Bitcoin $10,000: What Does It Mean?

by James Corbett

corbettreport.com

December 2, 2017

Bitcoin $10,000? Already? It seems like just a few months ago that I was writing about the price of one bitcoin surpassing the price of one ounce of gold.

Oh wait. I was. "Bitcoin Over Gold: What Does It Mean?" was written in March 2017. Fast forward 8 months and here we are with the price of one bitcoin topping $10,000. $10,138.06 as I type these very words, to be precise.

But what's in a number? By the time you read these words the price could very well have leapt to $15,000 and it could just as easily have plunged to $1,000. (If you're curious you can check the current price here.)

Don't believe me? Then you clearly haven't been watching the bitcoin price at any point over the past 5 years. Exhilarating spikes and dizzying plunges happen all the time. When it comes to crypto trading, volatility is the name of the game.

This, of course, is manna from heaven for the financial press, which can now generate a seemingly never-ending stream of "Oh My God! Bitcoin Is Exploding!" and "Oh My God! It's A Crypto Bloodbath!" stories, just swapping out one story for the other every day or two (sometimes multiple times a day). But all of these stories are a sham.

Case in point: ZeroHedge's story from earlier this week, "Crypto Carnage Continues As The Fed Warns Digital Currencies Could 'Pose Serious Financial Stability Issues.'" They manage to invoke the "bloodbath" description in the very first sentence to discuss the "clawback" from bitcoin's flirtation with $11,000 earlier in the week. As you may have noticed, bitcoin plunged back down to $9,000 on Thursday morning, prompting traders to claim (for the 198th time, in case you're keeping track) that the end was nigh for this silly experiment in internet play money.

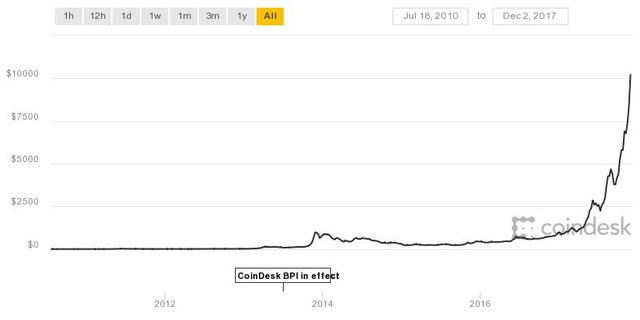

To illustrate their point they invoked this chart:

Complete with plunging red arrows to help the reader understand what downward movement on a chart looks like!

Scary looking, I suppose. Until you put it in context. When you look at the full history of the bitcoin price chart, do you see the tiny blip that was being hailed as a "bloodbath?" Neither do I.

Maybe we need some red arrows from the ZeroHedge team to help us see it.

In fact, the article gets even better. It goes on to explain that "there is no immediate catalyst" for this "carnage" and then includes a lengthy section on how the price could hit $20,000 by the end of the year. That's quite a lot of base-covering for a site claiming to have zero hedge.

Now, don't get me wrong: this isn't meant as a hit piece on ZeroHedge. If anything, ZH is one of the few sites that is willing to print a range of stories on bitcoin, from the absurdly bullish to the absurdly bearish and everything in between, so it's not a bad place to hear from both the bitcoin boosters and the crypto critics. But this example article does demonstrate some very important things about the bitcoin phenomenon:

- Anyone's random guess about the future price is as good as anyone else's.

- Spikes and plunges seldom bear any direct relation to any identifiable news stories or events.

- People are so hungry for information that articles will be churned out (and consumed by eager readers) despite the fact that they are devoid of any substance whatsoever.

Here's the fact of the matter: bitcoin is in a speculative bubble right now. The price is being driven up by intense interest from people who are just hearing of cryptocurrencies for the first time, people who have been on the sidelines but can't bear to feel they're missing out on the opportunity of a lifetime, and, more importantly, banksters and fraudsters.

It is the latter two categories of bubble blowers that, unsurprisingly, have a lot of bitcoin watchers (even some dyed-in-the-wool bitcoin die hards) wary.

The banksters are finding their way into the market in the usual way: derivatives. Why waste your time buying and selling bitcoin directly like a regular, day-trading chump when you can be a high-falutin' 21st century Gordon Gekko trading bitcoin derivatives? Well, never fear! The good folks at the CME and CBOE Futures Exchanges are going to be launching bitcoin futures trading later this month in a move that was just approved by the CFTC.

