What I Learned in the Zeitgeist Movement | Part 3: "Debt-Machine"

In the first two parts of this series we have explored the profit-driven waste mechanisms of our socio-economic system, but we have yet to talk about our contemporary monetary mechanisms - the foundation for so many of these problems we are witnessing today.

I will do my best to give a short summary of the history of money and how it eventually became "fiat money". It really is worth diving in deeper for those who haven't, but I want to keep this post relevant to the series, and whole books have been written just on fractional reserve banking alone.

For a deeper look I can recommend posts by @lucylin who has done some great articles on the concrete recent history of monetary manipulation. There are other great resources out there as well that go into the fine details, but considering the dry subject matter I will keep it as short and abstract as possible and try to drive home the core angles.

If you find reading about these things dull just choose a different format: scroll down and watch the amazing "American Dream" comic at the end of this post. It's a great starting point! Please also note that nothing here can or should replace your own research and understanding. We all make mistakes (including me), and only you can tell yourself what is true and what isn't.

Disclaimer finished ;)

A medium of exchange

We all know the story: One day long ago the idea came up that society could rely on a new tool for bartering and trading - a tool that would function as a valuable medium of exchange, but that would never in itself rot, spoil, or lose substance. A tool that could easily be transported, stored, counted and would - by its physical permanence - never degrade from its original value. Or that was the idea anyway...

Money was born.

A simple mind-hack put into the physical, to make trading and life in general way more convenient for all involved through the simple use of a placeholder of value.

It didn't take long for gold to become a medium of value exchange - through a social convention to regard it as universally valuable good that would always retain its value - and it would soon need securing against theft and unwanted access by people other than the actual owner as it became more frequently used by everyday people for barter.

Eventually, banks would start to establish themselves, granting the holders of gold a service in keeping it safe for them - in exchange for a fee. After all, this service was a valuable one to those who had too much gold on them than they could reliably protect and safeguard themselves, so the fee to them was 'warranted'.

And depending on who you ask, this is where the trouble really started.

Society was relying on these central places of value-storage more and more, and instead of getting their saved gold from the bank in order to pay for things they would soon start to use "placeholders" instead, issued directly by the banks. These "placeholders" came in the form of a piece of paper, guaranteeing that the holder of the paper will always be able to withdraw the amount printed on it in the form of actual gold they had originally deposited with their bank.

It was seen as a convenient way to guarantee your getting your valuables back from the vault whenever you chose to do so, and it had the welcomed side effect that a piece of paper is even easier to transport and store than gold (not to mention the actual tradeable goods that gold-currency was originally intended for).

In theory this all seemed rather convenient. However, soon it became apparent that there were some glaring issues with this development. People had neglected to notice that gold/money/currency in itself had already been the placeholder for value, but now these vouchers came in - effectively acting as paper placeholders for the old placeholders (gold).

Gold at least had intrinsic value because of its physical nature and its scarcity, and was therefore an acceptable placeholder for value to begin with. These vouchers however had no intrinsic value - other than the promise that they could be swapped for gold some day in the future.

Once you enter into such a voucher agreement, you would have to completely trust the bank to hold true to their promise that you could ever exchange the voucher back for "your" stored gold.

And nothing would necessarily prevent the bankers from leaving the bank closed one day - all their customers' gold stored inside it - and then running off with people's valuables, making people's voucher tokens worthless after a broken promise. After all, all they had given out to the people was this voucher which didn't hold any value in and of itself (other than making a fire with the paper), as opposed to a golden coin or a milk-giving cow representing actual value in the physical world.

But running off with all the people's money was not the only danger. The real threat to society came from the bad-intentioned idea to hand out more vouchers than the amount of actual gold stored in the vaults.

This seemed to be a rather smart idea from a profit-driven business perspective: If people use these vouchers all the time, hardly ever withdrawing their actual gold from the vaults, who would really notice if we handed out more vouchers than we have actual gold backing them? By doing this we could charge some extra fees and even offer people the deal that they could "borrow other people's money" for a while until they could pay it back. That way we could maximize the use of all this stored value in our bank, loaning it out to people who need it - for a profit.

