An Introduction to Cryptoeconomics

BY TAWEH BEYSOLOW II & ROBERT MASIELLO ON 6/02/18 AT 1:30 PM

Image By Foundation of Economic Education

As the cryptocurrency asset class continues to gain traction towards becoming a well adopted and utilized component with respect to traditional financial asset management processes and strategies, it is important to understand how these new financial assets are comprised, how they operate, and how they can be compared to existing markets, both at the macro-economic and the granular level. This starts by understanding the historical context by which cryptocurrencies come from.

In 2008, a person or group of people on the internet using the name ‘Satoshi Nakamoto’ proposed the first decentralized digital currency, Bitcoin, designed to work as a peer-to- peer payment network. As a brief and generalized background, on this network transactions are made between users directly and are added to a long list of transactions called a blockchain by way of a validation process — using strong cryptography methods — called Proof-of-Work. This validation process across the network is called consensus, meaning that all participants on the network eventually agree that transactions have happened in the order in which they say they did. This Proof-of-Work process — called mining — rewards a finite number of Bitcoin to those that solve the consensus algorithm and add transactions to the blockchain.

So, if a cryptocurrency is created and validated without the use of a central bank, can it be considered currency?

This unique framework is what many cryptocurrencies utilize and what separates cryptocurrencies from traditional money, which is generally backed by a trusted entity, such as a central bank, that confirms the integrity of transactions, thus providing it with value. So, if cryptocurrency is created and validated without the use of a central bank, can it be considered currency? And how can its value be derived?

The Utilities and Benefits of A Digital Currency

It’s important to first understand the benefits of a currency being digital and the unique utilities of cryptocurrencies. While the terminology used when referring to digital currencies and cryptocurrencies is typically varied, depending on the platform and medium discussing them, there are a few main differences to note when discussing the two.

• Cryptocurrencies, like Bitcoin, are a subset of digital currencies, as digital currencies essentially refer to any electronic form of money.

• Cryptocurrencies in particular, utilize the effectiveness of the electronic medium in which they exist to enable instantaneous transactions and borderless transfer-of-ownership, while also being universally accessible.

• Platforms referring to these financial assets with the blanket term “digital currencies” generally do so in an effort to ward off misguided notions typically associated with ‘cryptocurrencies’, such that they are used for illicit or illegal purposes.

There is some merit in the notion that only specific cryptocurrencies should be considered digital currencies, qualifying based on their function as a monetary device with relative similar functionality to traditional electronic currencies (central banked issues currencies). Where some cryptocurrencies are designed for singular purpose use cases (such as security and utility token cryptocurrencies), Bitcoin, Litecoin, and other public permission-less blockchain cryptocurrencies can be considered as digital currencies due to being universally accessible.

The Benefits

So, what are the benefits of a cryptocurrency? Cryptocurrencies, like most technologies, have evolved from a need to fix inherent problems associated with traditional reserve backed fiat money. However, unlike the need to create better cell phones, smaller laptops, energy efficient vehicles, and so on, cryptocurrency, due to it’s decentralized nature, represents a fundamentally different approach to the underlying problem it is solving; in this case, monetary policy and the mechanics of commerce.

It’s this decentralization aspect of cryptocurrency that is its greatest feature. Without the need to maintain a trusted or 3rd party authority (central and commercial banks) to validate transactions as well as create new money into the ecosystem, cryptocurrencies run in direct opposition to traditional currencies. This has wide reaching implications for the transfer of money on a global scale as many unnecessary intermediaries are removed from the transfer and ownership process to create a frictionless payment system. So if we understand the benefits and utilities of cryptocurrencies, how do we value them?

When studying financial markets, the number one question that people would like to know is often — what affects the price of a given asset? Thankfully, we have a wide array of tools and techniques that were used to analyze traditional financial markets (equities, bonds, etc), which we will heavily draw upon in this article

What Affects The Price of Digital Assets?

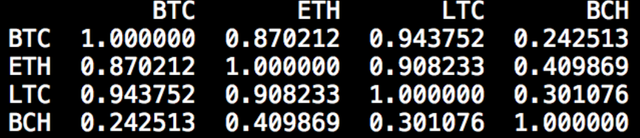

While it is not necessary to code, for those that can use Python or any other language that works well for data analysis, they can feel free to expand on the work presented here. Through this, and the coming set of articles, we will be utilizing Data Science methods to draw conclusions about how to understand what affects the price of a digital currency. Let’s first start by analyzing Bitcoin relative to a basket of other digital assets. We then will conclude by analyzing it relative to a broader market, which will include traditional financial instruments. The statistic we will use to analyze Bitcoin and other currencies in this article will be the correlation coefficient, which measures linear correlation between two sets of values. Simply stated, linear correlation determines the degree to which the movement of one series of observations positively or negatively is associated with the movement of another series of observations. Below is an example of some of the liner correlations we observe between different cryptocurrencies as they trade relative to USDT on a daily basis:

