New US Financial Collapse ahead!

It seems like financial collapses happen every 7 years, the latest happened in 2007-2008, and now another 7 years have passed, we are due for another one.

The last collapse was caused by sub-prime mortgages given out recklessly to people who they knew could not afford them, only to be sold and speculated upon by Wallstreeters. This caused massive economic collapse when the bubble popped, resulting in businesses going bankrupt all over the country and countless jobs being lost.

Now the same thing is happening all over again, but with car loans. They are doing exactly the same thing all over again. The sub-prime car credit market is rising year by year, while the car dealer lending is shrinking.

Now we got huge banks like Santander and others interested in it, certainly we can see the same pattern repeating itself: http://www.nytimes.com/2015/03/16/business/dealbook/many-buyers-for-santanders-subprime-loan-bundle.html?_r=0

When we have the Deutsche Bank on it's last legs from all the derivative exposures (it could be the next Lehman Brothers as some have suggested). Who knows what ripples can the next collapse send throughout the global financial system that could bring it all down.

The data certainly suggest that there is a new financial bubble growing. The same things are repeating again in the same manner, all the protests and legislation past 2008 was for nothing.

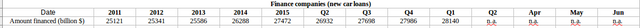

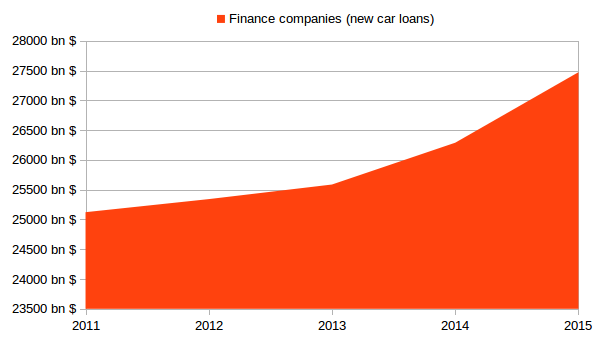

Let's see the numbers:

Source: https://www.federalreserve.gov/releases/G19/Current/

Accumulating debt is never good, and definitely not at these rates, the chart is very similar to that in 2007 for home mortgages.

The greed of Wallstreet never really ends, they almost all went bankrupt, yet they still pursue the same toxic business models, because they know that the government will bail them out with taxpayer money.

I think people should really get their personal finances in order, people should minimize debts as much as possible and try to have flexible jobs, that they can switch from in case their employer goes bankrupt. (Blogging on Steemit fulltime is very flexible)

Also not to mention being prepared is the key. Now you don't need a bunker in your backyard, but certainly basic preparations: like having cash at home in case ATM machines go out, and having your invested assets protected against financial meltdown is the key.

You don't want to end up like the people in Greece that went to withdraw their money after the bank had gone bankrupt.

So about only 22 Billion of potentially delinquent debt.

Almost all held by smaller predatory lenders and more aggressive investment groups.

The big financial institutions are smart enough to avoid this toxic debt. aka, there is minimal risk of wide spread economic repercussions due to defaulting car loans.

source: http://www.wsj.com/articles/j-p-morgan-chief-james-dimon-sounds-alarm-on-car-loans-1464889444

That said, many of these loans are predatory in nature, and there is plenty of criticism for the industry that one could offer on ethical grounds.

Banks are into it, but they are in the higher levels.

The smaller lenders bundle it up and get picked up by a small investment company, that gets up by the big banks. It's a house of cards scheme, the foundation is toxic, and they all build their crappy derivatives on it.

The bank doesn't care because they are basically just scammers selling them to clients, or doing market making which minimizes exposure.

They might be invested in the companies, or their risk extends until they kick them off their books, that is if they find investors stupid enough to buy this, which the always do.

Can you ecplain further on what you mean by protecting invested assests

It means that you are positioned and diversified in a way, that if a collapse happens you lose the least money possible, and perhaps even make money.

You assets should always be strategically allocated in a way to minimize risks and maximize profits.