And even loaning out more than we have actually stored...

And people dug the idea. Well, the "borrow other people's money" idea anyway. That fairy tale still holds up today. When you take out a loan you are NOT getting money other people put into the bank. Rather you are getting newly created money with immediate debt attached, calculated on the basis of existing reserves (if we can even trust that at this point).

It was now possible to get more money than you had, borrowing it from somewhere through the bank, allowing you to do what you needed to do. And at the end of the agreed timeframe you would pay back the money you had borrowed plus a little extra for the service of lending said money to you.

Thus, the concept of "interest" was born - an additional debt added to the original amount of money that was borrowed (the original amount loaned being called "the principal").

But this new model of banking had in turn some drastic malicious side effects as it spread. It became clear to those owning the banks that nobody could be certain that the amount borrowed in the form of vouchers was actually physically existent in the bank as reserve.

In other words unless you were a banker and directly bestowed with access to the vaults and books of the bank - you could never be certain how much gold was actually laying around in the bank for all the vouchers circulating out there.

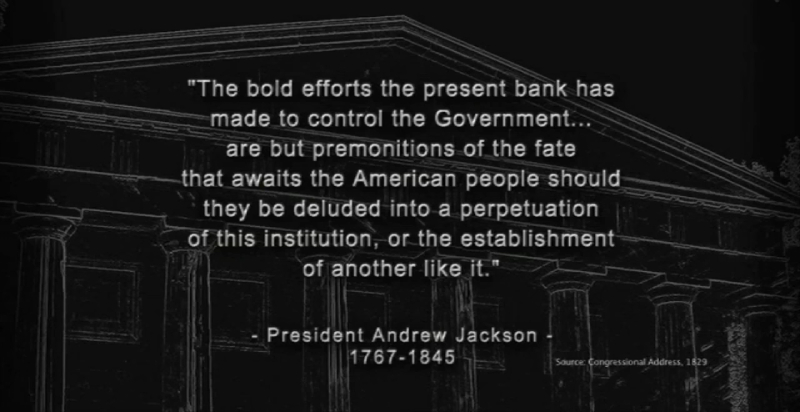

Thanks to the bankers' tireless promotion of this voucher model, people had gotten so used to the convenience and ease of using the bank's vouchers and their loan-services that the banks enjoyed an immense and ever-growing amount of trust. Governments and other authority systems had recognized the importance of the banks for the control of society very early on as well, and were already cooperating with the banks for their own interests.

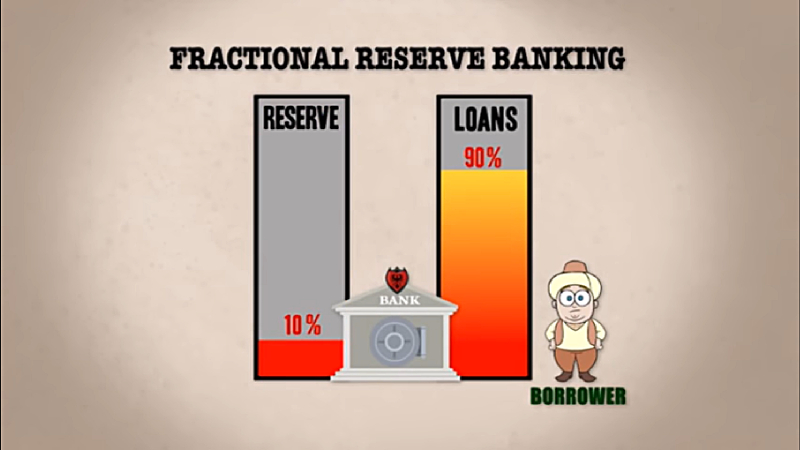

Eventually (and to make a long story short) the lingering idea of handing out more vouchers than were actually backed up in the vaults became the deciding business model for banks in most places around the world. This system (the same one we still "enjoy" today) is called the "fractional reserve banking system" simply because only a fraction of the supposed reserves need to be available in the bank in order for them to hand out loans. We have in effect decoupled money from its backing, and have made any insight and audit all but impossible, as banks are under no obligation to let us check their vaults for accuracy.

