MMG, an African-American-owned venture capital fund in Baltimore, has announced the addition of a $2 million investment from Citigroup Inc. Its Center for Community Development Enterprise will become a limited partner of the venture fund. The other investors include the Maryland Department of Business and Economic Development, the nonprofit Maryland Corp. for Enterprise Development, and the U.S. Small Business Administration. MMG's fund will help start, grow, and expand small businesses in the health care, telecommunications, and information technology sectors. The goal is to make 20 investments by the end of this year.

While the MMG fund is a unique concept, it aims to empower talented gamers to become professional blockchain game streamers. By investing in promising companies, MMG helps them achieve their dreams and make their futures brighter. While this is not a new concept, it is a good one for the industry, and it is a worthwhile way to invest in this exciting space. The information contained on this site is provided for informational purposes only and should not be construed as investment advice.

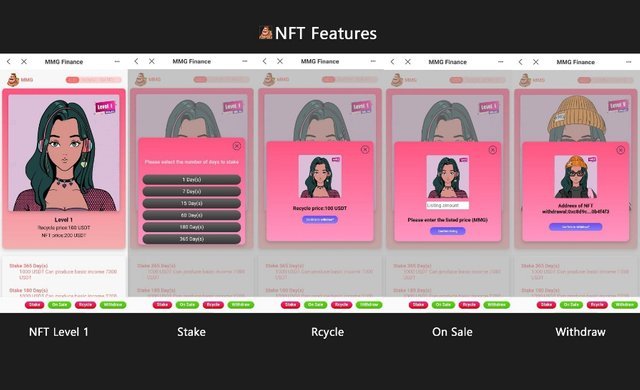

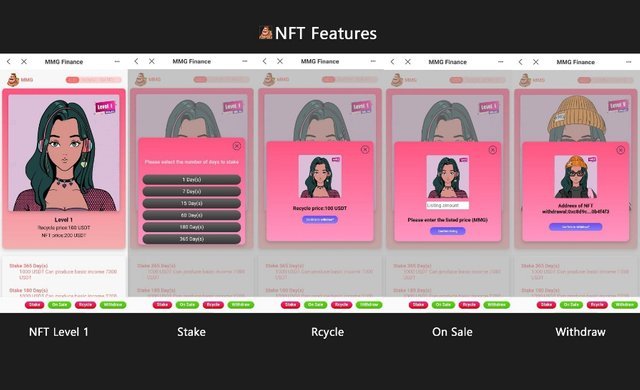

MMG is an organization that works to support new Crypto users by allowing them to earn a living as NFT game streamers. By educating these players to become successful blockchain game streamers, the MMG community is empowering gamers' futures. The company operates in the shadows, but boasts a roster of 500 Axie scholars and 2 million followers. MMG's primary focus is Southeast Asia.

The MMG community supports new Crypto users by enabling them to earn a living. In addition, the MMG community encourages its members to become native NFT game streamers, influencers, and advocates for the creator economy. While MMG may be operating in the shadows, it has built a community of talented gamers and continues to make a name for itself in the industry. The company's primary market is Southeast Asia, which is their primary market.

MMG has partnered with Prince George's Financial Services Corporation to provide micro loans to local businesses. It also provides educational sessions and MCBIF reporting documents. Its goal is to help players in the NFT metaverse improve their skills and mindsets through edustation. While MMG is focused on NFT training, the team is focusing on stream skill training and the development of their business models.

In addition to a fund pool, MMG is also developing a program to develop its own micro-loans. The company is also partnering with the BIZ CENTER for micro loans and account receivable financing. By doing so, MMG is providing additional resources to the communities of Maryland. These programs will be delivered by MMG to businesses in the metaverse. These are just some of the benefits of partnering with MMG.

In addition to the fund pool, MMG has established three affiliates in Maryland. MMG partners with PGFC to provide micro loan administration and MCBIF reporting documents. They also partner with the BIZ CENTER for business growth. Moreover, MMG has partnered with the Prince George's Economic Development Corporation and the BIZ CENTER for educational purposes. The latter is responsible for enhancing the educational services offered to the companies and communities of the region.

The fund is structured similar to its predecessors in the late 1970s and early 1980s. MMG partners have limited and general partnerships and each partner is responsible for putting money into the venture. The life of a venture capital fund is seven to ten years. The initial investments are made over the first two years and the fund is active for five to 10 years. Once the company has established its revenues, it will harvest the profits and make further investments.

Like its predecessors, the new fund must raise outside investors. The money is distributed through a prospectus to prospective investors. Once they have committed to the fund, potential partners will make their own commitments. In most cases, the funds have an average of two or three partners. The average amount of money invested by an investor is usually twenty to three percent of the total value of the funds. After these steps, MMG has successfully created a large venture capital fund.

➤https://monopoly-millionaire.com/

➤https://twitter.com/MMG_Token

➤https://t.me/monopolymillionairemm

➤https://discord.gg/8Jn9gMwwtv

➤https://coinmarketcap.com/currencies/monopoly-millionaire-game/

➤https://www.certik.com/projects/monopoly-millionaire-game

➤https://www.coingecko.com/en/coins/monopoly-millionaire-game

➤https://www.facebook.com/MMGProject

➤https://github.com/monopolymillionairegame

➤https://www.linkedin.com/in/david-cox-b28831216/

➤https://www.bizapedia.com/co/monopoly-millionaire-foundation.html

➤https://www.instagram.com/mmgtoken/

Writter:

➤Forum User Name: Markusschwartz4

➤Profile : https://bitcointalk.org/index.php?action=profile;u=2899967

➤TeleGram User Name: @smartcash05

➤BEP-20 Address: 0xAb419E95a8622d2d1447439af608D943c387af92