How to Purchase STEEM at a Discount on the Internal Markets by Locking in an 18% Margin of Safety - Profit on Undervalued Currencies and Increase Your Share of the Stake (SP) in the Ecosystem

I made a couple posts yesterday explaining why I intend to always be powering down my account to trade the markets while I use steemit, even while I attempt to increase my overall STEEM power. I was met with serious stink eye by a couple of you when I first outlined my strategy. I had very good discussions with @biophil, @ooak and @liberosist yesterday about it.

Let me lead with the caveat that if you're a 100% passive investor, and you don't want or need liquidity, and you don't ever want to look at the markets, then this method is not for you. Pull a @berniesanders and just pump it all into STEEM power, move on, and don't look back. I totally get it.

However, if you enjoy actively trading the markets with some level of assurance that you can make a profit on your investment, I suggest you take a minute to read the articles I wrote about this topic before.

Consider Reading My Previous Posts For Further Explanation:

Why Not Always Be Powering Down Your SP?

How Powering Down Can Increase Your STEEM Power Over Time

Please allow me to further explain my reasoning - both about why I'm always powering down, and why I immediately convert many of my SMDs to STEEM using the built-in 7 day conversion feature after I purchasing them at a discount.

Why I'm Always Powering Down

I'm always powering down because liquid assets are always worth more than illiquid assets to a trader. There is no loss in net worth or disadvantage that I can see to unlocking your liquidity by continuously powering down your STEEM Power, as I explain in my previous posts.

When I receive my 7-day payout, with liquid STEEM in hand, one of 2 things can happen based on market conditions:

Scenario #1: SMD available at a 10%+ discount on the internal market

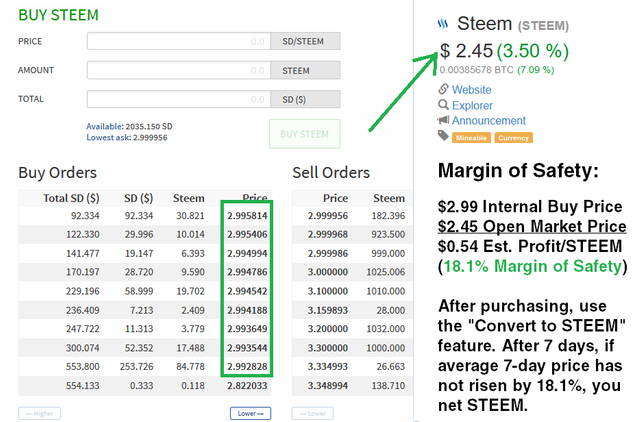

If the price of STEEM on the internal market is substantially higher than the price on the open market (10%+) then I'll sell my STEEM to get a discount on SMDs ($).

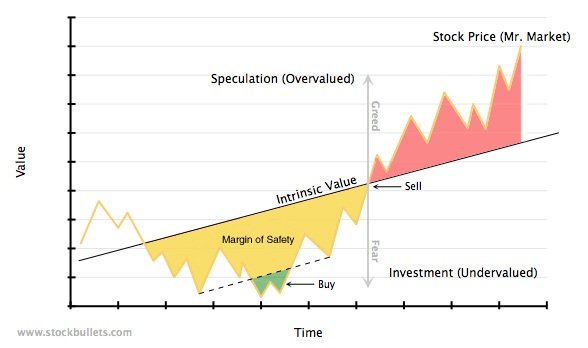

I'll then immediately use the built-in conversion feature to lock in my margin of safety on some or all of my available SMDs over the 7-day waiting period. The amount of discount between the market value of 1 STEEM in the open market vs. 1 STEEM in the blockchain market is the margin of safety. The higher it is, the higher the probability that converting over the 7-day period will be a net gain for me.

There is a modest risk. If the price of STEEM has risen substantially (more than 10%) over the conversion period, my margin of safety is wiped out and I'm either breaking even or taking a paper loss on the conversion I just made. Even then, there's no guarantee of a long-term loss.

If I decide to sell out of my STEEM balance at that time for Bitcoin, I'll likely be able to mitigate my losses by purchasing more STEEM at a lower price after it fluctuates back down. (This is making what I believe to be a very reasonable assumption - that the price of STEEM will occasionally descend, as all markets do, even if the long-term trend is likely upwards.)