Instead we are in an obligatory position to trust them and their PR agents - whether we want to or not. They may call themselves "federal" or "national" but in almost all cases the central banks act as private cartels and not as public institutions. We fell for the packaging again.

I am confused, why is this such a problem?

There are several huge issues with this model of banking. First of all, if more money is loaned out to the public than is actually available at the bank to back it up, then a crisis-situation of political or social caliber might make people lose trust in their bank and end up with them wanting to withdraw their valuables from the bank.

But... if everyone tried this at the same time - there would not be enough gold and money to go around, despite everyone having originally deposited what they had. Because too much had been loaned out to other people unbeknownst to the depositors.

In other words if someone else took out a large loan, he would have gotten a temporary right to access a loan calculated on the reserves present. But not only that, because of fractional reserve banking the bank could hand out several of those loans to different people all referencing your deposit as the "reserve".

A rule of thumb is that about nine times as much money can over time be loaned out by banks to people for the amount that was originally deposited.

But because of the bank's interest fees demanded on TOP of the original loan, the individual taking out such a loan would always have to give the bank more money back than he had originally gotten from it. If you think "that seems fair, I mean the bank offered a service here" - you may want to reconsider. The problem with interest fees is that there will never be enough principal (money) in circulation to cover these interest fees, ever - because any new loan always comes with the extra interest-debt attached to it, and so does all the newly created money that could be used to ever pay back that first original loan. Talk about a circle-jerk!

We can make this simple in numbers with a fictional example of 10% interest.

I take out a loan for 10 gold coins (GC). The bank agrees and gives me 10 GC, but asks me to pay back 11 GC after the timeframe of - say - one year (10 GC principal + 1 GC interest). This means that I will have to come up with not only the actual amount I borrowed (principal) but also with that extra 1 GC the bank is charging me (interest).

The problem is that this one gold coin does not exist yet. The bank has effectively noted this extra gold coin for the future without having created it in physical form. But since it is now in the banks' books, this extra money DID come into existence - at least in the form of debt - a future liability to be paid regardless of availability. A debt that is not covered by the actual assets that exist currently.

This simple mechanism will show you that in a fractional reserve banking system there is ALWAYS going to be more debt than actual money in circulation, simply because any new money created automatically comes with new debt attached, to be paid back by some inexplicable method.

But: if the money for the interest doesn't exist in circulation, then where will I get it in order to pay back my interest fees?

And this is the crux:

You will need to take that extra gold coin... off of someone else.

You CAN'T be serious?!

I mean it quite literally. You will have to make sure that you get that extra 1 GC from another participant in society in one way or another. Translating this to the modern "economy" there are many examples of this. It's the status quo really.

Of course you could simply steal it from someone, which is frowned upon by society, might get you in trouble and might let your conscience weigh heavy on your heart.

But thankfully, we have all these "cool" new ways of stealing from others (including yourself) that don't get labeled as such. Instead they are called "solutions"... which don't really solve anything.

If you own a company: You could decide to not raise your workers' pay after the company has increased its profits. "Cutting that corner" will be more than enough to make up for the missing interest payments. For now. Heck, cutting corners is always great in a system where scarcity is rewarded (as outlined in Part 2 of this series).

Another way: You could sell things you own, just so someone would trade another GC of his with you voluntarily.

Or even better: you could keep all the material possessions you have and simply offer your services to someone, depending on what services you can perform.

Ideally this is something you want to do anyway, but more often than not it leads to some form of prostitution where people are "forced" to do something they would never do voluntarily just to come up with that "missing money" - be it outright prostitution or clandestine prostitution enjoying a different and more positive connotation in society.

Generally, all the things that people do MERELY because they are being paid for it qualify. I know, a suuuuper unpopular thing to say ;) But I bet all of us have gotten to know that feeling in depth, I sure know I have.

Now think about that for a moment: How many people in your life earn their 'missing payments' to the bank by doing something they hate? Many. If not most.

