Nano | $NANO | Updated

History

Colin LeMahieu founded the project and is the lead developer of Nano. The original white paper paper and first beta implementation were published in December, 2014 making it one of the first DAG based cryptocurrencies. Other notable ones are Byteball and IOTA but I'll elaborate on that in a bit. This fact was most surprising to me because it felt as though Nano came out of seemingly nowhere.

During the time the network was live after the genesis of the project, it had limited development and a few technical issues. Colin actually stopped development for a while for personal reasons. Then in 2016/2017 a few people from the Nano community gathered around and started helping out. This is how the Nano faucet was born, a community member proposed the idea to distribute the project and volunteered to run it.

At that point development picked back up and contributors have been joining more rapidly ever since, which leads up to today and the overwhelming momentum this project has seemed to find.

Distribution

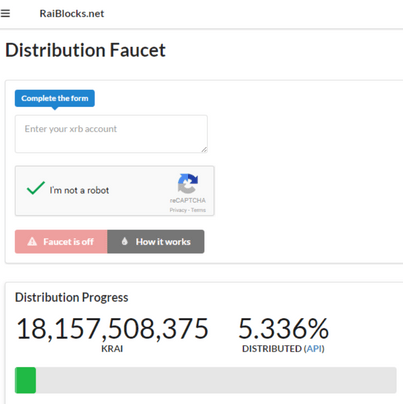

There was no ICO for Nano, the original distribution was performed though using an online mining mechanism called a “faucet”. Essentially it was a website you would go to, complete a captcha, and receive a small reward of the coin. Faucets were very popular during the genesis of cryptocurrencies because they gave people a way of getting involved without any need for invasive “know your customer” or KYC requirements.

When Nano started it was premined, and all of the available coins were kept in a genesis wallet in which the private key was kept in safety deposit box by Colin. Then, as the distribution by faucet continued, he would periodically take the private key from cold storage, and send a transaction to the landing wallet to fund the faucet. He would then return the private key to the safety deposit box.

The faucet reached a lot of people, the team estimates somewhere around 330,000 accounts accessed the faucet and a lot of those were in countries like Venezuela, the Philippines, and Korea. There where people who were able to actually provide for themselves and their families from it.

Soon after the faucet became very popular and there was a lot of sell pressure from people earning Nano and selling immediately which was suppressing the price and also putting a lot of stress on the exchanges. Not to mention there were endless attempts to hack the faucet. That meant that the Nano developers spent a large portion of their time keeping the faucet up and running instead of working on Nano itself.

Nano actually we got delisted from Cryptopia because faucet users were abusive to exchange support, but eventually they were able to be listed on Mercatox and BitGrail. Due to these these issues the team decided to turn off the faucet and burned the remaining Nano. At that point only about 39% of the total original circulating supply was distributed.

They publicly released the wallet addresses to the genesis account, the landing wallet account, and the faucet wallet account for community transparency. I will add the address in the description so you can see for yourself. No portion of Nano coins have been kept from the original genesis of the project, all existing Nano is currently in circulation.

Tech

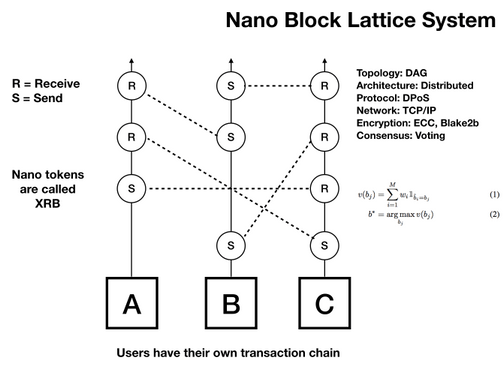

Nano is a third generation, trustless, low-latency cryptocurrency that utilizes a block-lattice architecture instead of your traditional blockchain that you see with other cryptocurrencies. Nano’s focus is for fast, fee-less, peer to peer transactions and that is what separates it the most from it’s similar competitor IOTA.

The team stated they’re focused more on micropayments than we are IOT or internet of things applications. But they stated IOT uses is definitely something they would support. In my IOTA video I touched on what a DAG or Directed Acyclic Graphs are, but I’ll quickly summarize again.

