A Rather Robust Blockchain

NEM; The sleeping giant no one ever hears about

Every time I look into cryptocurrency news the top stories are EOS governance problems, Bitcoin and Ethereum scalability issues, TRON a shitcoin, Tether is a scam....So many problems, not enough solutions. But then you type in NEM and all you get are stories on how they are implementing effective real-world solutions. I cannot find a bad thing about them. I really try my best to be as unbiased as possible about a project before and after I invest, keeping up with news, integrating & comparing information from multiple sources, and looking at both the good and the bad (disclosure, I am invested in NEM). Type in "NEM scam" or "NEM shitcoin" or "NEM issues" and the only remotely negative news you will find is the Coincheck hack where $530,000,000 in XEM (NEM's native cryptocurrency) were stolen which wasn't even NEM's fault. The relative lack of negative news coverage on NEM is warranted. They are superior in almost every regard to all other blockchains out there.

Blockchain Hubs

First off, NEM is the only blockchain project I am aware of that is firmly establishing itself as a leader in blockchain education in the soil of communities....literally. NEM has constructed blockchain hubs in both Brisbane, Australia and Westport, New Zealand. There is also one in Malaysia and plans to open one in the Philippines and North America. These are key to expansion and will be central to educating businesses and individuals on what blockchain is, how it can work for and benefit them and how easy it is to implement.

XEM

XEM is NEM's native cryptocurrency. 8,999,999,999 XEM were distributed back in 2015 to 1,500 trusted investors. As with any cryptocurrency, each address with XEM contributes to its distribution and are the equivalent to the banks of the cryptocurrency. Each address contributes to the decentralized nature of XEM and results in a deflationary economy based on distributed ownership as opposed to debt.

Low transaction fees

Each XEM transaction comes with a 0.01% transaction fee distributed to harvesters based on their importance score. So sending $100,000 worth of XEM would cost $1. It is quite apparent that NEM is not the platform of choice when it comes to making a profit from verifying transactions. Until the network reaches a very large capacity and price goes up significantly, turning over a nice profit will not be the case. However, with regards to the public and businesses, this is a very attractive feature.

Quick transactions

With block times of 1 minute, NEM transactions clear in minutes.

Proof of Importance (POI) consensus algorithm

One of the most unique features of NEM is it's POI consensus algorithm. It is similar to proof of stake (POS) in that it does not require any significant computer resources to harvest blocks (NEM's term for verifying and confirming transactions). Where POI differs from POS is the way in which harvesters are given priority to harvest blocks. In POS, the amount of stake you hold in your wallet solely determines your chance of mining a block. In other words, the richer get richer while the little guy gets brushed aside. With POI, the amount of coins is irrelevant.....up to a point. You must have atleast 10,000 "vested" XEM (worth about $1,200 at the time of writing) to be able to harvest blocks, however, after that it depends upon your activity. Vested simply means you have dedicated this amount of XEM to harvesting blocks. 10% of your XEM balance is vested every 24 hours once enrolled in the harvesting program.

Importance score

The account activity is quantified in terms of what is referred to as an importance score. This importance score is calculated by means of wallet activity rather than the amount of coins held in said wallet. Your score will decay over time so to maintain a high importance score, the account must constantly be active. So someone with 12,000 XEM who is constantly transacting with XEM, such as a merchant who accepts XEM as payment, will be much more likely to harvest blocks and have a much higher importance score as opposed to a person with 12,000,000 XEM that is just sitting in their wallet doing nothing. The POI algorithm also takes into account how long the XEM has been in the wallet as well as the quality of the transactions. The POI algortihm is also Sybil resistant. For example, if the person with 12,000,000 XEM makes multiple accounts and sends this XEM in a loop to all of those accounts, the algorithm will detect this and assign that person a low importance score.

