Ray Dalio's All Seasons Weather Portfolio for Investing

Hey guy :)

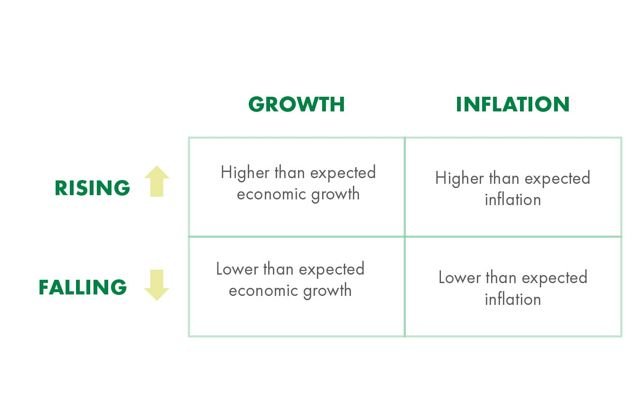

If you read Tony Robbins Money Master the Game or Ray Dalio - Principles books you will hear they talk about an All-seasons portfolio. An investment portfolio that is able to weather all seasons of the economy. to understand a bit more about the "Seasons of the economy" see my other article on What are the Seasons of the economy for investing.

Here I give a brief example of a portfolio that I made going off the general basis of this principle. By no means do I expect this to be a bullet proof portfolio. This portfolio has the structure of being safe, but, also due to my age/risk level/experience level, I altered it a tiny bit for a bit more growth potential. This is just to show you to give you an idea. I am sure there are many better ways to create a portfolio like this! Have fun!

Asset Allocation

My All Seasons Portfolio

Bond’s

Government Long-Term Bond ETFS (15% of Portfolio)

• BMO Long Federal Bond Index ETF: ZFL 0.43% fees, 2.99%yield, avg.22yrs, CDN federal bonds long term

• iShares Core Canadian Long Term Bond Index ETF: XLB (10%) 0.38% fees, 3.52%tyield, avg. 22years, CDN government bonds, 400+.Government or Corporate Intermediate & Short-Term Bond ETFS (25% of Portfolio)

• BMO Aggregate Bond Index ETF: ZAG (10%)0.23% fees, 2.93%Tyield, avg. 10yrs, mixed diversified CDN Gov. Bonds & 30% corporate. 10 holdings (other BMO bond etfs)

• iShares U.S. IG Corporate bond Index ETF: XIG (10%) 0.6% fees, 3.17%Tyield, avg. 10yrs, 1000+ US corporate bonds, CAD hedged

• iShares J.P. Morgan USD Emerging Markets Bond Index: XEB (5%) 1.05% fees, 4.11%Tyield, avg 11yrs 30+ sovereign debt of emerging market countries, CAD hedged

Stock’s, Gold & REIT

Domestic Stocks: (20% of Portfolio)

• S&P 500 index ETF: VFV (5%) 0.16% fees, 1.6%Tyield, P/E 21.5x

• Berkshire Hathaway: BRKB (10%) 0% fees, USD, 0%yield, P/E 20x

• CIBC Bank (Dividend) (5%)0% fees, 4.7%yield, P/E 9.2xInternational/ Emerging Market Stock/ Global Stock ETF’s (10% of Portfolio)

• FTSE Developed All Cap ex North America Index: VIU (5%)0.43% fees, 2%Tyield, P/E 17x

• FTSE Emerging Markets All Cap index ETF: VEE (5%) 0.47% fees, 1.9%Tyield, P/E 14.5xSector & Specialty ETF’s (5% of Portfolio)

• Riocan Real Estate Investment Trust: REI-UN.TO (2.5%)0% fees, 5.94%yield, P/E 10.86x

• Chartwell Retirement REIT: CSH-UN.TO (2.5%) 0% fees, 3.79%yield, P/E 8.6xCommodities (5% of Portfolio)

• IAU iShares Gold Trust - Gold bullion holding (5%) 0.25% fees, Doubled Profit from 2008-2010.. up 10% YTD. (price increases during economic crisis)Personal Investments (20% of Portfolio)

• Millennial E Sports

• Cryptocurrency (Bitcoin, Ethereum, Litecoin, Altcoins)

• Alibaba 0% fees, 0%yield, P/E 60.68x (up 100%YTD)

• Apple - 0% fees, 1.57%Tyield, P/E 18.47x, Cash Reserve $256Bn.

Quality content!!! Never thought I would see someone share their profolio based on Ray Dalio's All Seasons Weather Portfolio