- Directed refers to the fact that new transactions validate the ones before them, acyclic means that it is not a circle, and graph means that the lattice structure itself is also the ledger.

- The block lattice is essentially a system for all individual wallet or “account holders” to have their own blockchain, side by side.

*When one wallet wants to send to another, the sender side of a transaction creates two blocks: one send block on their personal blockchain and one receive block on the recipient’s blockchain. - When the receiving party comes online and their blockchain connects to the network, it pockets the transaction and the transaction is complete.

Transferring funds on Nano’s protocol produces two separate transactions. Firstly, a send transaction that deducts the fund amount from the sender’s balance, and a second receive transaction that adds the fund amount to the receiving account’s balance. Each send transaction must reference the owner’s previous block, so a double-spend on the block-lattice is not possible.

Nano uses delegated proof of stake (dPoS) system. If you are unsure of what that means please pop over to my Crypto 101 video where I cover consensus protocols.

With dPoS, users have the ability to choose a representative node to vote on their behalf. The voting process is balance-weighted, meaning that the weight of a representative’s vote is directly proportional to the amount of Nano that have been linked to that account. The greater the number of Nano linked to a representative, the more its vote will be worth. There is a public list of Nano representatives which I’ll add to the description.

It is important to note that Nano’s architecture also utilizes Proof of Work, but in a minor sense that is for an anti-spam measure not as an agreement protocol. Due to there being no transaction fees on the Nano lattice, an attacker could indefinitely spam the network. With the PoW implementation, each block has a small amount of work associated with it, approximately about 5 seconds to generate, and 1 microsecond to validate.

This forces a malicious actor to dedicate a significant amount of computing power to carry out an attack, while simultaneously requiring only a small amount of computing power by everyone else. Which prevents much larger issues from occurring.

Nano has a desktop wallet available to Mac Windows and Linux. There are also online wallets available. The team is very active and their discord server was a huge help when it came to sourcing information for my research, and the rebranding shows that they are committed to the success of this project long term.

Present

Currently the market cap sits at 736 Million in USD. Putting it at number 28 on coinmarketcap. As mentioned before it has undergone a large rebranding which was something that was seriously anticipated by the community. While I appreciate the rebranding, I think the name choice may be cause for some competition when it comes to search engine optimization and ease of locating information on the project.

Looking forward to 2018 on their roadmap they're continuing the development of their wallets. As well as working on implementing "smartcards" within their network.

Smart Cards are pocket-sized cards that have embedded circuits. Essentially, they are computers that are capable of running programs when inserted into any supported terminal. Smart Cards are used widely across the world by major credit card networks, governments and private companies to provide highly secure authentication and authorization.

BitGrail Incident

So unless you've been under a rock you've definitely heard about the "stolen Nano" that magically up and disappeared from the Italian crypto exchange on February 9th. The exchange released a public statement that it was rendered insolvent after an alleged hack of 17 million XRB. According to a Medium post by the Nano team, Francesco Firano, also referred to as "The Bomber" contacted the team to inform them of the losses one day prior. BitGrail suspended trading for XRB on the same day, as well. Long story short the Nano team concluded that it was a scam on the part of the exchange.

Recent News

On March 13th news surfaced of BitGrail reenabling XRB trading...

When the site relaunches, users will be able to withdraw 20% of their Nano, and the remaining 80% will be handed out in a new token called BGS, that will not be immediately available for withdrawal or deposit. Bitgrail claims it will then use 50% of its profits from the platform to buy back BGS at a fixed price of $10.50 per BGS.

Oh you know, the 'ol, "I stole your coins and I'm going to pay you back but in a token that's specific to my site and will generate me revenue" scam. Sounds a bit like how BitConnect "paid out" their investors fairly .. a.k.a reimbursed their outstanding loans in their native BCC token, and immediately after the price dropped and the coin was worthless.

On April 5th a class action lawsuit was filed against Nano developers:

A new class action lawsuit has been filed in the United States District Court Eastern District of New York on behalf of investors in Nano (XRB, formerly Raiblocks), according to a class action complaint signed April 5.