Supernodes

These harvesters are all connected to various supernodes around the globe which require 3,000,000 vested XEM to be ran. These nodes must be active 365, 24/7 and are constantly audited by NEM for performance. They are the backbone of the NEM network and are rewarded accordingly. There are around 500 active supernodes worldwide, a testament to the degree of decentralization NEM has achieved. The daily payouts began in June 2016 at 70,000 XEM distributed amongst all supernodes. This supernode program is funded by 211,000,000 XEM that has been set aside from the beginning specifically for this program. As you can see, it is not very profitable at the moment to be either a harvester nor a supernode operator. Well not much is profitable in cryptocurrency at the time of writing ($214 billion market cap). However, if the network grows and XEM prices increase, it will be. Getting in early is key with these types of things.

Low transaction fees

Each XEM transaction comes with a 0.01% transaction fee distributed to harvesters based on their importance score. So sending $100,000 worth of XEM would cost $1. It is quite apparent that NEM is not the platform of choice when it comes to making a profit from verifying transactions. Until the network reaches a very large capacity and price goes up significantly, turning over a nice profit will not be the case. However, with regards to the public and businesses, this is a very attractive feature.

Security

P2P networks have some limits, one being that it easily allows malevolent nodes to enter the network. To prevent this, NEM uses a modified version of the Eigentrust ++ reputation system which gives each peer that transacts on the blockchain a trust value dependent upon transaction or upload history with other peers.

“Having a reputation system for nodes allows nodes to select their communication partner according to the trust values for other nodes. This should also help balance the load of the network because the selection of the communication partner only depends on a node’s honesty but not its importance.”

Basically each node trusts other nodes to be good judges of whether or not some node they have never interacted with before is trust worthy. It's like you trusting the friend of a friend you have never met before. The NEM network works similar to this in that it creates a network of trust associated with each user and analyzes how much trust there is between each user based on how they interact with one another. Other nodes can tap into this trusted network and ask each other if a node they are interacting with is a hostile node or not. It's like a big room of gossiping women. Everyone knows everything about each other........without the subjective judgments or assumptions, of course.

Namespaces & mosaics

Namespaces and mosaics are they way in which digital assets can be uploaded to NEM's blockchain. They can be likened to a domain name (namespace) and a file hosted on that domain (mosaic). So for instance if I wanted to create a namespace, it would have to be unique, just like a domain name. There cannot be duplicates. Let's say I claim the namespace kittypirate. No one else can claim that namespace, it is mine forever. Namespaces may also have sub-namespaces, just like domains may have sub-domains. So the sub-namespace ship would look like kittypirate.ship. Namespaces may be transferred by means of multi-sig accounts whereby the primary account holder transfers rights to another account. Namespaces offer a way for businesses and individuals to identify with a namespace, allowing them to brand their products and services on the blockchain, just like a website.

Mosaics are digital assets created on the blockchain . A mosaic termed ruby under the sub-namespace kittypirate.ship would look like kittypirate.ship:ruby. This ruby is a digital asset that can be distributed like shares in a company in exchange for XEM. It is made unique by the namespace the mosaic is associated with. The amount of mosaic in circulation can be immutable (fixed amount) or created/destroyed in some fashion. A levy may be set on the mosaic or the equivalent of a tax for any transactions taking place with the mosaic. Mosaics are freely transferable, unless otherwise specified.

Namespaces and mosaics offer yet another attractive feature to the NEM blockchain's list of functionalities, making digital asset creation and transfer quick, cheap and easy.

Apostille; NEM's next-gen notarization service

Apostille provides a way in which data can be uploaded to the blockchain and notarized, or verified for legitimacy. The intricacies of how the system works are a bit complex so I will try to give a relatively simple overview of what it does and how it does it.

The key idea with the Apostille system is to create a unique private key for the file to be notarized using the user's private key. The notarizations may also be updated or transferred. So, if I wanted to notarize a car title on the blockchain, the process would go like this. The file name is hashed using SHA256. This hash is then signed with the user's private key. The hash of the file name and the signature are then used to generate the file's unique private key. This private key is then used to create what is called a hierarchical deterministic (HD) account. Once that is complete, the contents of the file are hashed, signed by the user's private key and sent to the HD account, which now contains both a fingerprint of the file and the file's metadata. This HD account is now said to be "colored" by the car title file, so anything sent to it will pertain specifically to the history of the car. The HD account is where messages updating the status of the car, such as insurance claims or maintenance records, can be sent to by namespaces owned by trusted businesses and kept track of in a permanent and tamper-proof way.

