South Korean exchanges Coinone and Bithumb raided by police and tax agencies

The recent flash crash in Bitcoin and most other currencies could have been caused by the recent raid in two of the biggest South Korean exchanges this week. Yesterday and article on Reuters explained what had happened and had some quotes by the officials.

"A few officials from the National Tax Service raided our office this week,"

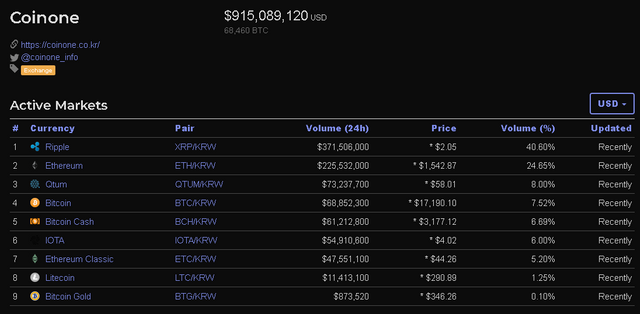

an official at Coinone. The exchange is one of the biggest ones in South Korea with a massive volume which trades these coins:

nonetheless many other currencies are affected in a flash crash as well since most are dependent on Bitcoin because they are primarly traded with it.

"Local police also have been investigating our company since last year, they think what we do is gambling,"

added the official of Coinone and said that they have been cooperating with the investigation of the tax agencies and police.

"We were asked by the tax officials to disclose paperwork and things yesterday,"

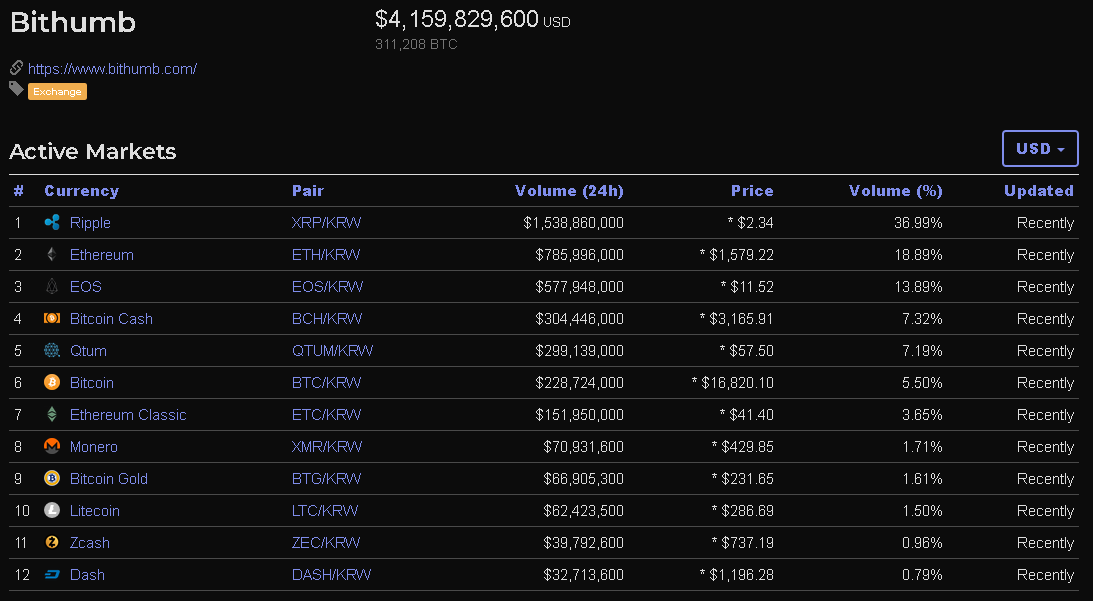

said an anonymous official from Bithumb which was also raided. Bithumb is the largest South Korean exchange and offers these coins, note that the volume is probably a lot lower now after these activities and the screenshots are fresh as of writing this article.

Authorities had recently stated that they are investigating 6 banks that offer virtual currency accounts to these institutions as they are concerned the use of these currencies will increase crime. The gambling aspect is also a major concern as many are drawn to trading now after Bitcoin's huge surge last year as cryptocurrency trading just keeps on growing in volumes.

I'm looking to add to the STACK. Reminds me of the China FUD that went down in November.

Also just read this: https://www.forbes.com/sites/pamelaambler/2017/12/12/south-korea-is-not-banning-bitcoin-trade-financial-regulators-clarify/#13bf76f11427

In short - regulators are looking to ban ICOs and weed out the "bad actors" (exchanges evading taxes, etc.) but not looking for an outright ban on cryptocurrencies wholesale.

If I was a day / swing trader, I'd be thanking them for this volatility. But alas I'm a simple HODLer that just adds to my position.

~ Kevin

Managed to get some cheap steem at 28-30k but wouldn't surprise me if we have a few more flash crashes coming.

People overreact easily in these markets. :D

If I learned 1 thing from my poker days it's to become cold as ice when it comes to dips / gains. Now I just need to increase my capital allocation into crypto and stop being such a baby boy :P

Or just trade your way up with a small amount and then you won't be as emotional about it. :)

Never trade with more than you can afford to lose in these markets, anything can happen.

Yup, good call. Been in the game since September, slow going but patience and dollar cost averaging in on project I believe in seems to be working. Hope it all doesn't come crashing down hardcore though.

