Speculating In Gold Mining Stocks

I recently wrote about the reasons why to invest in precious metals and briefly mentioned the mining stocks. So today I'll talk more about that specific subject.

First I want to quickly make sure the distinction between investing and speculating is made. Investing is for the money that can not afford to be lost, whereas speculating is for the money which can afford to be lost.

When it comes to the mining sector, there are three basic types of companies that trade publicly: exploration companies which search for mineral deposits, development companies which construct the mines, and producers which complete the last step of digging the minerals from the earth and selling them. The value of these companies is inherently influenced by the price of the commodity they are dealing with. This is one key thing that sets these type of publicly traded companies apart from most others.

The natural resource sector, which the mining stocks are a part of, is extremely volatile and cyclical. It is my opinion that when it comes to ways to speculating intelligently, natural resource stocks offer the most realistic chance of earning huge speculative profits. When I say huge, I mean returns in excess of 1000%. That is ten times your money, or a 'ten-bagger' as it is called in the industry.

So below I'm gonna go through a few historical examples of multi-bagging trades that could have been made in the past. The first chart is of American silver miner Hecla Mining Company:

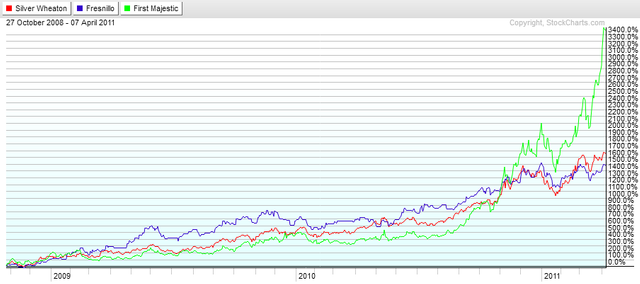

In only a little over three years, the return was over 1500%. If you had put $10,000 into this trade, you would end up with $150,000 in around three years. Nothing to scoff at! Next up is a chart of two other silver producers and one silver streaming/royalty company. They are Fresnillo PLC, First Majestic Silver Corp, and Silver Wheaton Corp:

So if you had put $10,000 into the best performer here, First Majestic, you would have wound up with $340,000 in over two years. A whopping return!

The idea of making 10-30 times your money is beyond appealing, but people are often drawn in with an emotional attachment to the speculation. Due diligence simply must be done for speculating. You must begin with the understanding that the stocks you are buying are inherently volatile, and that at least some of your picks will not turn out as you hoped.

For those that are serious about speculating in the natural resource sector, I would recommend reading this short report by Doug Casey linked below, which explains his methodology for screening resource stocks.

http://www.whichwayhome.com/gold-silver-platinum/resource-stock-evaluation.pdf

I’ll mention briefly that the number one thing the report says to look for is the people involved in the company, which refers to management. The 80-20 rule applies in the natural resource industry as in many others, which means that only 20% of the companies will produce 80% of the best financial returns. Identifying the winning 20% should be a key focus of the successful speculator. One trait that most of this 20% has is a track record of being serially successful.

If you aren’t ready to spend serious time understanding the mining business, or aren’t ready to spend the money for someone else to do the research for you, then this isn’t a venture for you. If you simply think the gold price is going to go up then just buy physical gold, but if you want to speculate in mining stocks then you will have to put in the serious due diligence required for success.

*This post is not intended as financial advice is any way. It is for informational purposes only.

*References:

http://www.cbj.ca/eldorado-fights-gold-mining-ban-in-greece/

https://www.911metallurgist.com/blog/10-insane-russian-mines

http://www.sharepickers.com/ten-baggers/

http://lightbulbfinancial.com/hedging-and-speculating-with-options/

http://tradeproacademy.com/category/volatility/

http://www.sixsigmatrainingfree.com/pareto-principle.html

Here are some related articles readers might be interested in

https://steemit.com/steemit/@yash2212/what-s-the-best-cryptocurrency-to-invest-in-long-term-why

https://steemit.com/stocks/@yash2212/the-ultimate-guide-to-becoming-an-investor

Upvoted and followed!! Please follow me back 😊. Check out my first art post!

https://steemit.com/art/@sherry-dow/my-first-piece-of-posted-art-look-closely

BULLISH on Gold and Silver. Upvoted and tweeted. Thanks for sharing. Stephen

https://twitter.com/StephenPKendal/status/825998378895032320