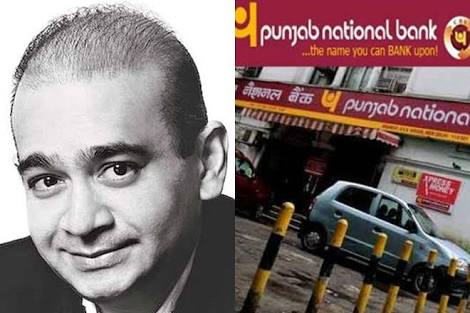

Behind The Huge PNB Scandal.

.jpeg)

Gokulnath Shetty, the PNB official at the centre of the Rs 11,300 crore scandal at Punjab National Bank, was among the two people arrested on Saturday as sleuths stepped up heat on Nirav Modi and his associates.

Shetty, a former deputy manager at the Punjab National Bank, and Manoj Kharat, have been described as the "single window operators" of the scam that is now being billed as the biggest in India's banking history.

The police also arrested a third person, Hemant Bhat, who, according to sources, is probably the "authorised signatory" of the companies tied to Modi.

The mysterious stay on transfer.

Shetty had been due to be posted out at least twice during his seven-year stint at the Brady House branch in Mumbai and the management is now grappling with the mystery of who stopped or failed to initiate his transfer.

Shetty issued letters of undertaking (LoU) without approval from higher authorities on behalf of companies of Modi group and Mehul Choksi for seven years. He was one of the employees authorised to use the SWIFT messaging system for sending LoUs.

“Shetty was due for transfer some time in 2013. However, considering he was holding a specialist position, the head office may have either not initiated transfer or someone played a role to ensure he was not transferred for another two years,” said a person from PNB head office. “The mystery really is why he was not transferred in 2015 on completion of five years.”

.jpeg)

How Shetty lost his cover?

The fraud, which has been going on since 2010, came to light in January after Shetty retired. Subsequently, claims of Allahabad Bank, Union Bank of India and Axis Bank for rollover of LoUs were not honoured by the new staffer overlooking the accounts. Shetty went untraceable since then.

According to guidelines for state-owned banks, a manager is due for transfer every three years and managers holding specialist positions can continue for five years. Rotating staff in sensitive positions, including the one Shetty held, is one vital risk management measures in a bank. Shetty had taken only one promotion in his 36 years of service. He joined the bank just around the second phase of nationalisation. In 1986, he was promoted from clerk to manager level.

Thereafter, Shetty did not opt for a promotion.

“PNB is looking into the HR practice and an internal audit is being undertaken, which will look at all these issues,” said a person familiar with the development who did not want to be identified.

But were there only 3 people in this racket?

What looks intriguing is the letters issued by Shetty and his associates were accepted by other banks who never crossverified anything, even accidentally, for years. Worse, the LoUs, by PNB’s own admission, flagrantly violated RBI’s limit of 90 days of credit by recasting that to a year. Yet, not a single overseas lending bank noticed this. There were 30 of them.

An LoU is a bank guarantee, a sort of gold promise the bank issues to customers, which they can use to get money from overseas banks.

.jpeg)

It’s something that should be accounted for somewhere, even if it is a non-funded item.

Is it possible that a branch that holds accounts for a list billionaire’s firm escapes close scrutiny? Modi was a Forbes rich-lister. Not a single external auditor, four at any given point in time, found anything amiss while reconciling transactions and undertakings.

The PNB, it seems, never tightened its internal controls and mechanism of guarantees and undertakings, despite being among banks, duped by Winsome Diamond Group, another jewellery firm that defaulted on letters of credit (LoCs) to the tune of Rs 6,800 crore. PNB had the largest exposure at Rs 1,800 crore.

Credit:- Economic Times.

Do Upvote & Follow.

Congratulations @akashs! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPhttps://economictimes.indiatimes.com/industry/banking/finance/banking/gokulnath-shetty-the-missing-clue-in-the-pnb-scam-lands-in-police-net/articleshow/62958305.cms

Plagiarism

Please avoid plagiarism & @Indiaunited trail will start curating your content after a week if no further issues are found.