The lawsuit is being filed by an American individual, Alex Brola, through Silver Miller law firm, and alleges that Nano’s core team both violated US securities laws by selling unregistered securities as well as negligently misrepresented the reliability of crypto exchange BitGrail, from which around 17 mln Nano ($187 mln at the time) were stolen in mid-February.

The lawsuit asks that Nano be ordered by court to “rescue fork” the investors’ missing NANO “into a new cryptocurrency in a manner that would fairly compensate the class of victims.”

On April 9, 2018 the Nano foundation announced a legal fund for BitGrail victims

TL;DR

While we recognize that the total value of the legal fund pales in comparison to the funds lost by the BitGrail victims, we are hopeful that it will give the victims the best chance to maximize their recovery. It is our belief that through ethical stewardship the cryptocurrency community will make much needed progress in their shared effort to convince individuals, institutions and governments worldwide that global, decentralized currencies are feasible, stable and worthy of support. Most of all, cryptocurrencies rely on the support of passionate, diverse and vibrant communities of users. To that end, we are very thankful for the Nano community and hope that together we can achieve our goals.

Sincerely,

Nano Foundation

As far as my thoughts on the Bitgrail incident go, I think its absurd what happened and I can understand the outrage of those affected. However, l do not think that forking the project, and putting the blame on the team is the best way to go about it. Not only that but forking the project is going to create more turmoil and ultimately devalue the project more. Its unfortunate that the exchange is not being held liable. I have no knowledge of what kind of jurisdiction the US would have when dealing with an Italian exchange, I suspect none. Going forward, please remember that storing your coins on an exchange is NOT the same as holding them in a private wallet, you have no control over them. And for the love of all that is holy do not use BitGrail anymore..

Nano Related Links

- Genesis account: xrb_3t6k35gi95xu6tergt6p69ck76ogmitsa8mnijtpxm9fkcm736xtoncuohr3

- Landing account: xrb_13ezf4od79h1tgj9aiu4djzcmmguendtjfuhwfukhuucboua8cpoihmh8byo

- Faucet account: xrb_35jjmmmh81kydepzeuf9oec8hzkay7msr6yxagzxpcht7thwa5bus5tomgz9

github

FAQ

Raiblocks Beginners Guide

Whitepaper

Hackernoon

globalcoinreport

bitcoinbeginner

Rebrand announcement

Representative List

Join my discord!

Follow me:

Patreon

My other vlog

Twitter

Steemit

Instagram

Cryptex Discord

Website

If you're feeling generous- Tip Jars:

ETH: 0x3b97C664a9DAf6c79d6d577E0048a412BaAe68dE

BTC: 1K2Qjrf5KUxMpLqfmXLWJxwBnPzayoiGGL

Bitcoincash: 1ECdtoqg3RcWkt4JY9bb1BrvBpLsm7h3ho

LTC: LhimSAApQPY68EzXzLU1YVw4hndLfjEcXw

VTC: Vdd9P644T3eLrkwKWy5eTTXTCEipiot7Y4

LSK: 1894536853028791512L

PIVX: DFWUCjXZcedi6Upbf1u4BW753nj2aU5eAG

BLOCK: BoCdcCLtyzxQ5ggMq3nD8j6wZ8XsYKUjyD

DASH: Xx8CXP1kX3kafwyEZmismSm1UFmAQdHYuz

ADA: DdzFFzCqrhtCK3FGLqHmUpuyQaUk4pADjHJyMxg3CnM7LQiKaTsqTvBa4haDJ8Rvw68SFUjKyWKy1f9XJhihXKeVonksR6qvCRSJe3vo

DISCLAIMER:

The information provided is not to be considered as a recommendation to buy or invest in certain assets or currencies and is provided solely as an educational and information resource to help traders make their own decisions. Past performance is no guarantee of future success.

It is important to note that no system or methodology has ever been developed that can guarantee profits or ensure freedom from losses. No representation or implication is being made that using the attached material will guarantee profits or ensures freedom from losses.

CryptoCandor shall not be liable to the participant for any damages, claims, expenses or losses of any kind (whether direct or indirect) suffered by the participant arising from or in connection with the information obtained this website or directly from the website owner.