allow you not to face them as a counterparty - which we have also already seen), or 3) Reduce risk (unwind positions or hedge potential for loss from counterparty risk)

And now that final hedging of Counterparty Risk is occurring at a rapid pace"

Also breaking now on Business insider:

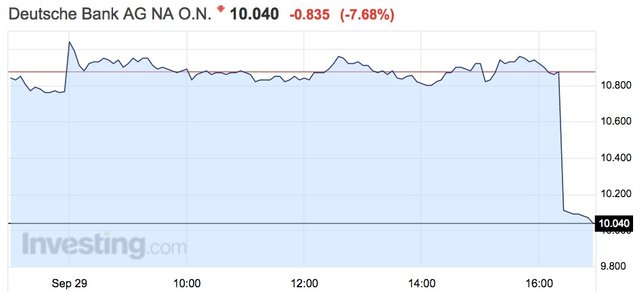

Hedge funds are dumping Deutsche Bank and shares are tanking

"Hedge funds are starting to pull business from Deutsche Bank, amid mounting concerns about the struggling German lender. And one analyst this morning sent a note to investors calling the company “Douche Bank.”

Bloomberg News reported last night that about 10 hedge funds have moved to limit exposure to the bank and have withdrawn funds, fearing that the bank could collapse under the weight of a proposed $14 billion fine from the US Department of Justice. The news sent stock plummeting in the US and again this morning in Germany."

Interesting article. I was about to post a similair thread. Cryptos are currently high risk. But the market will find it's way and blockchain is here to stay. Besides coinmarketcap.com there is: https://www.coincheckup.com I don't know any other site that gives such good inisghts in the team, the product, advisors, community, the business and the business model, etc. See: https://www.coincheckup.com/coins/Counterparty#analysis For a complete Counterparty Investment research report.