How the monetary markets evolved to where we are today

This blogpost analyses why trading changed from bartering, to the need for a middle ground which we call money. It also explains why the need for cryptocurrencies was created. If you are not interested in the history behind this evolution, but want some information about the benefits and disadvantages of cryptocurrencies instead, feel free to scroll down the post to the Bitcoin image and start reading from there.

Why is there a need for money?

In order for something to be valuable, people need to feel that it holds value. If nobody values what you have, it's basically not worth anything. It cannot be traded for anything else and becomes, in essence, worthless.

Value comes in many forms, there is emotional value, financial value, functional value, social value.

- emotional value: “you cannot buy my mothers jewelry for market price”

- financial value: set by the market, e.g. the price of 1 ounce of gold

- functional value: if you own 1 car and you need it to go to work, you will not sell it for less than it would cost to replace your current car, regardless of market price

- social value: how others perceive you: “don't do business with them, they scammed me”, or “that company treated me well, their service is worth the extra money”

The more value something has to you, the more you're willing to trade it for or the more you'll want in order to trade it.

This is the point where money comes into place, or at least a common method of payment.

At first there was a bartering system, it's the most basic form of payment and still used all over the world today. You provide some service or material good in a pure trade for something you need. This system does work, but it's very basic and not suitable for an economy to run on since it contains loads of limitations. We've all seen a scenario where someone wants to barter for a good or service and the person who can provide it isn't interested in anything this person has to offer, making a trade very complicated to nearly impossible.

Let's look at an example:

- a carpenter is trying to get a loaf of bread

- the baker only wants to trade a loaf of bread for some milk

- the farmer who has the milk wants wood to fix his barn

- the carpenter provides wood to the farmer and gets milk in return

- the carpenter provides baker with milk

- the carpenter gets a loaf of bread from the baker

Often times people felt like they were forced into bad trades since the valuation of products is so widely dispersed. Imagine having to trade your car to receive one loaf of bread so you could eat.

The solution to all of this was money, it's basically a common bartering tool connecting all goods, services and tools. It has become the basic glue that holds any economy together.

- the carpenter provides wood to the farmer to fix the barn and receives money in return

- the carpenter goes to the baker and buys a loaf of bread with some of the earned money

In order not to bore you to death with the evolution of money which we were all taught in school, let's just write a quick synopsis of it:

First there were coins. These were heavy, bulky and noisy during travel and eventually paper money was invented. Paper money solved the problems coins had. They were light, compact and quiet during transport. But transport speed was still limited. Leading to the invention of bank money (credit cards, debit cards, checks, ...).

Money could now be transported from one place to another in a matter of seconds to a few days, with an added amount of security from common thieves.

Unfortunately the thieves got smarter and the banks got greedier, leading to more and more money being created and people started to realize that their money-assets were being inflated to become a worthless commodity.

People were realizing that their $1.00 note from yesterday does not hold the same value as the $1.00 note today and many are dissatisfied because they have no control over their own fiat currency whatsoever. Basically others can decide how much your fiat assets are going to be worth in the future.

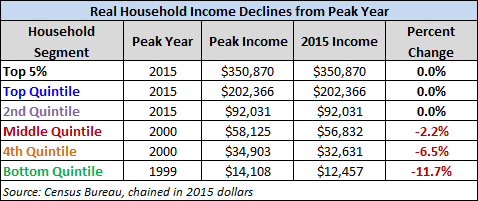

For those of you who are interested in a more in depth analysis on the loss of purchase power, there is a very interesting article explaining the statistics of the Bureau of Labor Statistics. It shows how the bottom 60% of incomes are poorer today than they were during their peak years of 1999 and 2000. https://www.advisorperspectives.com/dshort/updates/2016/09/15/u-s-household-incomes-a-49-year-perspective

For those of you who are only interested in a synopsis, this is the conclusion of their investigation:

Note that the statistics range only until 2015, and a quintile means a 20% range: bottom quintile being the bottom 20%, 4th quintile is the bottom 20-40% range, middle quintile being the 40-60% range, 2nd quintile the 60-80% range, the top quintile being the 80-100% range.

The faster growth of costs over average wage earnings creates distrust and poverty, which leads to a demand in the market for a solution to this problem. This brings us to the current place of monetary evolution: cryptocurrency.

