Is India's Debt BUBBLE About To Pop?

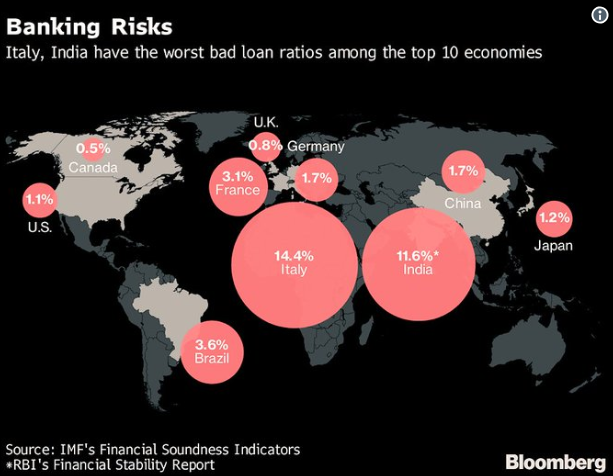

Forget about Italy as one of the worlds biggest economies India's banking sector is turning sour as Indian banks are sitting on about 11.6% terrible loans as there are now talks about bailing out banks creating a "fake" bank to hold the insolvent "assets" that the banks around India are holding.

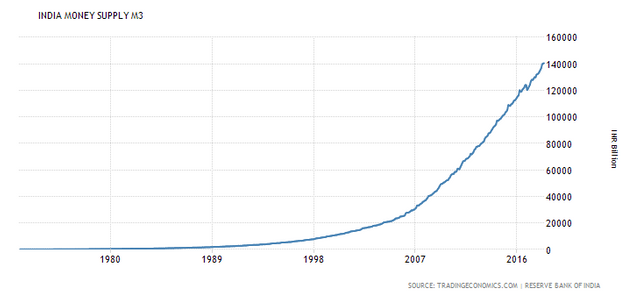

India has also tried to go cashless without any significant breakthroughs as people are still using cash and the black market is still alive. India has seemed to create a bubble equal to Chinas credit bubble. The debt was used to make it appear that the economy was growing while debt was increasing even faster showing that it takes more debt ever to keep the economy or shall I say the debt and banks alive.

.jpg)

"Surprisingly", most of the debt is centralized in the State-Owned Banks. The government has made bad decisions all across the world, and there is no surprise that government-backed banksters would make bad loans as they most likely know they'd get bailed out.

Below is an excerpt from a Zerohedge article giving you the details of the coming credit crisis in India.

According to Bloomberg, India's $1.7 trillion formal banking sector is presently struggling with $210 billion in bad loans, most of which are concentrated within its state-owned banks. During the 2018 fiscal year, growth slowed to 6.7%, down from the previous year's 7.1%, back to its levels from 2014, before Modi came to power.

The state banks have been so badly mismanaged that some analysts say the country's banking crisis is an opportunity for private sector banks, as CNBC reported.

"If you take a 10-year view, currently the private sector banks' market share is 30 percent. Probably it will become 60 percent," Sukumar Rajah, senior managing director at Franklin Templeton Emerging Markets Equity, told CNBC.

As a result, he said, "the overall health of the banking system will improve because the better banks will be a bigger portion of the market and the weaker banks will become a smaller portion of the market."

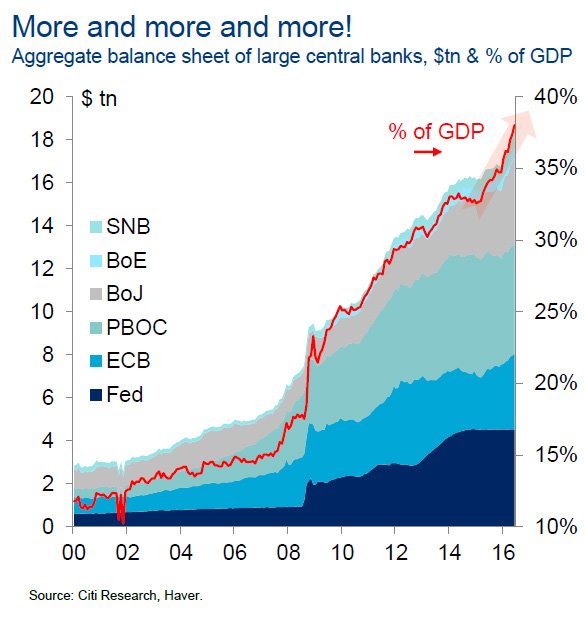

Above you can see India's rise in currency supply, there is no doubt that we are hitting the hockey stick moments in monetary supply worldwide. When will we hit the time when the monetary and debt based system collapses.

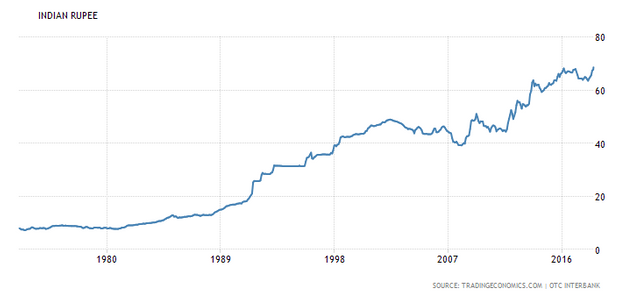

Let's take a look at the Indian Rupee to see how it has fared over the last decades to see if its value has dropped as debt levels have increased.

Since March 1973 the Indian Rupee has lost a whopping -89.56% of its value, and if you look at the hockey stick of the M3 money supply in India and the hockey stick of the value of the Rupee, it becomes clear that when you print currency out of thin air, you devalue your currency.

In late November last year, Modi showed $32B worth of Rupees to "recapitalize" the banks or bailout as it should be called. https://www.zerohedge.com/news/2017-11-22/indias-207-billion-mess-once-lifetime-opportunity-asias-richest-banker

This of course failed, and India's banks are starting to look more like Italian banks like Unicredit, Monte Paschi and Vento.

It all comes down to the simple observation of seeing that history is yet again repeating itself as when you print the excessive amount of debt and charge interest on it you will fail. But don't worry India is working on Securitization schemes of corporate debt in India. India is yet still behind the western countries which are at their end of a debt and fiat cycle but are working hard to catch up.

You never know how much of the Indian debt that is bad that was securitized. Remember it only took about $13B of bad mortgages to start a financial avalanche around the world India currently has $210B worth of bad debt.

We are about to hit a brick wall worldwide as monetary expansion has been hitting many speed bumps, but I think this is a wall only we will only be able to print more money out of thin air through central bank QE bailouts and buying up all assets. I have written before the Central Banks will own everything and then nothing.

Protect your wealth and get off the monetary grid in my point of view! Gold, Silver Crypto and other commodities to sustain yourself when the currencies collapse. The people who were ready for a fiat collapse did the above and through history many times they survived and even thrived through a transition period of chaos.

Peace, Love and Voluntaryism,

John S

India has a fairly high rate of gold and precious metal ownership. A lot of this can be attributed to jewelry, but I wouldn't be surprised if the consumption/ownership was also seen as a hedge against the rupee as trust in the financial system has crumbled.

Bailouts encourage corruption. They should be allowed to fail every time, or else you get worse tricks than the last time every time. Crooks gotta crook & keep crookin

To the question in your title, my Magic 8-Ball says:

Hi! I'm a bot, and this answer was posted automatically. Check this post out for more information.