Mijin

Mijin is the private, permission based blockchain developed by Tech Bureau. It is an extension of the NEM public blockchain and offers confidentiality for businesses. The owner (s) of the blockchain decides who may view and add information to it. It offers a high degree of throughput (4,000 tx/sec), no transaction fees, and can be easily implemented into a businesses without effecting the current infrastructure in place, at a low cost. Oh ya and it has a sweet logo.

Catapult (mijin v.2)

Catapult is the long anticipated update to the NEM blockchain with a number of improvements and innovative features not present on any other blockchain. It was first deployed on Mijin and is now on the public blockchain as well and is designated as the core operating system. Catapult also achieves around 4,000 txn/second.

Aggregated transactions

This feature is quite ingenious. It allows for the simultaneous exchange of assets between two parties and an exchange without the need for any private key information being exposed to the exchange. So lets say a buyer wants to purchase a license of some sort for 3,000 XEM, such as media usage rights, and they go through an exchange to find a seller. The buyer, however, does not feel comfortable with exposing their private key information to the exchange, but the exchange requires a fee of 6 XEM for finding the seller. With Catapult, the buyer can transfer the the 3,000 XEM directly to the seller as well as pay the 6 XEM finders fee all in one aggregate transaction. Therefore, all of the transactions either fail or succeed simultaneously, all the while keeping the buyer's private key information safe. This is detailed in the picture below:

As mentioned before, this aggregate transaction feature is not present on any other blockchain and is a very attractive mechanism for exchanging assets in a secure fashion.

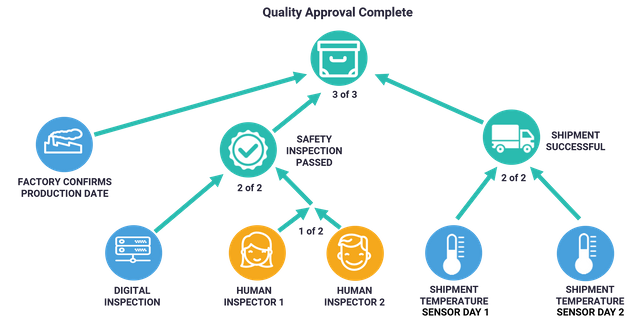

Multi-level, multi-signature accounts

This feature of Catapult increases the variety of requirements allowed that must be met for a particular transaction to take place. You may set it up so that you need 3 different signatures from 3 different trusted sources to unlock a wallet or for a transaction to go through.

For example, lets say in a manufacturing supply chain, quality approval for a product needs 3 signatures to complete. These 3 signatures will only be obtained whenever 3 different requirements are met. The first requirement is that the factory confirms a production date. The second requirement is that both digital and human inspection of the product must be performed. And the final requirement for the transaction to go through is that the shipment temperature must be in range. All of this data is uploaded to the blockchain in a permanent and tamper-proof manner and must all be present for the quality approval assessment to be complete and the transaction signed. The presence of all of these signatures triggers a smart contract to fulfill the terms of its agreement once the 3 requirements are met. This provides a sort of escrow service to ensure the smooth transfer of data in a trustless and verifiable manner, only when certain criteria are met.

Multi-sig accounts also allow for the secure and seamless transferal of ownership of a wallet, namespace or mosaic. A user could create a 1-of-1 multi-sig account and relinquish control to another user. Once this happens, the original owner's private key for the account is nullified. The original owner would still be on the account and allowed to transact, however, would need the signature of the new owner first to do any of these things. This is called a parent/child account.

4 layer blockchain architecture

Catapult has 4 layers that run independently of each other. This is to prevent congestion in one area from slowing down the entire network.

