You Need Money To Make Money

In the previous article, ‘Money, Money, Money’, we talked about financial repression and how it is impossible to earn a decent rate of return on savings. So, if we want to put our money to work, we need to look at other ways of using money to make more money. We take an asset and use it to make money. If the asset also happens to become more valuable, then we have a capital gain. If we make money by using the asset, we are creating cash-flow which we can spend or reinvest. Here are three examples of using an asset to make money: a savings account, a stock and a home.

If we keep our money in a savings account and earn interest (not recommended because of low interest rates and high inflation), we can dispose of the earned money in two different ways. We can take it out and spend it so that the principal amount remains the same. In this case, we have invested for cash-flow. Or, we can leave the interest in and earn interest on that interest – in that case, we have invested for capital gains.

If you buy a stock that pays dividends, you are investing, at least in part, for cash-flow. Dividends are a share of company profits distributed to shareholders in proportion to their stake in the company, usually calculated as so much per share. You are investing for cash-flow from the dividends and, possibly, for capital gains if the price of the stock goes up. However, you still receive dividends even if the price goes down. An investor who buys a stock that appears undervalued and likely to gain in value is buying for capital gains if there are no dividends. A trader who buys and sells stocks on a short-term basis to take advantage of price fluctuations is trading for cash-flow.

Similarly, if you buy a home to rent it out for rental income, you are investing for cash-flow. If you are buying a home in the hope that its price will go up and you can sell higher, you are investing for capital gains. Many people saw buying a house and waiting for its price to go up as a way of making money, but the decline in the housing market since 2007 has shown this is not a good idea.

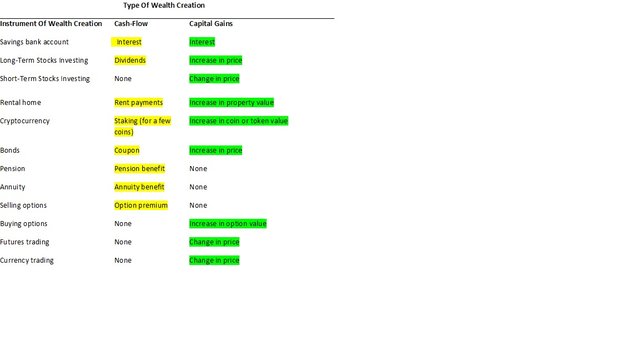

Here is a chart of asset types and how they generate cash-flow and capital gains or not. If you are not putting your money in a bank savings account, you may put it into one of these and make money directly through cash-flow or indirectly through capital gains.

We will investigate some of these in future articles.

@usbailey32, I gave you a vote!

If you follow me, I will also follow you in return!

Enjoy some !popcorn courtesy of @nextgencrypto!