And then there are the fraudsters. If you haven't heard of the tethercoin/Bitfinex disaster-in-waiting, there are any number of resources online to get you up to speed. Suffice it to say, Mt. Gox was not the only super shady exchange scam in bitcoin history and it certainly won't be the last.

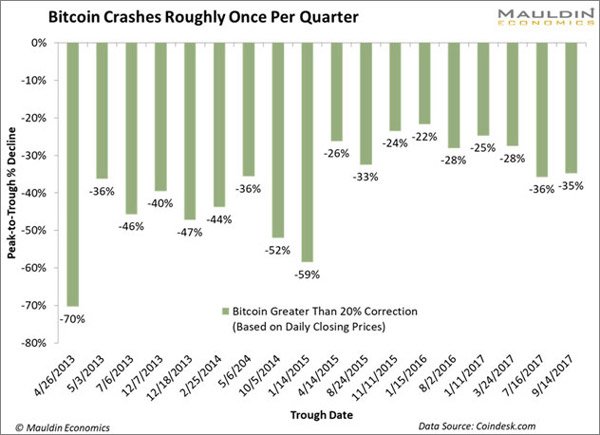

Combine all of this with the inevitable (and not undeserved) Tulipmania comparisons and the stage seems perfectly set for yet another installment of the quarterly bitcoin crash.

But every quarterly crash in the past has been followed by exponential growth that has brought bitcoin to new heights. Will this time be any different? Are we about to see another +20% "correction" and another period of exponential growth? Or the bursting of the bubble altogether? Or no correction at all on the way to $20,000?

Well, here's my controversial answer: It doesn't matter.

That's right, it doesn't matter. If you're investing in bitcoin because you want to make some quick bucks, you're an idiot. Now to be sure, there are a lot of millionaire idiots out there, and if all you want in life is lots of zeroes in your bank account, then have fun. Maybe you'll buy low, sell high, cash out with a lot of Federal Reserve Notes and live "happily" ever after (by which I mean "until the Federal Reserve Notes become toilet paper"). Or maybe you'll buy in at the top and lose everything. Again: it doesn't matter.

Why not? It's like saying that the story of the internet revolution was the story of what happened to this or that trader during the dot-com bubble. Yes, maybe Trader A made a fortune and Trader B lost it all and Trader C broke even, but on the world-historical scale, it doesn't matter. What matters is that the world has transitioned from a pre-World Wide Web economy to a World Wide Web economy, and we are still dealing with the ramifications of that. The first bubble of speculative investment surrounding that transition and its inevitable popping is now a footnote in that history, just as the daily price movement of bitcoin (measured in fiat dollars) will be a footnote in future history.

The main story is the transition from the pre-cryptocurrency economy to a cryptocurrency economy. Given the lingering and still unresolved question of the scaling debate and the many forks and splits it has caused so far, it is by no means certain that bitcoin will even survive at all, or that the crypto that emerges with the "bitcoin" name will bear any resemblance whatsoever to the central bank-less, borderless, instantaneous and practically-free medium of exchange that was originally promised to bitcoin's (mostly libertarian) early user base. Again: it doesn't matter.

What matters is that the cryptocurrency idea will survive this period, whatever happens with the bitcoin bubble, just as the World Wide Web didn't go away when the dot-com bubble burst. Now you might love that fact or you might hate that fact, but it's a fact.

As with everything else, it's a question of what we do with this fact. Can a cryptocurrency that lives up to the "pirate money" ideal be created, or is the idea destined to be neutered, co-opted and wrestled back into the service of the banksters?

Now that is the question that matters. But that is a question for another day. In the meantime, better prepare some popcorn. This is going to be one hell of a ride.

Im really curious about what will be the top end... Because BTC can't keep moving up endless... I think.....

two things to say about this: 1. i think the price is indicative of a limited supply. people are waking up to how pernicious inflation really is. 2. regarding the popping of the bitcoin bubble. this will happen when the next gen coins really start doing the things the set out to do. DASH and Cardano are good examples of these.

Bitcoin is considered to be the gate to enter in cryptos, therefore, if Bitcoin price goes up it benefits alts as well.

Bitcoin is now at 11663$ :D

Right, and long term prospects are great for bitcoin, especially because of CME futures coming soon.

https://steemit.com/bitcoin/@petermail/how-big-bitcoin-will-b

True, Steem is now exploding 1.4$

If someone is saying his investment in Bitcoin grew up x1000 times, do not think this will also happen to yours. Do you really believe in $10 mln bitcoin?

