How To Get Around Sanctions

by James Corbett

corbettreport.com

June 2, 2018

"Abandon all hope ye who enter here."

That, famously, is the inscription above the gates of hell in Dante's Inferno, and, if Uncle Sam gets his way, it will be the first thing that comes to mind for any company seeking to skirt the Iranian sanctions that are snapping back into place in the coming months.

Why? Because there are a growing number of companies and even entire countries that are openly proclaiming that they will not go along with these latest sanctions and will continue trading with Iran as before.

Now let's be clear: There is always diplomatic arm-twisting and wrangling that occurs whenever a powerful nation (or group of nations) wants to sanction another. If a blanket UN resolution upholding the sanction regime fails to pass, there is always the tried-and-true tricks of carrot-and-stick diplomacy that can be deployed. Backs can be scratched, deals brokered, threats made, and hey presto! your ability to exert economic pressure on an enemy (even one who is already economically distanced from you) can be greatly amplified by your allies. For an example of this, see any of the sanctions that the US has slapped on Russia in recent years and the way Canada, the EU and other US allies can be pressured into going along with them.

But this round of US-imposed sanctions—attempting to block businesses from trading with large swaths of the Iranian economy—is decidedly different. For example, it's not often that you see a US Treasury Secretary having to publicly threaten a major American company, but that's essentially what happened when swamp creature Steven Mnuchin told Boeing (as well as Europe's Airbus) that they will "have their licenses revoked" for dealing with Iran, thus costing the company tens of billions of dollars in lost business.

Neither is it common to see the US outright threaten to sanction allies who don't go along with sanctions against enemies, but that's precisely what happened when swamp creature John Bolton suggested there would be secondary sanctions on European companies that trade with Iran.

The pressure seems to be working. Many companies are throwing in the towel already and caving to the pressure. France's Total has already announced that it is highly unlikely it will be able to continue with its investment in the South Pars natural gas field development, and the chairman of the world's top oil trader has declared the sanctions to be unavoidable (inspiring the particularly blunt headline "There’s No Getting Around Iranian Sanctions" from OilPrice.com).

In other words, "Abandon all hope ye who trade with Iran." Except...

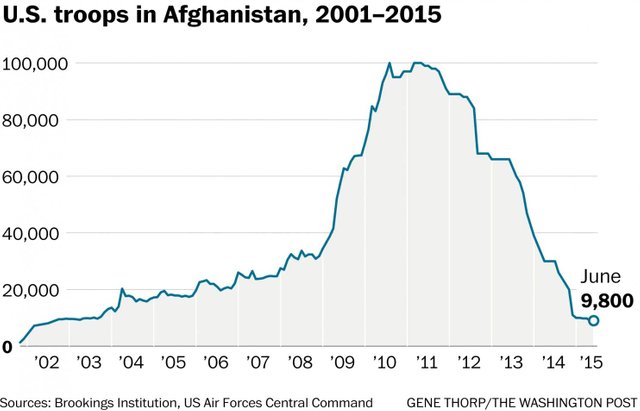

The very fact there are so many outright threats and so much overt arm-twisting going on here to bring everybody on board with these sanctions tells us that not everybody is on board with Uncle Sam's plan. We've already seen how European leaders are at least talking tough about standing up to the US on this issue, and now even the neocon warhawks and their media lapdogs are openly questioning whether the sanctions will harm the American war machine's efforts to "stabilize" (read: extract the mineral wealth from) Afghanistan.

But what about skirting the sanctions altogether? How tough would it be for companies (or countries) that actually want to stand up to the US to get around this economic embargo?

Well, just ask Sushma Swaraj. He's the foreign minister of India, and he just made a public declaration that India will only "comply with UN sanctions and not any country-specific sanctions." Given that India is a long-time trading partner of Iran and has always been thirsty for Iranian oil, Swaraj's declaration is a major victory for Iranian foreign minister Javad Zarif, who is currently on a diplomatic tour trying to drum up just such support from Iran's trading partners.

The other stops on Zarif's tour? China, Russia and Brussels.