Scenario #2: No discounted SMD available or SMD is selling at a premium

If no discounted SMD is available on the internal market, then I either cash out my liquidity if I need it elsewhere for some reason, or simply reinvest it back into STEEM Power.

Doing this weekly, over the long-term, will yield better results than simply holding SP. But, to me, no matter what, having that weekly power down cash flow as zero-penalty liquidity is gold. It's unbeatable, and if you're willing to be at your computer once per week at a time to trade your newly minted STEEM, you'll likely benefit with a larger net increase in STEEM Power in the long-run.

Prices naturally trend up and down, so I think it makes sense to try to buy and stockpile STEEM Power at a low price and sell it at a premium price for SMD on the internal exchange, if the opportunity is there. If the opportunity isn't there, I can either cash out to Bitcoin or pump it right back into STEEM Power if it still seems like the best option, even if there wasn't a net gain that week.

Do You See The Opportunity Here?

TL;DR:

An 18% margin of safety on a purchase is a Trader's dream. Actively trading your liquid STEEM (no matter whether it's earned naturally through posting, upvotes and/or with weekly payouts via Powering Down) when there's a reasonable margin of safety (a 10%+ discount on the price of STEEM in the open market vs. the internal on-chain market) can help increase your share of the SP stake over the long haul.

Thanks again to all 3 of you I had discussions with yesterday. Here's what @biophil said about this strategy:

I'm starting to believe you. This is actually a pretty important service you're providing for the Steem system, because what you're specifically doing is taking SMD out of circulation (buying them) when they're undervalued, and destroying them (converting to STEEM), which will help bring their price up.

You have no idea how good that makes me feel. Profiting by providing a service to the STEEM ecosystem is hard to beat. You should strongly consider it if you want to take a more active role in boosting your SP and net worth!

Great write up on a really good looking arbitrage opportunity!

Glad you found it useful, I really appreciate the upvote. Thank you!

scalp is awesome and i agree with almost everything you said, BUT, i wouldnt use the "convert to steem" feature... 7 days is way too much time in crypto and everything can happen, like a 100% pump or dump. So i just buy and sell at the market. since yesterday i'm selling at 2.95 and buying at 2.75 and multiplying my steem's.

Raphma I Am confused and I Am sure that I'm missing something but if I buy steem at poloniex or bittrex for 2.45 at this time and sell it for 2.90 on the steemit market I will be paid in sbd here on the market .And sbd are selling at a 17% discount on poloniex so I don't see how I can profit from this please show me step by step on what you are doing to make a profit trading this.

you are misunderstanding... the inside market here in steemit is Steem/SBD and i'm buying at 2.75 SBD and selling at 2.95 SBD, so 0.2 profit per steem (and we just a had a little change, it might go to 2.9buy and 3.1sell). i never said i was buying in bittrex/polo and selling here.

in bittrex, the market is steem/btc, so it's completely different and you need to take in account the value of steem/btc and sbd/btc.

raphma , thank you for the explanation

This is a good point. You can probably make a lot of profit by simply holding both STEEM and SMD and taking advantage of the natural trends on the internal market vs. converting. I use the conversion feature because I feel it's safer for my style of investing, particularly because I already have that margin of safety (profit) built-in as long as the price swings are not too radical. But as you said, pumps or dumps can happen at a moment's notice.

Thanks for your reply!

Interesting viewpoint here. Thanks for adding this to Steemit

Thank you for taking the time to leave a comment. Let me know if I can answer any questions for you.

Hi! This post has a Flesch-Kincaid grade level of 11.4 and reading ease of 60%. This puts the writing level on par with Michael Crichton and Mitt Romney.

are you not goin to pay the contest you made where you said it will end a day ago? you have $2000 in your wallet, so youre just scamming people? I rly hope not bro!.

Really, buddy? You go through all my threads and call me a scammer because I didn't make the winner announcement or pay you fast enough for your tastes?

I'd seriously rethink your strategy when you enter future contests. I was going to make the winner announcement tonight...

dude you said constest ends on july 30... that was a day ago.. I couldn't believe you was goin to go silent about it after I helped you share that conquest and as you can read on that post, most people came to participate bc of my post.. but yet you went silent and I checkd your posts and you made like 3 and replied on other peoples comments, thats why i tried to catch your attention this way, bc as you know there are no private messages in here with "seen" marks... I WILL DELETE all comments now that you responded. this is not a strategy, and this was not intended to injure your reputation. I will also delete this one after the announcement!.