Buy the crash, lock in the gains in part.

If you don't mind my asking, what's your current crypto allocation in terms of percentage of investable wealth?

I'm around 10% right now. I feel that in a growing, not well-understood market where 10-1000x are (relatively) common, you don't need to allocate a large % of total capital to do well. And you protect your downside if it burns to the ground.

But I truly believe we're in the first true boom where the common man (us) is able to invest directly before most elites, gatekeepers, and institutions. So I'm considering upping my allocation to around 20%.

Thanks for sharing, I appreciate the insight and the thought process.

Happy to - I'm far from an expert (barely a novice) so I relish the chance to talk w/ others!

You go boy.

People tend to stop trading with a particular coin once there is a little crash. We need to stop overreacting.

It's sad our steem couldn't hold $5. :(

Yeah I loaded up on a boatload of EOS on the nice dip.

Well done - EOS is in my "potential ETH killers" part of my portfolio too.

Definitely my number 1 holding. Can't see how any other project can touch it as far as tech is concerned.

Thanks sharing this news.

You're welcome!

What a horror...In Korea it is not clear what is happening with cryptocurrency!

thanks for sharing this news. at least we are aware of what happen out there. this is one of the reason why bitcoin and sbd are down. but i think we can recover. if i have some extra cash its time for me invest. it will go up again someday. i know its kinda risky . but nothing in this world is not risky.

The tax man may be avoidable at first but in the end he will get basically every cent he feels he is "due". Nothing is certain in life but death and taxes and that doesn't appear like it's going to change any time soon.

Governments are going to be clamping down on anonymous purchases/trades in the crypto space, mainly by targeting the fiat entry points such as what is taking place in South Korea right now. Next they will likely start gaining access to various major centralized exchanges to get trade information on the various users of these platforms (similar to what took place with the IRS and Coinbase a few months back). And finally the last wave will be to directly target privacy coins such as Monero/Verge/Nav... as those will become the final tax-haven left standing, and they will target them in a way that centralized exchanges will de-list them and people will only be able to buy/sell them on a peer-to-peer level through a decentralized exchange, but even then the holder wont be able to sell them for fiat or trade them for other non-privacy coins very easily or on any major levels.

All this should not be unexpected as its quite blatantly clear how this is all going to play out. Governments will allow cryptos to thrive in the long run, but not without cementing their ability to collect what they feel is due (taxes, taxes, and more taxes...).

What you're saying is right, Governments will find ways to tax cryptocurrencies one way or another. But two things could happen, firstly governments could render cryptocurrencies worthless due to over-regulation, in other words destroy the reasons why these are so useful i.e. privacy, low fees, real time, etc. thus destroying the blockchain world. Or they will hopefully realise that cryptocurrencies do provide a useful service and so they strike a reasonable balance between regulation and freedom. There's a third thing that is already going down the gurgler, governments could do next to nothing. But this won't happen.

Hopefully governments will find the sweet spot which enables cryptocurrencies to flourish and perform while keeping officials happy. I'm holding my breath but ...

Thanks for mentioning NAV. Remember, they are located in New Zealand, historically one of the hardest nuts to crack for tax authorities. They are also working on seamless encrypted exchanges between coins and fiat. Read between the lines and you'll see the NAV team basically agree with you on what's coming and is preparing.

No prob, NAV is a decent and mostly overlooked privacy coin at the current time. I personally avoid privacy coins but that is just me, to each his own I guess. BTW nice Q quote. :D

I thought the point of decentralized exchanges was that they couldn't be raided? There was actually a building to raid? Is it possible that such a thing could happen in the US or one of the larger countries?

I'm new to all this, but those were the first questions that popped into my head. I think privacy coins are going to be more popular this year, especially in countries where problems like that are likely.

These exchanges are not decentralized.

Not able to buy any STEEM, my portfolio is bleeding at the moment! It is weird that coinmarketcap took away all volume from Korean exchanges from its site before this happening, it could be a coincidence though.

Earnings from this comment will be donated to steemlab

Don't think they are relevant, I stumbled upon this tweet:

Oh well, entertaining that thought was fun..ended quickly haha.

Woah, what? That's some crazy shit, man. Wonder how much truth there really is to the gambling allegations though. I didn't manage to buy any cheap Steem, but I did pick up some Storj on your recommendation from that one post you made. Kinda good, I guess? lol.

hodl tight, news like this is why you can't just trust technical analysis in these markets. :)

Trust me, I will, man. Not selling out anything anytime soon :P Especially my Steem.

Maybe that’s why crypto prices are going’s down?

In my case I am just holding my steem here in steemit because I can’t move it to an exchange since I don’t have accounts there lol

But I am waiting for bittrex to allow new accounts so I can join them

I want to join, Please allow me.

This will even make the people's trust in cryptos just like after the China's ban on bitcoin, it surged to ATH. Blockchain technology is far behind these temporarily chaos.

We all knew this was going to happen, governments will crack the whip if they think you are tax evading. I don't blame them honestly. These exchanges need to get a little smarter or be replaced by a decentralized exchange instead. Everything is taking a pounding today because of this one country has that much of an effect on these markets still is shameful.

Welm said.. I agree with your knowledgeable opinion @bitcoinflood

Good time to HODL otherwise you will lose.

Good time to BUY steem if you are sure that's the new low.

Keep on steemit.