High Bitcoin Prices Boost Profits For Miners In China

High prices for bitcoin will ensure profits for its miners in China, despite a crackdown by the country’s government. This is the conclusion of analysts at Bloomberg New Energy Finance (BNEF). According to them, a bitcoin price point above $6,925 guarantees profits for miners under “any electricity regime.” At discounted rates of electricity, bitcoin miners will be able to break even with their mining costs at a bitcoin price of $3,900. That figure goes up to $4,800 at wholesale benchmark rates. (See also: China May Curb Electricity For Bitcoin Miners.)

Bitcoin’s price surged past $7,000 in November 2017. While its price has mostly moved sideways in recent weeks, the cryptocurrency has stayed above the $12,000 mark. Analysts and experts have optimistic forecasts for its price this year. For example, billionaire Michael Novogratz, who has invested 30 percent of his fortune in cryptocurrencies, has predicted a price target of $40,000 by the end of 2018.

China’s Electricity Equation

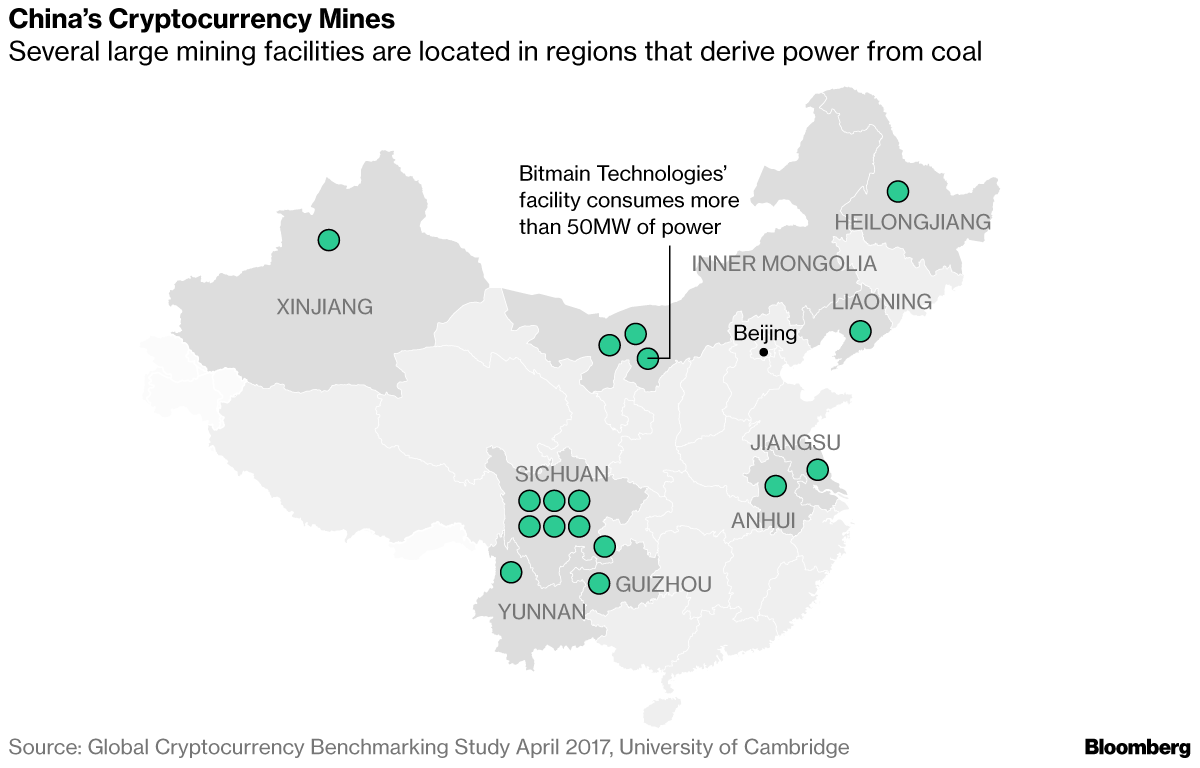

Electricity is responsible for 90 percent of overall costs for bitcoin mining. China is the world’s largest consumer of electricity. But it also has the cheapest rates because much of its power is derived from cheap coal and hydropower. Those cheap rates combined with overcapacity at hydropower mining centers are attractions for bitcoin miners. (See also: Do Bitcoin Mining Energy Costs Influence Its Price?)

For example, several bitcoin mining operations within the country are concentrated in the Sichuan province, an area with plentiful hydropower. According to the BNEF report, bitcoin mining uses 15.4 terawatt hours of power, which amounts to just 0.2% of China’s annual electricity production.

Bitcoin mining operations have also benefited utilities, which are able to divert surplus power and earn revenue from the operations. Those benefits are expected to continue in the future. According to another Bloomberg report, the closing of bitcoin mines has coincided with the completion of high-voltage transmission lines between the northern and western parts of China, which are oversupplied with power, and the east, which is power-deficient.

Investing in cryptocurrencies and other Initial Coin Offerings ("ICOs") is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. As of the date this article was written, the author owns small amounts of bitcoin. It is unclear whether he owns other bitcoin forks.