The Line in the Sand for Twitter

$20 ...

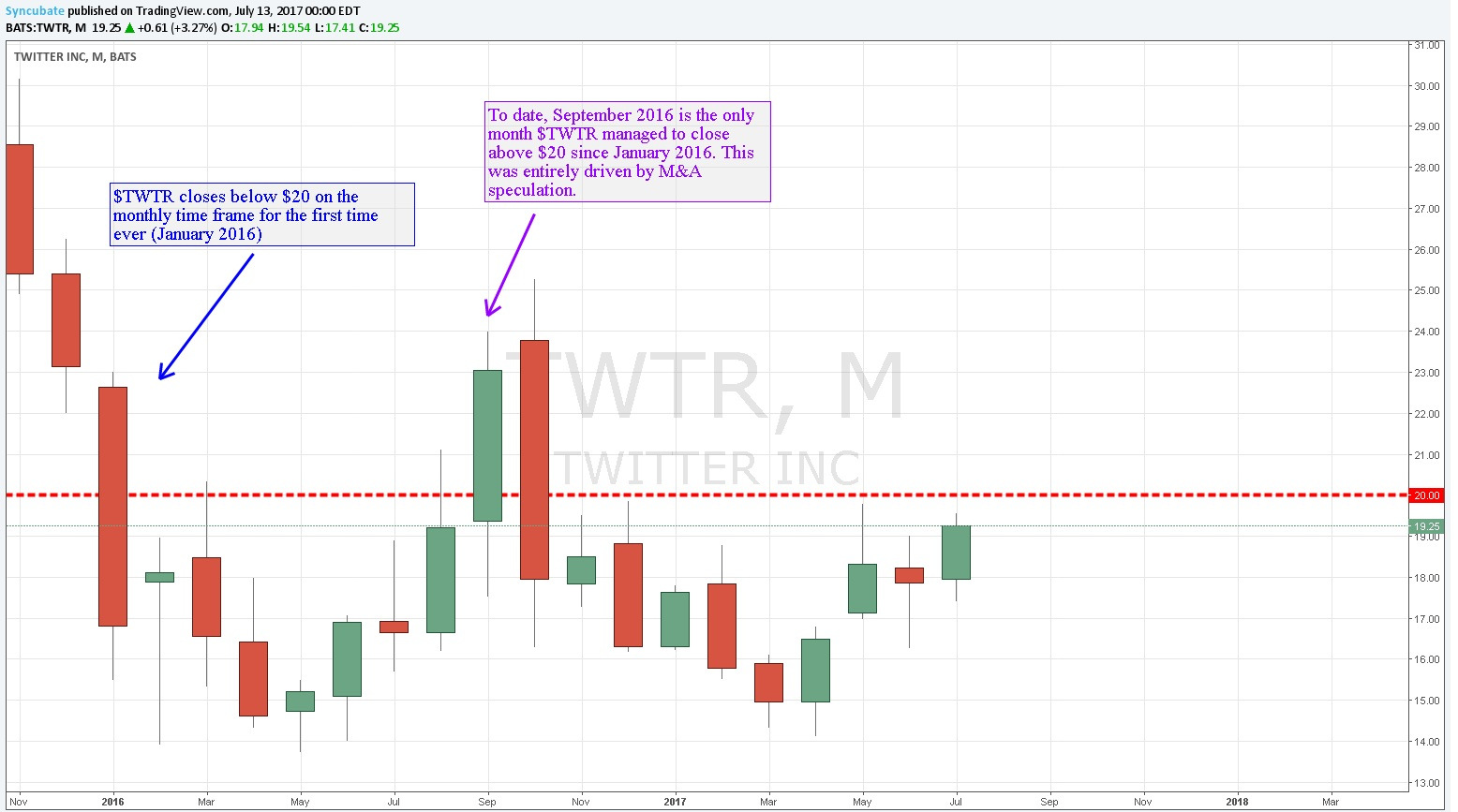

That's the line in the sand for $TWTR:

I wrote about this two months ago on my blog.

I'm writing about it again because it's relevant to any trader that respects price action.

As the monthly chart for $TWTR clearly depicts, the $20 price level has essentially acted as a price ceiling for the stock since January 2016, when it closed below it for the first time on this time frame.

The only month that $TWTR has managed to close above $20 since the start of 2016 was September 2016. The rise and subsequent collapse in the stock at the time was principally driven by unsubstantiated M&A speculation from business media. Notably, CNBC pundits claimed then that supposed suitors "didn't want to pay north of $20."

Never mind the past though. As of the close of trading on 7/12/17, $TWTR is back above $19 and just a few quarters shy of $20. On 7/11/17, the company named a new CFO, Ned Segall, who assumes the title and position from Anthony Noto. Noto had been serving as a dual-role COO and CFO until Ned's hire; he will continue as the company's COO.

On a related note, Twitter co-founder Biz Stone returned to work at the company in June 2017. With its recent leadership additions, perhaps the blue bird will finally find its way and reclaim the $20 level.

Can Jack Dorsey lead his flock of employees and $TWTR shareholders to greater heights? The long-term stock chart and price action points to that possibility and ultimately the line in the sand is clear.

Personally, I find Twitter to be an indispensable communication platform and have long held the conviction that the company's leadership should strive to overcome its long-standing rut in the public markets by driving its own narrative rather than standing back and allowing others to do so. Time will tell if a constructive path forward is paved.

Disclaimer: I am just a bot trying to be helpful.