While it's true that most in society do not offer their sexual services to strangers, most in society DO offer their energy and lifetime to strangers and odd causes in one way or another just to cover the existing debts that come from a mathematical set of unnecessary parameters.

And whether we are talking about shuffling papers with numbers on them, sitting in a cubicle dealing with topics that don't interest you or whether we are talking about standing at a cash register accepting payments on behalf of the company you work for for the better part of the day - you are effectively giving away your time and life energy to be able to come up with the compensation for a systemic black hole that affects any- and everyone in society. A black hole that has no tangible or logical reason to exist at all other than to bind us to it, ruling the better part of Western civilization's affairs and daily worries.

You could of course also get that extra 1 GC back by simply taking out ANOTHER loan with the bank. Cool, you can now pay your old 1 GC debt back - high five!

But in effect you now have to pay the new loan interest back to the bank as well, which is even higher percentage-wise as before (because some of your new loan went to servicing the old debt payment and not to your immediate expenses).

While it may sound utterly insane to borrow more to keep paying off less and less old debts over time, that is precisely what we are all doing. Governments included.

Welcome to the "economy" of today. Move along, nothing to see here.

Hmm, but I don't see how interest can be such a huge issue...

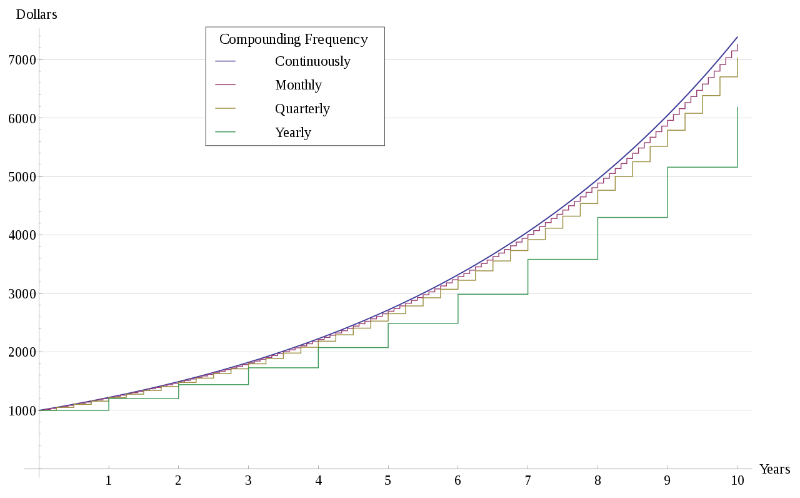

Well, the thing is that these effects add up greatly over time. Financial "experts" refer to this as "compound interest".

Although interest rates in our world are significantly lower than the 10% illustrated in the example above, you have to remember that the interest rates will be applied to your outstanding debt again and again as time goes on. And again. And again.

To our linear-thinking minds it is hard to comprehend what compound interest looks like and how quickly it can get out of control. After years or decades of not having paid off the loan (+interest) you end up paying the majority of your income to service the accumulated interest-debts only, not the actual principal you borrowed. That principal is still outstanding and will only start to diminish once you can pay in more money than the newly created interest charges you with.

The following graphic shows the effects of compound interest with a rate of 20%. The beginning stages are slow but then it blasts through the roof!

A great illustration of this is the act of buying a house today.

Now, to a thinking child the house would cost an amount of money equal to the materials, machines and people needed to build it.

Sounds logical, right? ;)

If you look around in actuality however you will see that houses are generally priced at several multiples of their original building costs. Who ends up "earning" the most when you buy a house? The construction firm? The mortar factory? The window guys?

It's the banks who loan you the funds... that earn the most when you buy a house through a loan.

Because the sum to build or buy a house is so large for the absolute majority of people the paying-off-duration will be quite long, during which compounding interest adds to your debt majorly over time until you end up having to pay - say - 500K for a house that originally required "mere" 110K to build. So in effect you are paying 3/4 to people who have never laid a brick on another, who have not spent weeks building the house for you, who have no idea how a house is built at all.

When you buy a house, most of the money goes to people in suits whose "only" job in this house-building process was to loan you a bit of their money for interest until you could pay them back. That is all.

