Can Apple Save FAANG From Becoming Toothless???

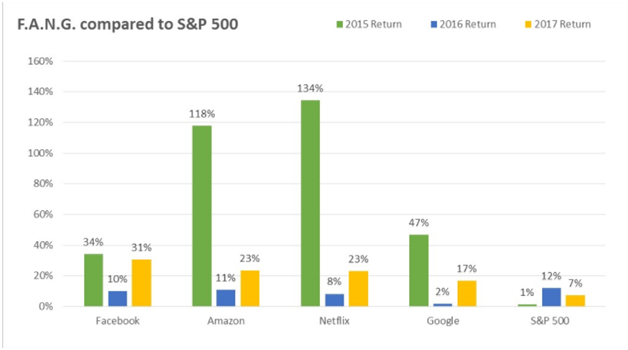

Facebook, Apple, Amazon, Netflix and Google have lost a combined $185 billion in market cap over the previous two sessions. There are fears that their recent results could mean the incredible growth in recent years is over. For example, Facebook earnings beat expectations, but some user metrics slightly missed. Netflix’s revenue didn’t meet expectations, but the bigger miss was their subscriber growth and weak subscriber growth outlook.

Amazon and Google are down 5% from their most recent highs. Netflix is in a bear market. Facebook is in a bear market as well, but also negative for 2018.

Apple is scheduled to announce their third quarter earnings after the closing bell today. Apple is the largest holding in the SPY S&P 500 ETF with a 4% weighting and represents the last letter in FAANG that has any chance of holding up this group of tech titans. More importantly since the FAANG stocks have been responsible for a huge majority of the growth in recent years, holding up the broader market might be in the hands of Apple’s earnings as well.

In the past, Apple’s third quarter earnings have been its slowest quarter, so investors will listen attentively for guidance for the next two quarters. Two highlights to pay attention to during the earnings announcement are the following:

Roughly 66% of Apple’s revenue comes from iPhone sales. Since the iPhone X was Apple’s most popular smartphone last quarter, has the novelty worn off and are customers still going to be willing to shell out $1,000 for this phone?

Apple Services which includes app, music, and games sales, AppleCare, and Apple Pay fees is now the size of a Fortune 100 company. Guggenheim Partners analyst Robert Cihra sees strong services performance and raised his quarterly revenue estimate to $52.9 billion from $52.4 billion. Thus, it’s important for Apple to post strong service numbers to offset the iPhone sales this quarter.

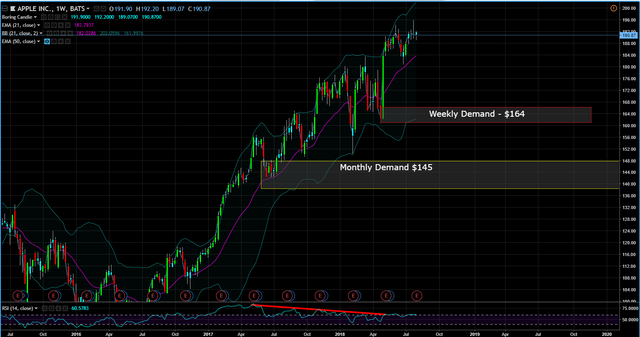

If Apple blows out the numbers and if forward guidance is spectacular, look for Apple to start smelling that trillion dollar market cap. However, if forward guidance is lackluster and price drops, pay attention to the weekly demand zone at $164 and monthly demand zone at $145.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Published on

by rollandthomas

I think the next step for growth for these giants is to start going after each other’s markets, my money is on Amazon! It’s already gone after Netflix with Amazon prime! And FB has mentioned going after Match.com! I also recommend looking into IQIYI (Netflix of China, Baidu spin off) as an up and coming stock.

Agree and thanks for the comment.

Sad about Facebook because it happened with an over-night gap, but I still think that it will recover in the long period.

Apple, on the other hand, seems to be always very solid. I will look at your demand zones.

Good luck :)

Facebook isn't going anywhere anytime soon, their growth is just slowing down which is still envied by many companies.