Liner correlations observed between different cryptocurrencies as they trade relative to USDT on a daily basis / Riverblock.AI

Although USDT is not precisely the same as USD, it is a very good proxy. An example of how to read this table would be to say, for example, that “movement in BTC prices is 87% linearly correlated with movements in ETH prices.” With this in mind, we can see that every currency (except for Bitcoin Cash) is highly correlated with each other. However, this is not the only data that we can analyze, particularly since BTC has become significantly more mainstream. With this in mind, let us look at some larger amounts of correlations between crypto and broader financial instruments in the past 2 years:

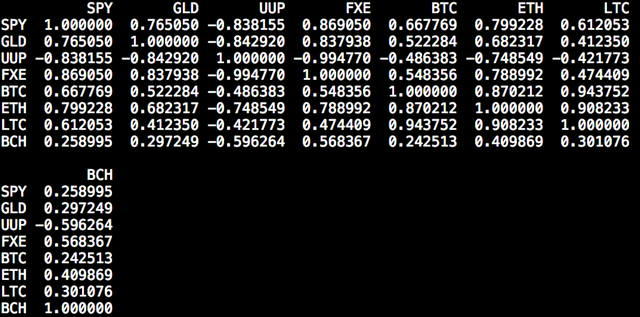

Correlations between crypto and broader financial instruments in the past 2 years / Riverblock.AI

When introducing a couple of the new instruments, we now start to see some data that now starts to add complexity to our understanding of how BTC moves relative to the broader market. For those unfamiliar with traditional financial markets, they will see the basket of securities we analyze are the following:

• SPY — S&P 500 ETF

• GLD — SPDR Gold Trust

• UUP — Powershares USD Index Bullish

• FXE — Guggengeim CurrencyShares Euro Trust (Euro Index)

These basket of securities form a reasonable proxy for broad segments of the global financial market. Furthermore, movements in the price of these assets relative to one another can help us to understand what is useful for predicting a given asset’s price or price movement. For example, we see that UUP is negatively correlated with the price of BTC by roughly 50%. As such, the following would be a reasonable hypothesis to inspect further:

Weakened confidence in the US dollar is associated with upwards price movements in BTC markets.

The quantitative proof we have for making such an assumption, is given preliminarily by the correlation coefficient. However, the qualitative proof is given both in this article and implicitly in the purpose of digital currencies. When you buy digital currencies, you are effectively taking a short position in the fiat currency you exchange it for. As such, in a perfectly liquid market, it makes sense that periods of weakened economic confidence would see flights to digital currencies, which represent a paradigm divorced from the central banks that control the fiat currencies when use in daily life.

This thought process can be used to guide the modeling of the price of BTC with respect to different macroeconomic factors (particularly as it relates to long term price projections of digital assets).

Exploratory modeling techniques such as this have been the underpinning of quantitative finance and as show, can back our assumptions for decision making with quantifiable proof. Now that we have come to the end of our first article, what would be important for those who want to use a more data driven approach to digital currency trading and investing?

• Look for correlations across the product(s) you are interested in trading — We performed some of this analysis earlier, but this is cursory compared to what users should be doing with respect to modeling digital currencies. Readers should spend most of their time ensuring doing preliminary data analysis.

• Start forming a repeatable, explainable, and profitable trading strategy — Many people who trade often have idiosyncratic methods that they often can explain themselves but have difficulty explaining to others. This is an example of a trading strategy that likely will not serve the readers well over long periods of time. Finding a method that you can clearly dictate to others will indicate that you yourself understand exactly what you are doing at every step. Secondarily, readers should be able to repeat this strategy more than once, and ideally, along a regular schedule. While there are certain events that might not be segmented equally between observations (exchanges crashing, coins going to 0, etc), there should be a set of processes that are the same generally every time a trade is initiated.

• Data provides the proof for a solid qualitative understanding of a market. Neither is more important than the other — In Data Science there is an old saying which would be useful to remember — Garbage In, Garbage Out. Good data with a understanding of algorithms and modeling will yield poor results. Similarly, bad data with a good understanding of algorithms and modeling will yield bad results. The complexities of financial markets are massive, but the power of algorithms can be used to expedite the work of analyzing data manually. However, algorithms will not find answers that do not exist. Work long, hard, and carefully to ensure your assumptions are validated before you build solutions using Data Science.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

Riverblock AI

Chief Data Scientist Taweh Beysolow

Managing Partner Robert Masiello

Riverblock AI Logo

More on us👇

Founded in 2018, RiverBlock, Inc. is dedicated to advancing the field of analytics by providing highly actionable predictive modeling software for digital asset markets. We believe the convergence of open financial systems with artificial intelligence is rapidly approaching and have built a roadmap to be a leader in supportive investment products and capabilities for the digital asset financial landscape of the future.

Contact us to learn how we can support your digital asset investment objectives:

Address

— 244 Fifth Avenue, Suite Q212 New York, N.Y. 10001

God bless you. https://steemit.com/@biblegateway