China won't need much convincing of anything. Already in a tense trade dispute with the US on a number of fronts, China wasted no time at all jumping into the vacuum created by the US sanctions. A new 8,000 kilometer railway link between China and Iran just happened to open at the very moment that Trump was announcing the intention to snap back sanctions, China's CNPC has already said they'll fill the hole in the South Pars development deal left by Total, and a Chinese investment firm has just announced plans to spend $2 billion building an oil refinery in the north of Iran. And lest there be any inkling of doubt as to China's stance on all this, the Chinese foreign ministry just confirmed they'll be specifically addressing "how to avoid major disruption of joint projects" with Iran at a regional summit next month.

Similarly, Russia—also the victim of a number of US sanctions—is highly unlikely to start winding down its business dealings with Iran. On the contrary, a recent meeting between Iranian and Russian officials ended with the decision to formulate a plan for skirting international banking sanctions by transacting in cryptocurrency.

And Europe? Well, in addition to the "with friends like that..." and "unreliable" jabs that have been wafted at the White House from various EU leaders in recent months, there's now the sticky issue of an entirely different set of sanctions. Namely, the steel sanctions that, it turns out, the US is going to impose on the EU after all. So while Brussels is lining up at the WTO for their chance to sue Washington, it's just possible that they might be tempted to defy the US on the Iran issue as well.

Of course, one of the key challenges in transacting with Iran in an era of renewed US sanctions is the fact that the vast majority of international trade is still settled in US dollars. But for those intent on circumventing the American trade restrictions, all this really does is incentivize the shift away from the dollar to other settlement currencies. Hence India's rice and tea exporters "are keen to trade [with Iran] in Euro [sic] or any other currency" to circumvent the dollar, and the EU is now contemplating buying Iranian oil in euros.

Other, more creative options exist for those businesses, individuals and countries that wish to get around the Iranian embargo. Iranians have long used pay-for-play citizenship in locations like St. Kitts and Nevis to skirt restrictions on trade, and it should be remembered that the gas-for-gold scheme that Turkey and Iran used to get around the nuclear sanctions last time around—one of the most elaborate sanction evasion schemes in history—was only recently detailed in court.

And so, it seems that there is an alternate inscription that could be written above the gates of the Iranian sanction regime. Not "Abandon all hope ye who enter here" but "Where there's a will, there's a way." Or, in other words, if the political will exists to defy the US on this issue, individuals, businesses and nations will find a way to do it.

A country like North Korea need not be asked this,already both North Korea and Iran are allies. Of course Russia and China will go way in trading with Iran. Soon as more countries and companies begins to defy such sanctions, the US will have to take it off before they fall at the receiving end

Afghanistan's mineral wealth is no longer as important as it was when we invaded. At that time the only large known deposits of lithium, like for batteries, were in Bolivia and Afghanistan. The Bolivians were not playing ball, they have been pissed at American corporatists since Bechtel tried to own the rain there.

But that was a long time ago, in the meantime we have discovered a large domestic deposit of lithium. The oil pipeline was often discussed but the real prize there was the lithium, which we no longer need from there.

Good luck switching from dollars to the Euro which is shitting the bed. At the end of the day they can pick of they want to do business with the US or Iran and that is an easy choice for anyone.

A bit too much arrogance here, funboy51. America is the most indebted country in the world. Why would anybody, in the long run, want to trade for $$ any more? We all know the Dollar will collapse, the minute China says 'now'.

And if you don't need the mineral wealth, why don't you get out of Afghanistan?

And while you're at it, get out of the rest of the world as well, with your military bases and your invasion forces.

We are the worlds largest producer of oil and gas and the worlds largest consumer of illicit drugs. The status of the dollar is not going to change any time soon. Mexican cartels can't switch to the yuan can they? Are American junkies going to start exchanging their USD for yuan to buy drugs with?

As far as the Euro, take a look at it, it's shitting the bed. So china holds massive debt in dollars, what would that be worth if the dollar collapses?

We have been:

Because the leaders in your country like the protection provided by the American taxpayer, don't worry though Trump is going to make you pay for your own security, that will be great won't it?

if the political will exists to defy the US on this issue, individuals, businesses and nations will find a way to do it. - and will ultimately only do more damage the U.S. dollar

The U.S. is being set up to make the U.N. appear like the answer - increased centralization of power is always the wrong answer. Thanks for the analysis James, it helps to lay the process bare ...

Time to hunt these LUCIFERIAN fuckers down .