When is selling a Put better than buying a stock at the same price?

Wow, a naked put question here. It delights me to be able to answer a question from someone who is a novice to trading in the stock market.

When is selling a put better than buying the stock at the same price ?

- When you sell naked puts to bring in money into your account on a monthly basis with which you can pay your mortgage, car note, have $100 spending money, send Mom $200 cash through FedEx delivery and put aside $150.00 into your savings account with still some premium left over.

- Almost always unless the stock were to get killed (drop lots). The put writer loses here and the guy who waited with patience gets to buy the stock at a much lower price.

- Lots of moving parts here. I’m going to teach you how to get $750 from writing a naked put on *NFLX *below. You get the $750 as soon as you press the button (write naked put). In the case that you compare this to buying the stock when the stock drops to your strike price, it’s better to have the stock if the stock were to shoot up more than + 7.5 points. If NFLX shot up 20 points that's $2,000 dollars earned by the patient shareholder ($20 per 100 shares). It is not guaranteed however that the stock *will move up. *The naked put writer *does *earn $750 as soon as they write the put (guaranteed (it’s unethical to say guaranteed in the stock market, but I’m saying guaranteed you will get this put premium in order to explain it to you layman’s terms)). So you get the $750 off the bat when you write the put but nothing more, while the shareholder gets everything to the upside, +10, +20 points or more; but only if it *does *in fact move up. Now listen …

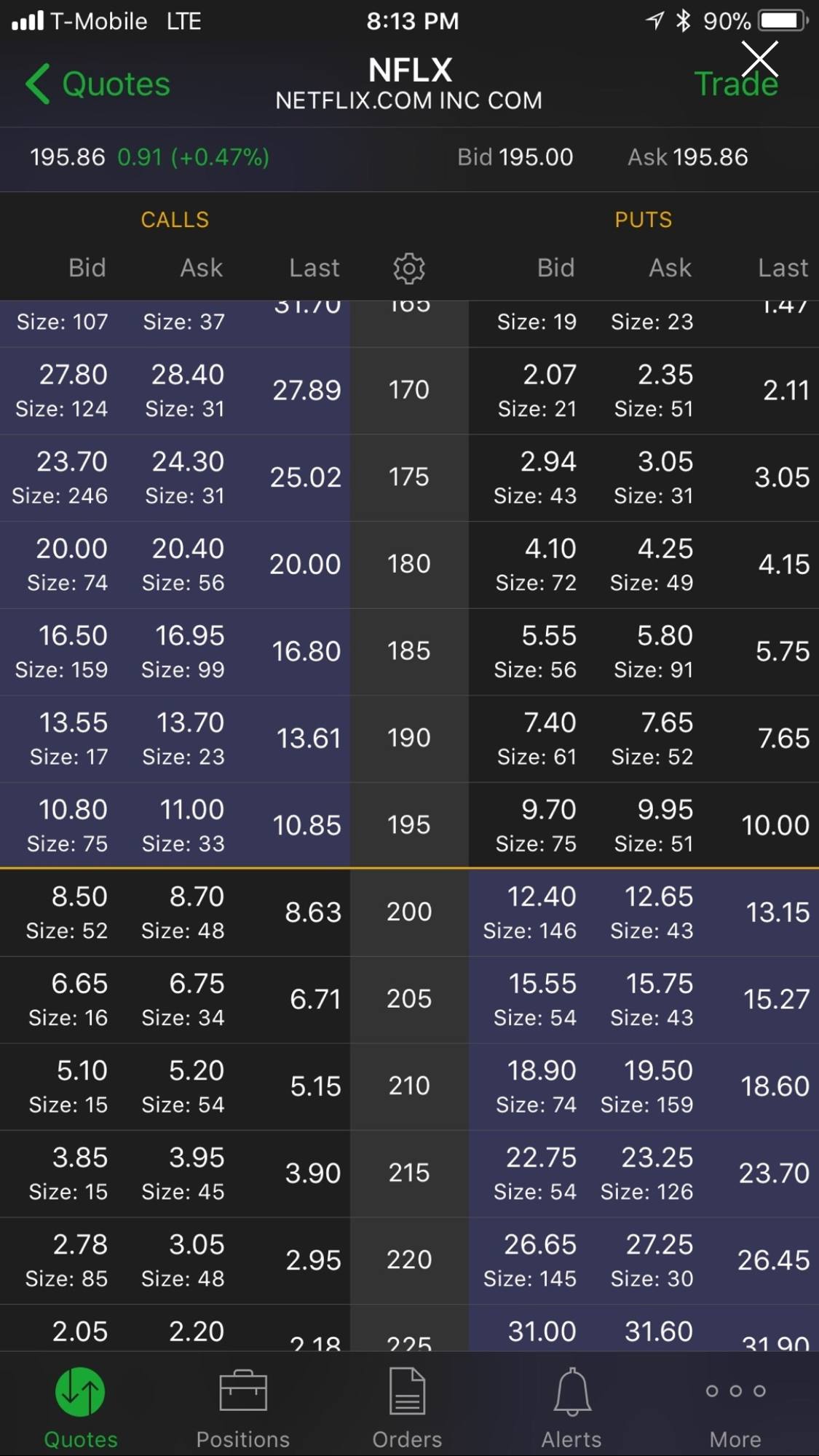

Let me explain. So here is the scenario. What a Trader will do is take $50,000 and write 5 naked puts on NFLX stock. We are in October so we write the november monthly’s. Here is what the option chain looks like.

