Novice vs Experienced Traders by Scott Goddard

NOVICE TRADER

►Thinks Trading is exciting and full of adrenaline

►Focuses on avoiding losses at all costs

►Thinks an 80 / 20 win loss ratio is essential towards success

►Constantly looks for big trade wins over shorter term time frames

►Enters trades thinking they are right

►Has unrealistic profit expectations - 100% + per annum

►Hates to be wrong which leads to poor risk management

►Believes that preying marketers are selling the magic formula

►Thinks the media understands the markets and trades News

►Believes their methodology has to be complex to be profitable

EXPERIENCED TRADER

►Knows that Trading takes patience, is methodical and often has boring processes

►Knows that losses are part of the process and accepts them

►Realises that success can be achieved with a 50 / 50 win loss ratio

►Is methodical and grinds it out over the long haul

►Enters trades knowing they could be wrong

►Has realistic profit expectations and understands prolonged losing streaks are possible

►Knows they will be wrong often and always applies strict risk management strategies

►Understands that the No 1 secret to trading is that there are no secrets

►Knows that news is simply noise and is not part of their trading strategy

►Keeps it simple !

Scott Goddard

Technical Analyst, The Chartist

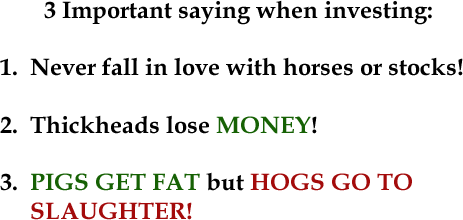

Below there is my next pending order to sell short EURUSD and the target is 0.5% , the risk is 0.2%. I always keep my chart simple and my analysis too. The key is money management!!. Real expectations. If I lose this 0.2 ok, is nothing, If I win this 0.5% is just another trade. Keep the consistency, keep alive, trade for live, the market is always there, think like a Pro.

Gl & Good trades