For those who are new to cryptocurrency, the dictionary describes a cryptocurrency as “a digital currency in which encryption techniques are used to regulate the generation of units of currency and verify the transfer of funds, operating independently of a central bank. “

Basically it means that it's a non-physical and encrypted currency. The downside to this is that you cannot actually hold it in your hand like you can fiat currency (coins and notes), nor can you see the currency in real life. This makes it easy to lose and eventually also easy to spend (look at credit card debt issues around the world).

Most often, people that do not know about cryptocurrencies (or are very new to the scene) see this as a major hurdle to cross. Indeed it is a risk involved with the scene, but as with everything in life, the knife does cut both ways.

Some of the major advantages involved with cryptocurrencies are the fact that they are not controlled by a bank or a government, both of which are increasingly more distrusted by the general population. This results in your wealth in cryptocurrency not being bound to these corporations and they have no control over it whatsoever.

We have all heard (or maybe even experienced) scenarios in which the bank, or a government entity seized or confiscated some (or maybe all) of your assets. They put a lock on your bank accounts (or emptied them), your credit cards no longer work, your house cannot be sold, your savings cannot be accessed, bonds and stocks cannot be redeemed, etc … . This is happening to random people and can definitely happen to you as well.

Steemitian @doitvoluntarily has recently written a post about this, if you're interested you can find it here: https://steemit.com/government/@doitvoluntarily/the-battle-against-civil-asset-forfeiture

This is where one of the major advantages of cryptocurrency lies: they cannot confiscate what's inside your cryptocurrency wallets. The only information the government entities or banks can find is when and where you traded your fiat currency for cryptocurrency on a site like coinbase.com. This is because those sites store some of your personal information.

Because cryptocurrencies do not work like banks or credit cards, transactions become increasingly more anonymous. A bank or credit card transaction first pulls your information and then uses that to send the payments, whilst cryptocurrencies use a push mechanism. Basically you decide what amount to send to the recipient of your transaction and no personal data is linked with that transaction (This also prevents identity theft since your personal information is not required).

After you've transferred your e.g. Bitcoin to your private wallet, the government will have a much harder time finding your funds, let alone seizing them. Without your security codes, nobody has access to these funds. (So please do not forget to backup your security codes in a location only you know yourself and never give them to anyone)

Another benefit of cryptocurrencies is that they are not mass-produced. There is a limited supply of any given cryptocurrency at any given time, some coins incorporate a predetermined yearly inflation of their coin totals, whilst others have a hard cap that will never change (no inflation of the currency at all ever).

The only way for the government to stop you from accessing your cryptocurrencies is to restrict your access to your personal wallet at all times. If you're using hardware wallets, alongside web wallets they would need to keep the hardware wallets away from you and completely restrict your access to the internet at all times.

The market has noticed this distrust of the governing and/or controlling bodies towards the current monetary system and it has enabled a movement which has strayed away from them. This very platform (Steemit) is a prime example that this is not only happening in the monetary system, but also in the political and emotional sphere of life.

New demands have risen and the market is responding as we speak.

Most images used in this post were downloaded from unsplash.com and pixabay.com and are free to use for commercial use for everyone at this time. However I did shrink and/or edited them to reduce loading times on the blog.

Here are the links to the original images in case you are interested:

Dollar bill image: https://unsplash.com/photos/JW6r_0CPYec

Credits: Photo by NeONBRAND on Unsplash

Coins image: https://unsplash.com/photos/jNk0hMuB_90

Credits: Photo by Da Silva on Unsplash

The bartering image is public domain in the US and can be found here: https://upload.wikimedia.org/wikipedia/commons/thumb/e/e2/A_Maori_man_and_Joseph_Banks_exchanging_a_crayfish_for_a_piece_of_cloth%2C_c._1769.jpg/800px-A_Maori_man_and_Joseph_Banks_exchanging_a_crayfish_for_a_piece_of_cloth%2C_c._1769.jpg

Thieves image: https://pixabay.com/en/thieves-theft-robbery-swag-money-2012532/

Bitcoin image: https://pixabay.com/en/bitcoin-digital-money-decentralized-2007769/

Advantages vs disadvantages image: https://pixabay.com/en/males-3d-model-isolated-3d-model-2339843/

Anonymous image: https://cdn.pixabay.com/photo/2012/02/17/09/03/invisible-13955_960_720.jpg

Thanks for your good posts, I followed you! +upvote

Congratulations @thoughtsoncrypto! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!