THE GREENARENA BILLIONAIRE. DIFFERENCE BETWEEN ASSET AND LIABILITIES

Good day the distinguished steemians and all the Honourable and esteemed members of this community.

Let us all Ponder on this Motivational piece

I Just want you to be a motivational a little more

What the Rich teach their children: Asset vs Liability

One day, the son of a rich man, who was an undergraduate,

approached his father and the following discussion took place.

Son: Dad, may I speak with you?

Dad: Go ahead.

Son: Among all my classmates, I am the only one without a car. It is

embarrassing.

Dad: What do you want me to do?

Son: I need a car. I don't want to feel odd.

Dad: Do you have a particular car in mind?

Son: Yes dad (smiling)

Dad: How much?

Son: $1600

Dad: I will give you the money on one condition.

Son: What is the condition?

Dad: You will not use the money to buy a car but invest it. If you make enough profit from the investment, you can go ahead and buy the car.

Son. Deal.

Then, the father gave him a cheque of $300. The son cashed the cheque and invested him in obedience to the verbal agreement that he had with his father.

Some months later, the father asked the son how he was faring. The son responded that his business was improving. The father left him. After some months again, the father asked him about his business

again and the son told him that he is making a lot of profit from the business.

When it was exactly a year after he gave him the money, the father asked him to show him how far the business has gone. The son

readily agreed and the following discussion took place:

Dad: From this I can see that you have made a lot of money.

Son: Yes dad/

Dad: Do you still remember our agreement?

Son: Yes

Dad: What is it:

Son: We agreed that I should invest the money and buy the car from the profit.

Dad: Why have you not bought the car?

Son: I don't need the car again. I want to invest more.

Dad: Good. You have learnt the lessons that I wanted to teach you.

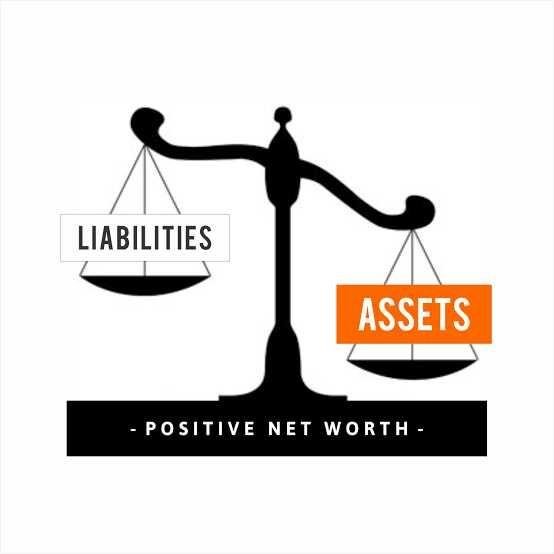

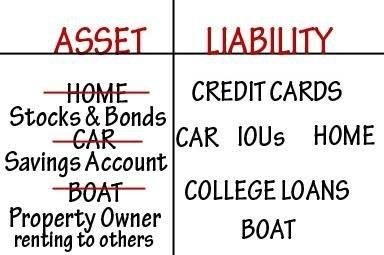

You didn't really need the car, you just wanted to feel among. That would have placed extra financial obligations on you. It wasn't an

asset then; but a liability. Two, it is very important for you to invest in

your future before living like a king.

Son: Thanks dad.

Then the father gave him the keys of the latest model of that car.

Morals:

Always invest first before you start living the way you want.

What you see as a need now may become a want if you can take a

little time to get over your feelings.Try to be able to distinguish between an asset and a liability so that

what you see as an asset today will not become a liability to you tomorrow.

The difference between the rich and the poor is that the rich look for assets while the poor look for liabilities...

Identify yourself

Build yourself

Be yourself...

If you find this interesting, kindly upvote and follow me @e-top

Thank you for Your attention

Exactly @shrinivasdontul. Majority are suffering today because of the wrong decision they have made in the past. Misplaced of priority is detriment to ones life.

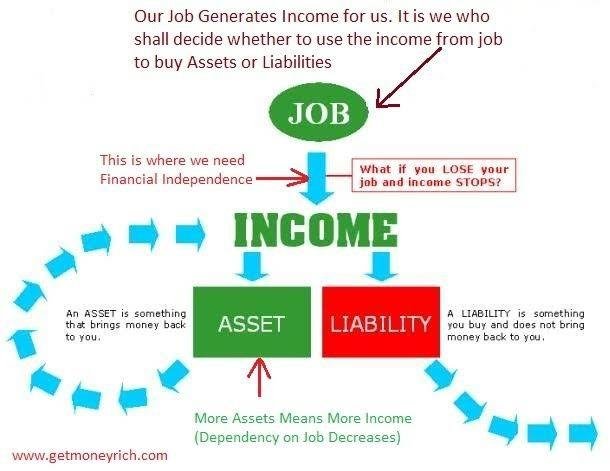

90% of people look for liabilities. Theor most important dream is to have a home in good locality. They take loans amd serve it for 20 to 30 years. During this time they also buy cars and other liabilities. By the time they pay of the loans they are about to retire. What they earn in their entire life is Home where they stay. Only a small percentage of people realize they must start investing in assets early. Such people retire early and enjoy the perks of their investments. These are the people who become job providers.

Most people fail to invest when they have the capital(money) and suffer at the end after spending the money on luxury.

Yes mam @wisdomcouture. Majority don't set there priority right and also lack a business strategy.

I really appreciate your comments.

Thank you and God bless