In your life time?

Really?

This has been one hell of a ride. And this will continue.

I'm glad I'm on this route.

Since 2011.

Good insight!

I strongly believe massive down turns are out of the picture for bitcoin now. Its seriously been through the ringer and every time the price increases to all new highers.

We had China ban it, then as the price kept going up they said oh shit perhaps we should start trading it again lol

Hard forks like crazy which even the largest ended up sky rocketing bitcoin prices instead

Coinbase FBI says they want inside scoop on traders and still goes up.

Every time there has been a correction but every time we hit new highs which means one thing.

Demand continues to skyrocket and for the foreseeable future will continue to while demand is in a limited supply.

Most HODLers say they wont let go of their bitcoin till we hit 100k + which will further reduce the supply. I see us getting very close to the 50k mark in 2018

I agree, and disagree. I think that BITCOIN in some form will most certainly achieve those lofty heights. At current BTC has brand name recognition, just like HERTZ before AVIS (BTC, BCH).. and then came Enterprise (X coin unknown at the time). I think that BTC is a good basis point, but the legacy developers are strangling it by failing to advance the technology, thus allowing splits to occur. In order to keep market share they should be advancing technologies in order to kill spin offs before they can even start. Evaluate a technology, segwit, lightning, block size increase (this needs to happen seriously) and implement it before a competitor can. Think (Myspace vs Facebook), Sure Myspace was first, had the market, but failed to adapt to the competition and either buy them up or crush them before they could gain a following; thus FB to murdered them. In the short term the charts seem to indicate a downward trend before consolidation to reach these lofty highs you speak of.

https://steemit.com/bitcoin/@pawsdog/12-2-2017-the-market-view-and-trading-outlook

@pawsdog

BTC is kind of planning its own path though and when you start to look at it it seems like a solid and understandable plan. They look at bitcoin as a store of value (what is currently used to get into the markets and then start trading with) They believe other chains over top of BTC are what will be used for day to day transactions such as the lighting network. When you start putting all the peices together it increased the value of BTC because lets be honest here everything trades for BTC. Its going to be very hard and a long time till another coin overpowers BTC in terms of branding. Right now when you talk about crypto it always starts with bitcoin if you try and start it with Ethereum for example they have no idea what you are talking about. Love the input btw voted ya up :D

I again agree and disagree to a point. I believe that those with a good understanding see it as a long term store of value, not a payment method for everyday things. At a blistering 7 transactions per second, that is really all it can be. I also see a great many other players as well notably miners and governments whom in reality control the block chain, though we wish it were not so.

https://steemit.com/bitcoin/@pawsdog/is-bitcoin-really-decentralized-or-are-we-being-led-like-lambs-to-the-slaughter

Not being a conspiracy theorist, but I have to look at the finances of the miners and take that into consideration in terms of price, future growth and sustainability. As the blocks get more difficult, the costs to solve them will increase proportionately to a point of diminished returns that can only be offset by an exponential increase in transaction fees, appreciation in price and block rewards. At a point all the coins will be mined, so that well will run dry and be removed from the equation. Necessitating even higher fees, this will lower the total number of transactions, leading to further increases in fees to offset the fewer transactions etc. Which could force it into a long term store of value due to prohibitively high transaction fees. That however would also destabilize the rest of crypto market as who is going to pay $100 fee to trade for $100 worth of Alt Coins or Bittrex? I think the Concept shows so much possibility, but the business model needs work.

Enjoy the banter.. Your followed...

@pawsdog

“There will be at least 3 or 4 more bubbles”

-A. Antonopoulos

Who cares, bitcoin and cryptos are here to stay, even if CME could easily be an attack from financial institutions seeking a way to stop the phenomenon and spread delusion on bitcoin.

I will hodl for dear life and if it crashes, buy even more, crypto is the real money, fairly distributed in a decentralized network and limited in supply, not that fiat paper garbage overprinted by a centralized greedy and fraudulent authority.

It means the sheeple are waking up to the scam of the US dollar. It's pretty cool when increased awareness means increased value for those two are already awake

Spot on.

Nobody seems to know what the hell is going on despite a daily deluge of articles.

I can't take anymore articles that mention tulip mania 🌷

Life in a nutshell, eh? Ain't got a clue about nothing. #FakeNews

Next target is $25000.