So if the API server gets clogged for whatever reason, it won't affect the performance of the peer-to-peer core blockchain server. This also allows updates for the layers to occur independently of each other.

NEM runs on 100% original code

NEM is not a fork of any other blockchain. It's code was made from scratch and thus runs independently of any other blockchain. The only thing that bothers me is that github activity has been quite stagnant in some areas lately. Looking at github activity and the number of contributors in a certain area is imperative when judging the integrity of a blockchain project. No activity=no progress. A low number of contributors is not a good sign either.

The nem.core code section of their github, where much of the blockchain logic lies, has been inactive for almost a year now and only has 3 contributors. However, the issues section does seem to be more active under the nem.core code section. This lack of activity appears to be because of a greater focus on the development of NEM's Catapult upgrade, according to the more active github activity in that section. Catapult will be discussed later in the article. One of the more active sections is the Nano wallet, their desktop wallet, which I use and does run seamlessly and has quite a nice user interface. It has 25 contributors, 4 of which contribute the most. The NEM iOS app has quite a bit of activity from 2015-2017 but little in 2018 with only 2 main contributors. But what do I know, I am not involved with NEM in any way. I am just a guy looking at github activity and making assumptions. Let the superior performance speak for itself.

Projects being built on NEM

There is no shortage of projects being built on NEM. They range from payment protocols, IoT, gaming, exchanges, cryptocurrency savings platform etc. For example, PundiX is a cryptocurrency payment processing platform that enables businesses to easily transact with cryptocurrency. As simple as using a credit card, you can buy services and products with crypto as well as buy and sell cryptocurrency with PundiX in-store devices. According to their roadmap, they plan to ship 20,000 devices and 300,000 XPASS crypto cards by 2018 year-end. The full list of projects built on NEM can be found here.

Conclusion

After reading a lot and comparing various cryptocurrency projects, overall I have to say NEM comes out on top for me personally. They have numerous innovative features not present on any other blockchain, quick transaction times, low fees, turn-key style integration, a long list of projects using NEM, and massive blockchain hubs to top it off. I have high hopes for this project and stand true to my prediction of them being a top 5 crypto within a year.

References

Beikverdi, A. (2015, May 15). NEM Technical Reference Introduces Reputation-Enhanced 'Proof of Importance'. Retrieved from https://cointelegraph.com/news/nem-technical-reference-introduces-reputation-enhanced-proof-of-importance

Julian. (2018, July 18). NEM Launches Two Blockchain Hubs in Australia and New Zealand. Retrieved from https://nemflash.io/nem-launches-blockchain-hubs-australia-zealand/

Mathiau, A. (2018, March 10). NEM Shows Off Big List of Projects Built Using the NEM Blockchain - Crypto Crimson. Retrieved from https://cryptocrimson.com/nem-list-projects-built-nem-blockchain/

NEM. (2017, June 11). NEM Apostille Service Introduction and Tutorial. Retrieved from https://blog.nem.io/apostille-tutorial/

NEM. (2017, March 18). NEM Releases Assets and Domains. Retrieved from https://blog.nem.io/mosaics-and-namespaces-2/

NEM. (2018, February 23). Https://nem.io/wp-content/themes/nem/files/NEM_techRef.pdf[PDF].

Mcdonald, J., & Oliverio, J. (2017, January 15). Https://nem.io/wp-content/themes/nem/files/ApostilleWhitePaper.pdf[PDF].

Ryan/NEM. (2016, July 19). Relationship Between NEM/Mijin/Catapult. Retrieved from https://blog.nem.io/relationship-between-nem-mijin-catapult-u/

Saul, R. (2016, January 13). NEM Supernode Rewards Program. Retrieved from https://forum.nem.io/t/nem-supernode-rewards-program/1735

Tuwiner, J. (2018, March 30). Introduction to NEM (XEM): The Proof-of-Importance Coin. Retrieved from https://cryptoslate.com/nem/

Congratulations @perricita! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!