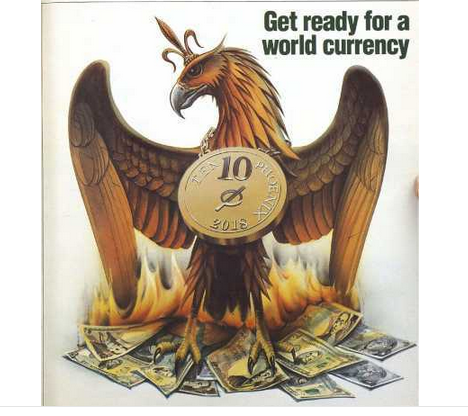

ROTHSCHILD PUBLICATION PREDICTS THE NEW WORLD ORDER WILL BE IN PLACE BY 2018

The Economist magazine published that there would be a world currency in place by 2018. Of course, the controlling interest of the magazine is held by the Rothschild family, who think of themselves as the legacy of the magazine. With this in mind, the Economist is operating as a quasi-propaganda arm for the banking empire and it is meant to prime the public opinion that the globalist agenda will implement.

CONTROLLING INTEREST OF THE ECONOMIST HELD BY ROTHSCHILD FAMILY

In the magazine, on January 9, 1988, it was said that 30 years from now people in the United States, Europe and the Japanese along with others in countries that are rich, will be paying for shopping using the same currency. The price of items will not be shown in yen, dollars or the great British pound, but in one currency. This currency is going to be favored by shoppers along with companies as it would be a great deal more convenient than the different currencies of today.

IDEA OF SINGLE CURRENCY STARTED BACK IN 1988 AND WAS CALLED OUTLANDISH

The idea of a single currency back in 1988 seemed to be outlandish. One of the biggest changes to the world economy since the 70s has been that flowing money has taken over trade in goods as being the force behind driving the exchange rates. Due to the integrations of the financial markets around the globe, the differences in national economic policies that are known to change the interest rates, big transfers of financial assets are made from one country to another. The transfers are able to swamp the trade revenue flows in effect on demand and supply of the different currencies and so in the effect on the exchange rates. Telecommunications technology is continuing to grow in advancement and transactions are going to be cheaper and they will get faster. Thanks to economic policies that are uncoordinated, currencies are only going to get even more volatile.

THE CURRENCY UNION IS GOING TO BE DIFFICULT TO RESIST

The national economic boundaries are very slowly dissolving and the trend is going to continue, and the appeal of the currency union is going to be hard to resist to everyone, apart from the foreign-exchange traders along with governments. With the new single currency, the economic adjustment to the shift in relative prices is something that is going to occur smoothly, and it will happen automatically. With no currency risk trade, employment and investment will be spurred on. The new single currency would see constraints on national governments being tightened. There is not going to be such as a thing as national monetary policy. The new currency supply would be fixed by a bank that was central. There would be a world inflation rate and thanks to margins that would be narrow, each of the national inflation rates would be in its charge. Countries would be able to use taxes along with spending by the public to offset any falls in demand that was temporary and would need to borrow instead of printing money to finance any deficit of the budget. There would be no recourse to the inflation tax, and so creditors and governments would have to judge borrowing along with lending plans a great deal more carefully than they do at present. This would perhaps mean a huge loss of economic sovereignty; however, trends that make a single currency appealing would take the sovereignty away. Even if exchange rates were more or less floating, the individual governments would have policy independence checked by an outside world that was not friendly.

NATURAL FORCES WILL PUSH WORLD TOWARDS ECONOMIC INTEGRATION

With a new century coming, natural forces are going to keep pushing the world into economic integration that is going to offer a broad choice to governments. They can choose to put up a barricade, or they can just go along with the flow. Preparing for a single currency is going to ensure there are fewer pretend agreements on policy and there will be more real ones. There will be active promotion of the private sectors use of international money along with any national money that exists. It would mean that people would vote using their wallets for a move that would end up as a full currency union.

A single currency might start out as a mixture of national currencies, and in time the value against the national currencies is not going to matter due to the fact that people are going to choose it as it is going to be a lot more convenient and there will be stability behind the purchasing power.

10 YEARS LATER ECONOMIST PREACHES GLOBALIST AGENDA AGAIN

In 1998, ten years later, the Economist printed another article promoting globalist agendas, One World, One Money. This was similar to the piece they had written ten years prior, and it went on to try to explain why a more controlled and centralized system is going to be beneficial to the global economy, while at the same time ignoring that a centralized global currency is going to be a huge coup for international banking cartels. It will also be the bottom line, financially, for the banking empire of the Rothschild family.

Creation of a single global currency is also going to give a great deal of geopolitical capital to international bankers that have not been elected, and it could take power away from the people of nations along with government representatives. But the question is whether or not anyone wants international bankers to have a huge amount of power, politically, on top of a lot of financial influence and the amount of sway they already have in power. People today want to have more say in their own lives and they do not want policy dictated by bureaucrats and banksters.

The Rothschild family is keeping a profile that is very low in the public eye. However, they do still have many business operations, and these are spread out over a wide array of sectors. There is not any particular member of the Rothschild family seen on the richest list of Forbes, but the family is said to have control over more than 1 trillion dollars in assets worldwide. Therefore they do still have a voice that is strong over the entire geopolitical spectrum, and many see this as a hand that is hidden that manipulates events quietly in the background under a veil of secrecy.