NetEase: Epitome of The Stock Market's Bull Run

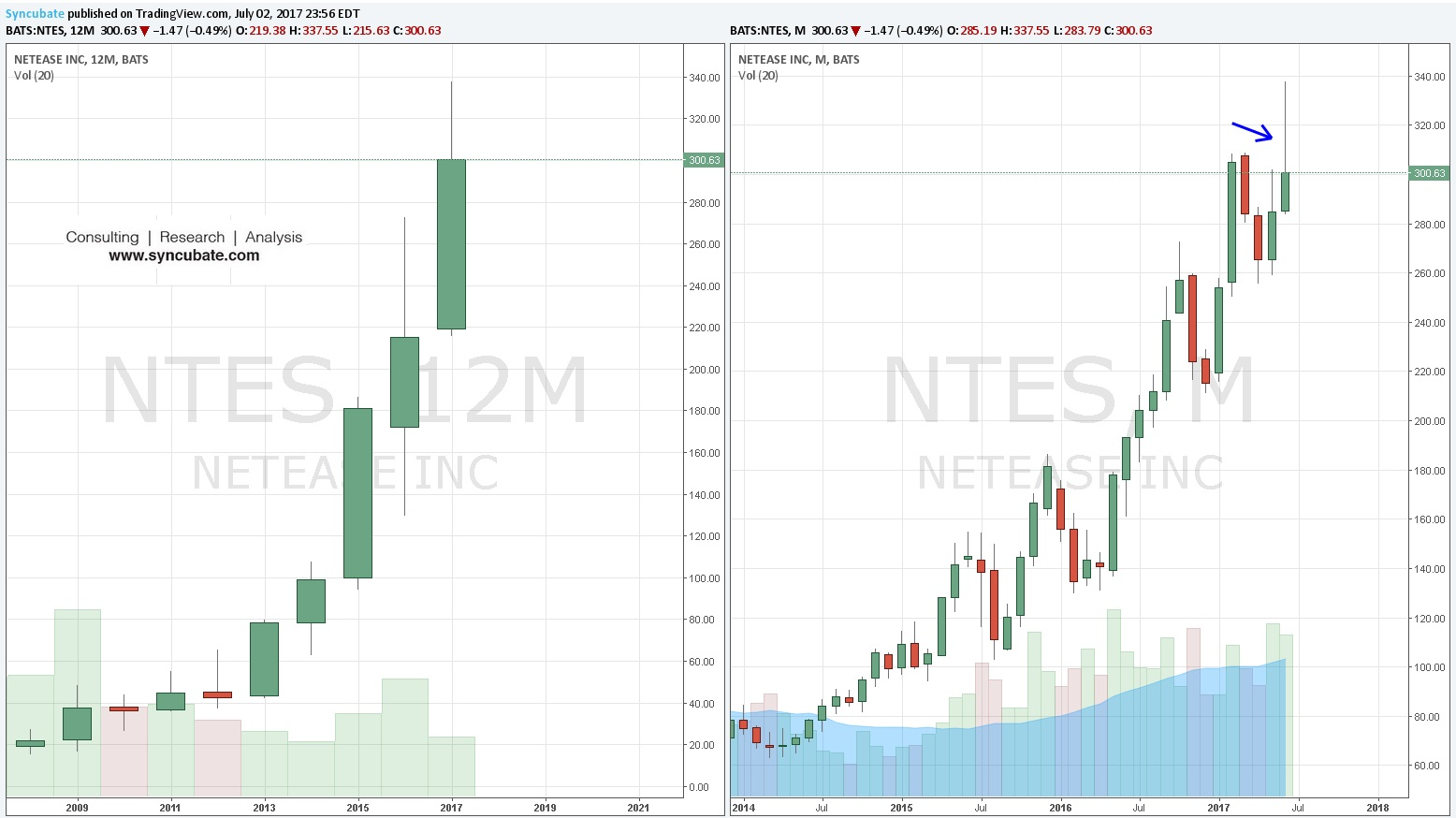

They say a picture is worth a thousand words. In the case of Netease Inc., it's worth nearly 2000% in gains since 2008:

Coming out of the financial crisis, $NTES steadily traded in a range of between $15 and $65 a share until the end of 2012. Then the fireworks commenced.

By the end of 2013, $NTES closed at nearly $80 a share. In 2014, the stock back tested its mid-$60s breakout level and then continued higher, closing the year at $99.14.

$NTES has since tripled from its 2014 closing price and is now worth over $300 a share. It has not had a down year since 2012.

Notably, $NTES traded as high as $337.55 last month, its highest price ever. It finished the month of June 2017 at $300.63 a share. Its monthly candle stick formation depicts a long upper shadow, indicative of sellers outnumbering buyers and driving the price lower.

$NTES bulls should be mindful of the fact that its long upper shadow is in fact its longest ever on the monthly time frame, as pointed out by the blue arrow on the chart

Despite pressure from $NTES bears, the bulls were still able to close the stock above the $300 level in June. Looking back over the last nine years, $NTES is an epitome of the stock market's bull run, having enriched early investors many times over.

As we enter the second half of 2017, it will be interesting to see which side the market's scale tips in favor of: the bulls or the bears? Share your thoughts in the comments below.

A very informative and insightful post!

Thanks! Glad you found it informative.

need more market's scale tips from u..Pls share and keep steem on

Great insight on the market scale tips, thanks for sharing! looking forward to more!