Gold reserves to surpass 4,000 tons

China's burgeoning gold reserves, which some analysts estimated to have surpassed 4,000 tons as of June, reflects the nation's plan to diversify its reserves away from US dollars at a time when the dollar's value has plummeted, as well as to strengthen the country's standing in the global financial market, experts said.

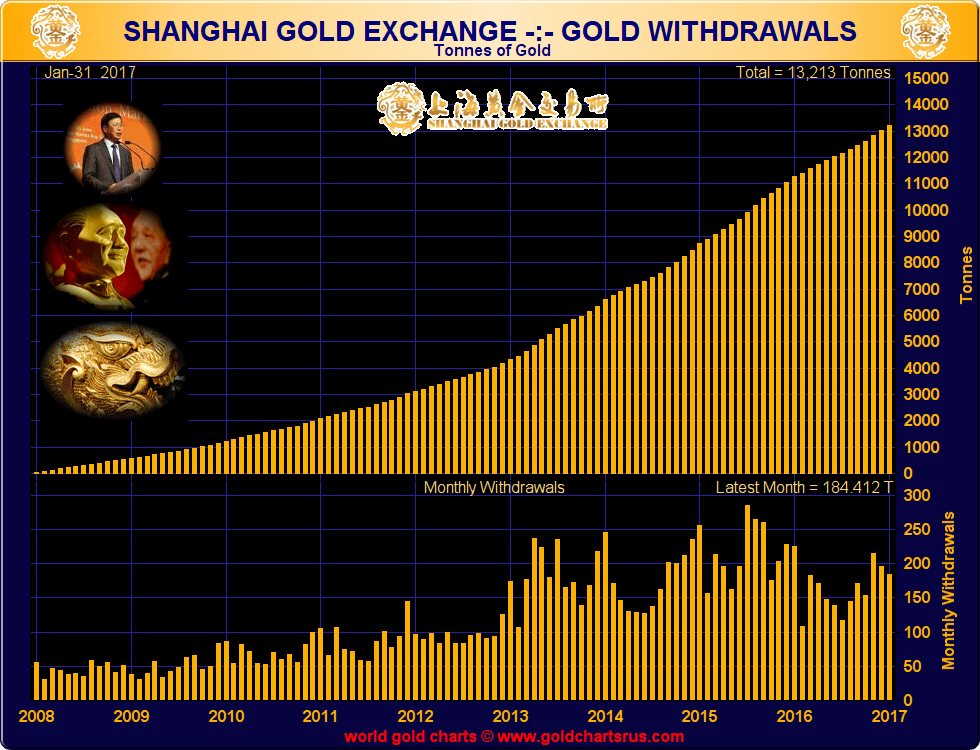

Although the People's Bank of China (PBC), the country's central bank, has not publicly disclosed plans to increase gold reserves since October 2016, some market analysts, based on calculations on domestic gold output and imports in recent years, estimated that the country's above-ground gold reserves totaled 20,193 tons as of June, according to a report published by domestic industry website cnfol.com over the weekend.

While about 16,193 tons of gold are owned by Chinese citizens, the remaining 4,000 tons are held by the country's central bank, said the report.

The estimated number could mean that China may have overtaken Germany as the second-largest holder of gold in the world after the US, which has gold reserves of 8,133 tons based on a report published by the World Gold Council.

The PBC claimed to hold 1,842 tons of gold reserves in October 2016. In July 2015 and April 2009, the reserves stood at 1,658 tons and 1,054 tons, respectively.

Meanwhile, Chinese investors' enthusiasm for purchasing gold remains unabated, as downward pressure on the yuan continues and the property market in first- and second-tier cities cools, said another report published by the World Gold Council in July.

In the first half, a total of 158.4 tons of gold was sold in the domestic market, up 51 percent year-on-year, according to data released by the China Gold Association. "China's central bank is apparently moving to increase the portion of gold in its $3 trillion foreign reserves," Liu Xuezhi, a senior analyst at the Bank of Communications, told the Global Times on Sunday.

Gold rush

China has in its rapid economic growth accumulated enough dollars to maintain its trade account, and the country is now looking to diversify its portfolio to avoid potential risks, such as the devaluation of US dollar, the largest reserve currency in the domestic market, experts noted.

The value of US dollars has slipped by 9 percent in the first half of 2017, posting its worst-ever performance since 1985, news website wallstreetcn.com reported on Friday.

The US Dollar Index was down 0.72 percent at 93.37 on Friday's close.

"Unlike credit currencies that are subjected to market uncertainty, gold is a relatively safe and independent vehicle to hedge against fluctuating exchange rates and at least maintain the asset's current value," Liu said.

The US Federal Reserve is expected to raise its benchmark interest rate again in December, which may prompt the yuan to edge down, Liu said.

At this time, increasing gold reserves could also serve as a cushion, buffering the yuan's downward pressure and stabilizing the yuan's exchange rate, Liu noted.

Abundant gold reserves could also cement China's position in the global financial market, as well as accelerate the yuan's internationalization process in the long run, Zhou Yinghao, a senior analyst at the Beijing Gold Exchange Center, told the Global Times on Sunday.

He noted that one of the criteria that determines whether a currency can qualify as "hard currency," or globally traded currency that serves as a reliable and stable store of value, is the amount of gold the country holds.

"For example, the influence of the US dollar on the global economy is partly because it has the biggest gold reserves in the world," Zhou explained.

Still, China's gold reserves only represent around 3 percent of its total foreign exchange holdings, which is quite small, according to the cnfol.com report.

The central bank may be fattening its gold reserves as it looks to increase the yuan's share in the basket of currencies used to calculate the IMF's Special Drawing Rights, experts suggest.

"The increase would be conducted in a gradual and stable manner, so as to avoid exerting massive impact on the market," Zhou said.