You're Earning A Lot. Now, What? | Money Management and Saving Tips

You have found a new, easy way of earning money (or cryptocurrency) without any initial investment through Steemit.com and the Steem Blockchain. You even have already made multiple payouts in this platform, accumulated an ample amount of STEEM and/or SBD. and sold them for either Bitcoin or cash. With endless earning opportunities the Steem blockchain has in store for its users, doesn't it seem right if we put these earnings (and all other income, really) to good use and start saving?

What is Money Management?

Money Management is a process of tracking, balancing and aggregating your income and expenses, in order to help people with wiser spending habit and active personal finance.Source

Money Management is really important. Who wants to be a one-day-millionaire after receiving income, then facing a lot of financial problems at the end of the month? Here are some basic things you can do to successfully manage your finances:

Save a Realistic/Doable Amount

One most common mistake we commit is that we try to save as much as we can every month. This usually reaches to a point where you have nothing left to spend until the end of the month, because you have allocated the money to your savings. And, when this happens, you tend to use your savings when you're out of budget - which disregards the essence of saving at all.Save a small amount initially, and slowly increase that amount over time. If you had a raise, maintain your old spending habit and put the extra income to savings, not for spending. Where to put your savings? It's up to what really works for you. You can invest it, or create a savings account, you can even go creative by making your own piggy bank!

Minimize Your Debt

If you are in significant debt, I suggest you to adjust your savings amount and allocate a portion of it to pay your debts. Increase your savings when you have settled all your debts, which you should do soonest! If you are stable and completely out of debt, make sure that your monthly expenses never exceed your monthly income. You should also pay all the bills on time!

Create a Budget Plan and Stick To It

You should allocate percentages of your income based on your spending. Be sure to set up a budget plan. It doesn't have to be too tight. You can be flexible, too! For example, during my college, I allocate PhP 700.00 per month for transportation. It is quite hard to exceed this amount since I only have 3 school days a week.

Track What You Spend

Budgeting does not end in creating and sticking to your budget plan. You need to keep track of and record all your cash flows for a more successful budgeting and saving. Sounds simple, but this requires discipline and consistency. There are different ways in doing this. But, personally, I use a money tracker app called Money Lover.

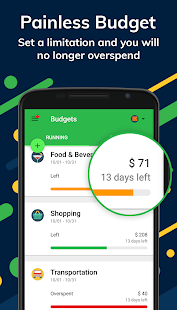

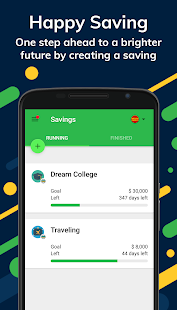

Money Lover App

I have been using the Money Lover app for at least 3 years now. I have tried a lot of different apps but this one worked for me. The budget and savings plan are easy to setup and use, with push notifications reminding you to keep track of your data. It also allows you to have multiple wallets for better tracking. And guess what? We can now connect our bank account to Money Lover! Now, we only have to think about the cash we have.The best thing about this app is that all your data is synchronized across your devices. You can even access your data through the web! Plus, you can export all your entries to an excel file in seconds if you want to go traditional. Visit their website here.

Excellent!!! Information!!!------------------------------------------Click for more info

Excellent article. I subscribed to your blog.

Good luck to you!