Neufund - the new way to fund ventures

Neufund is a capital accumulation platform for the community. It acts as a bridge between the investment world and blockchain space.

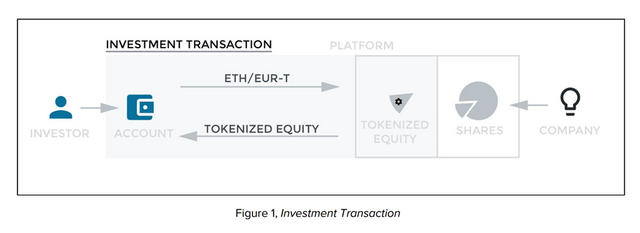

Using legal and technical infrastructure, established companies can legally issue a new type of asset, which is called "capitalized" capital on the platform. Such cryptographic tokens reflect the value of a business operating in the real world, and at the same time are liquid, like currency.

This is achieved formally, through the connection of traditional contracts with Ethereum smart contracts, mutual reference and code correspondence. Blockchain and smart contracts allow Neufund to accelerate the investment process, reduce investment barriers, harmonize the interests of inventors and eliminate transaction intermediaries.

Neufund tokens form an ecosystem that appeals to all who share the understanding that ICOs are the future of financial system, as they catalyze innovation and liquidity in unprecedented ways. On the one hand, Neufund is developed for investors: its mechanisms allow following a new path, and its low entry barriers also provide the general public with the opportunity to own investment decisions and invest in projects that make them interested. On the other hand, Neufund is developed for startups and companies that want to facilitate access to financing and take part in the crypto world by adding their shares.

In general, the Neufund fund-raising ecosystem offers a fundamentally innovative approach to project financing. The platform allows companies to issue capital in tokens and use the safe and cost-effective application of smart contracts. This opens up a broad investment side of the project. In addition, the platform itself belongs to the community, and everyone can participate in without exceeding the minimum ticket size. Investors are also strengthening their positions by increasing liquidity, as they can trade their tokens at any time. The platform provides unprecedented flexibility in funding, where community participation can accelerate fund-raising to 6 weeks.

ICO Neufund is scheduled for the autumn of 2017. However, developers prefer to call this the Initial Capital Construction (ICC) mechanism, since the funds allocated by investors will remain at their disposal. The mechanism of initial capital construction is a process that does not correspond to the currently existing ICO process used by other project objectives. In this case, it launches the investment platform ecosystem, assuring Neufund liquidity. This corresponds to the obligations of participants to invest tokens in the future shares of the companies on the platform. Capital construction is the only goal, since Neufund does not rely on ICCs to finance operations. Neufund does not have access to the funds allocated by the participants of the ICC. Funds remain under their sole control. This is the main difference between a typical ICO and an Neufund ICC.

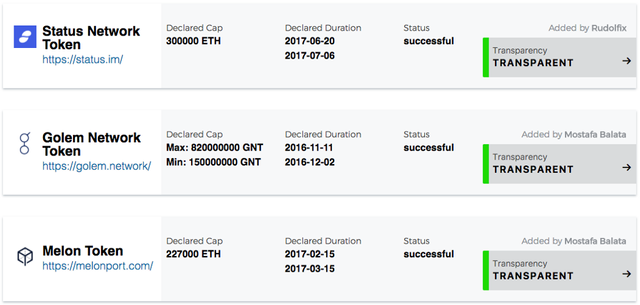

Neufund has initiated an entire ecosystem that is economically owned by its community and which extends far beyond the Neufund platform. In order to promote clear leadership and protection of participants, a European regulatory report was launched, which led to the formation of a global initiative on Blockchain policy. The developers prepared the ICO Transparency Monitor as a peer-to-peer analysis tool for the community to assess fundraisers. Numerous tutorials for startups will help investors to be well informed (available on Ecosystem Impact). In order to improve corporate governance, Neufund developed an innovative employee option plan. By providing these tools for free, Neufund plays an active role in promoting the crypto community as a whole.

During the initial mechanism for the construction of Neufund, a user will be able to transfer ETH as the native token of the Ethereum blockchain. On the Neufund platform, the next step will be the opportunity to invest in the stock tokens of both ETH and EUR. For EUR, tied to the platform, Euro Token (EURT) will be provided as an internal stable coin, tied in 1:1 proportion to EUR and thus allowing to be independent of the volatility of the cryptocurrency.

It should be noted that Neumarks are not bought in the first place. The authors receive Neumarks as a reward for their contribution to the ecosystem. For each successful investment in the company on the platform, a user receives the Neumarks until a total of 1.5 euros is reached.

Neufund ensures that the data and facilities on its platform are protected from threats that have got the reasons of the bad DAO reputation. The platform plans to store all of its assets, that is, hardware wallets, through proper procedures. The DAO, in contrast, was hacked because ETH was stored in smart contracts.

Neufund is designed to become a real symbolic economy. The cost of the Neufund platform grows with the increase in the number and volume of investments, so its economy should be designed to stimulate investment and reward participants. Thus, the cost of the platform is expressed through Neumark tokens, which the participants earn. This, in fact, means that the community economically owns the ecosystem, and this encourages investors to invest in the platform, and its growth with further investment.

Website: https://commit.neufund.org/

White paper: https://neufund.org/whitepaperdownload

Author: https://bitcointalk.org/index.php?action=profile;u=980049