Union Bank in the Philippines Embracing Cryptocurrency

Union Bank Showcases Mining Rig During a Business Conference

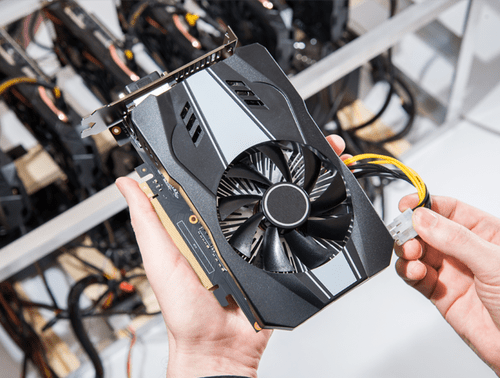

Union Bank showcases its enthusiasm with cryptocurrency and blockchain by showing its mining rig during a business conference with CEO Mr. Edwin Bautista and Mr. Miguel Cuneta, COO and Co-Founder of Satoshi Citadel Industries.

Union Bank is the first universal bank in the country to embrace the blockchain. The bank is one of Visa’s first partner for B2B Connect, a cross-border payments system built on the blockchain. B2B Connect can cut transaction time from 3 – 5 days to at least within 24 hours.

Apart from the partnership with Visa, Union Bank also announced the digitalization of its operation. From having a fully digital bank branch – The Ark, that uses an iPad instead of the usual paper slips, as well as helping rural banks and the unbanked with the help of the blockchain.

During the Business World Economic Forum, Mr. Miguel Cuneta, the COO and Co-Founder of Satoshi Citadel Industries shared an image of him with the Union Bank’s CEO Mr. Edwin Bautista.

The image depicts the two together with the bank’s cryptocurrency mining rig. Although it is not stated what kind of cryptocurrency, Mr. Cuneta shared that the bank is exploring and experimenting how “mining” works.

source : https://bitpinas.com/news/union-bank-showcases-mining-rig-business-conference/

How UnionBank Embraces the Blockchain

Visa created a cross-border payment system built on the blockchain, the Visa B2B Connect, and UnionBank will be one of the first banks to try this system. The Visa B2B Connect can transfer funds within 24 hours. This is a speed faster than the usual 3 to 5 business days using conventional channels. Another improvement is lower transaction costs.

“At the start, we said we need to defend ourselves against the fintechs that will be encroaching on our space, then it dawned on us that “Hey, this is an opportunity to enter a new market for us.” At the same time, we help the economy, we help the country.” – Mr. Edwin Bautista, President and CEO, UnionBank

UnionBank’s The Ark

UnionBank fully embraced the new technology with the launch of The Ark. The Ark is a bank branch that hands an iPad instead of the usual paper slips. Customers can also experience a car or a house before they can get a loan with the help of virtual reality.

With the bank’s digital pivot, it is also “retooling” its workforce by training them on things like coding. This practice will equip them to better adapt to digital banking.

Employees who are not yet ready to face the bank’s technological transformation may have to be moved to the bank’s subsidiaries.

“When you look at some of the rural banks that we have been buying, a lot of that would still be face to face when we got out there in the provinces.” – Mr. Edwin Bautista, President and CEO, UnionBank

UnionBanks plans to open 10 more digital banks like The Ark in the Philippines this year.

source : https://bitpinas.com/news/unionbank-embraces-blockchain/

Visa Partners with UnionBank to Build a Blockchain-Based Payment System

Visa and UnionBank announced a partnership to create a cross-border payments system built on the blockchain, the technology behind bitcoin.

Visa and UnionBank announced a partnership to create a cross-border payments system built on the blockchain.

In a press conference, Visa and UnionBank announced Visa B2B Connect, a system that can facilitate cross-border payments system that runs on the blockchain, the technology behind bitcoin and other cryptocurrencies.

With the Visa B2B Connect system, transaction time will be completed in real time (or at least within 24 hours). This is significantly faster than the usual 3 – 5 days of processing in the conventional banking channels.

The Benefits of Blockchain

Because the data will be in the blockchain, confirmation (or authentication) of transactions will be faster. This allows the money (or payment) to be verified faster because the blockchain’s ledger will verify if transactions are correct and real. Visa Asia Pacific B2B head said in a statement:

Visa B2B Connect takes on innovative approach and eliminates friction for cross-border transactions by using distributed ledger technology to enhance the speed, security and reliability if these transactions

The system will also eliminate the need for businesses to open bank accounts in each country because the banks are already dealing with each other via the Visa Network.

Both organizations announced that Visa B2B Connect will be in full operation by the 4th quarter of this year. Visa noted it plans to partner with more banks for Visa B2B Connect.

B2B Connect

Visa originally announced Visa B2B Connect during the FInTech Festival in Singapore way back in November 2017. On that event, it already announced UnionBank as one of its partners, with the other being South Korea’s Shinhan Bank and Singapore’s United Overseas Bank. American Express is also testing its own blockchain-based payments system.

source: https://bitpinas.com/news/visa-unionbank-blockchain-b2b-connect-ph/

"Union Bank showcases its enthusiasm with cryptocurrency" This is actually a Cheering newsflash for all the crypto followers and followers.