As you can see NFLX is 195.86

The naked put (right side 190 strike) pays 7.40 by 7.65 so let’s say $750. Multiply that by 5 you get 5 * 750 = $3,750.00 - cash deposited in to your account !

They require about 1/3 of the cash requirement to write the puts as they do if you buy the stock so 190 strike / 3 = 63.33 or $6,333.00 cash per put you write.

$6,333 * 5 contrasts = $31,665 cash requirement to perform this trade. Taking $50,000 you have plenty and if you get assigned at 190 per share you have the cash to take the stock with 50% margin requirements. 190 * 5 = $95,000. 50,000 / 95,000 = 52.631% cash at hand. This is a very familiar situation for me as a trader.

So, once again we take $50,000 and write 5 naked puts of NFLX November 190’s for $750 each = $3,750 deposited into our account just by pressing a button ! We only have the responsibility to take NFLX at 190 if it were to drop by next month. Since NFLX is 195.86 we have a buffer of 5.86 points. NFLX is doing so well lately and with Trump emboldening investors. I’d put my money on this trade.

- If *the *stock stays the same - great; we walk away with $3,750 for a total of $50,000 + $3,750 = $53,750.

- If the stock goes up - Great; let NFLX go to 200. We just write the put again next month for the 195* strike* this time. The postition expires and we have the $53,750 in our accounts.

- If the stock drops - great; we take 500 shares of NFLX - it gets assigned to us but at 190 so we just saved $586 per 100 shares (5.86 per share). We get the stock at a discount . Since we are getting paid $7.50 premium per share the stock would have to drop all the way to 182.50 - to where we would break even . $750 cash premium and - $750 loss in the stock per share (190 - 7.50 = 182.50). If the stock drops below 182.50 we start to loose real money. We loose $1 per share for each $1 it drops below $182.50. It’s the proper risk to take in NFLX.

So let’s say NFLX maintains its price or it can stay the same or drop to $190 per share (-5.86). We walk away with the whole $3,750 or $7.50 premium per share * 500 shares = $3,750. - Pay mortgage $2,100.00

- Pay car more $424.00

- Send mom $200.00 cash FedEx.

- $100.00 spending money.

- $150.00 into your savings account.

$2,974 spending - $3,750 = $776 profits left in the account for a total is $50,776.00. Do it all again next month and every month. Retire to the stock market !

To wrap up your question. How is this better than buying the stock at 190 ?

Well, NFLX is 195.86 so you would have to wait till it dropped to 190. As you can see NFLX is quite the mover and it might never drop to 190. It’s like sitting there with the money and never getting a chance to use it. When you wait on the sidelines like that it could be quite aggravating and with no guarantee the stock will drop to your price. You would save the $5.86 per share if it did infact drop to 190 where you could buy it. More so even, lets say NFLX dropped all the way to 170 ! The put writers lose here and you would save about 25.86 dollars per share. Patience pays off for you here but you better get in quick cuz NFLX won’t stay down there for long. The put writer looses - 20.86 (stock loss) + 7.50 (naked put premium) = $13.36 per share loss. What they have to do now (what I have done) is dip into my other accounts to recoup that 13.36 * 500 = $5,940 loss to get my account back to atleast $50k where I can write the same dollar value position again next month with some dignity. The philosophy here is that the stock *may *drop 25 points here or there perhaps twice oer year. But it won’t drop like that every month. I can however write my put *each and every *month for $7.50 premium per share as explained. Just by pressing the button !

With writing the naked put you are performing the higher level trade with the advantage of having being paid the cash in hand to do so. Weather the stock drops or not you still get paid the $750 per contract (100 shares). If you did not write the put you might have to explain to Mom where her $200 went. You would only have the benefit of saving $5.86 per share if you did not write the put and waited till the stock dropped to 190.

So, as you can see, there is no comparison with writing the put and waiting till the stock dropped. The only down side I can see is that you are *obligated to buy those shares at 190. *You would *get those shares *even if the stock dropped to 170 - you buy’em at 190 ! Even if the market crashes you buy at 190 but you can sell out your position either way.

So let’s take $50k and bring in $3,750 per month. Do this 10 months out of the year and take two months off. Earn $37,500 on $50,000 for a cool 75% return for the year and retire to the stock market. Find a mentor to teach you this stuff and never look back.

I make this look easy- it’s not easy.

Thanks for the question.!