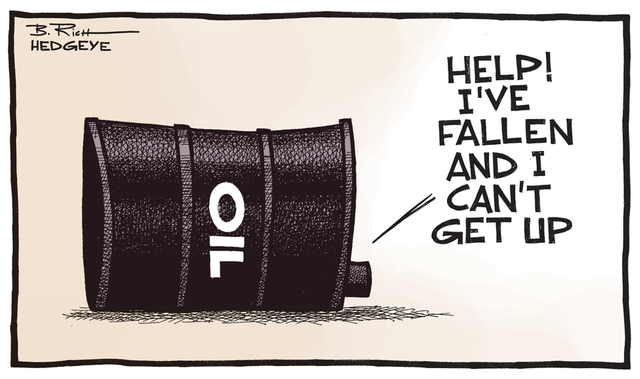

Wall St for Main St: Another Collapse In Oil Prices Is Possible

Mo from Wall St for Main St took a look at the Dow Jones Chart and oil chart and provided in depth technical analysis. He also followed up from one of our shorting ideas in our 2015 review and 2016 outlook report, which is Chipotle.

What did he talked about?

He looked at the resistance level that is building up in the Dow Jones and what it means in the near term.

Why he believes oil prices will fall between now and 2017. The oil price has failed to break $50 resistance level several times for the past 12 months.

Chipotle is in consolidation mode barring a collapse in the stock market and economy. We suggested shorting or buying put options on CMG in our report. He will look at how our idea fared in 2016 and provided a short term outlook on the stock.

Thanks Mo, I have been keeping an eye on oil myself. Some very interesting things we're seeing with the markets lately. I am thinking the US might be getting ready to uncap some long capped rigs... We'll see...

Thanks for sharing...

Welcome. It will be a while unril oil goee up again. Until then, buy up the cheap oil stocks.

Cheaper oil means cheaper fuel and heating oil.

Yay

cheaper oil means my family doesn't work.

Sorry to hear that. Your family work in the oil industry?

Yeah. Well they did. My step dad, my two brothers, my sister, and my 3 brother-in-laws all got laid off. They know how it goes and should have saved more. When government's get involved in setting prices this is what happens. I heard Saudi Arabia and Russia finally agreed on a price cap so maybe their jobs will come back. I have mixed feelings about the whole situation though. I believe in the free market so i would prefer opec to be dissolved and the government stay out of the way, but in that scenario oil would always be below $50 a barrel and my family probably would have never worked in the industry because it wouldn't be worth fracking. We could just import it from the middle east or Venesuala where they don't need to frack cheaper.

If we had free market in the oil industry, I think the prices will be higher due to oil companies now having to go off shore to find oil which is costly. Even fracking require oil prices to be at least $60.

Would they go up? You don't think we would just get it from countries that don't have to frack or go offshore? They still have tons in Venezuela, the Balkin's and other places.