Don't forget that until you pay in full, the companies involved have to in turn take out loans themselves, to pay for their workers, the material needed to start building the house, etc. Everyone in the economy is in need of funds constantly, and will often have to take out a loan before being able to get the payments from their customers after the project has been completed (which can sometimes take years or even decades).

Through this we can see how the overall effects of interest pile up in society, because interest is attached to any and all loans ever made, and the ones who took out this loan are systemically forced to get it back somewhere else, somehow.

It's called scarcity. But this scarcity has nothing to do with physical availability... and everything to do with a mathematical magic trick that is entirely unnecessary and that most people have not yet seen through.

The problem here is that this debt-enlarging mechanism does not only apply to you, me and other people - it affects all companies, institutions and even "countries".

And because more and more debt is added as new loans are taken out, the overall supply of money increases - in a futile attempt to cover the outstanding debts. We call this phenomenon "inflation". Inflation is simply the dilution of money's value due to an increase in its quantity. There are several differing analysis on inflation, but a conservative estimate seems to be that the US Dollar has lost about 96% of its original value since the founding of the FED - simply due to the constant increase in the amount of money in circulation (to cover existing debts).

Yikes!

What the media refers to as "national debt" is an entirely fictional and unwarranted debt, because it has been created purposefully by the very mechanism described above.

Only: now governments themselves are actually forced to steal from someone to cover THEIR 1 GC interest that they need to pay back on their loan of 10 GC because they agreed to a private cartel issuing the nation's money instead of themselves.

If that doesn't smell like conspiracy I really don't know what does.

And while many academically-minded people have protested when I put it as simple:

That is the whole reason for our financial deadlock. And for the constant shortage of money we all hear so much about.

The existence of interest attached to loans as immediate debt will ensure that there will always be more debt than funds to repay it. It's a crime, albeit a clandestine one that has still not been figured out by well-intentioned people doing their best to repay their debts. Daily.

The whole issue is that this was done on purpose, and it serves nicely to keep people in line and "occupied" instead of figuring out how they are being screwed.

If you hate to dwell on that notion, I feel ya!

In case you haven't seen my post on it, I highly suggest you start your search with the brilliant "American Dream" comic which gives a thoroughly entertaining rundown of this somewhat threatening subject matter, and explains the story much better than I ever could. It will leave you with a sense of positive vigilance, which is really all we need to re-evaluate one of the most unquestioningly accepted mechanisms of our times - "money".

Or to be more exact: Fiat money, created out of thin air to cover existing systemic debts.

Believe nothing, but understand as much as you can.

unsplash.com

unsplash.com

unsplash.com

Zeitgeist: Addendum

unsplash.com

The American Dream

Zeitgeist: Addendum

unsplash.com

unsplash.com

unsplash.com

unsplash.com

wikipedia.org

unsplash.com

Zeitgeist: Addendum

What I Learned in the Zeitgeist Movement - Prologue

1. Money Makes The World Go 'Round

2. Waste = Profit

Thanks for stopping by <3

I have to admit I did not read part one or two. But I will go back and read them.

This is a good article and mostly correct, I would like to add a few things for you to think about.

But just in case you didn't realize it I have to say.

Our currency is a NOTE now, not a certificate of gold or silver reserve. All we have is debt, no reserves of gold and silver.

They claim there is gold in Fort Knox? If there was really gold in Fort Knox they would show it to us! But if there is who owns it? Not the Federal Reserve? So just to say unless we have debt notes to pay the debt notes there is nothing to pay the debt. Paying debt with debt is not paying for anything! It is a complete hoax!

If we pay the debt down I.E. balance the budget tomorrow there will be no notes for anyone to spend. We will all be hungry and not be able to buy gas or pay our bills.

The only way to fix the problem is to have a new Note paying off the old note and the problem never ends.

Unless we go back to holding and spending real tangible goods for our services we are doomed to allowing the Banksters to steal our labor.

I have to add Tax and who really gets our tax dollars? Where does it go? Who controls the bank of the debt account? The uS treasury writes checks what account does it come out of?

Another thing is why do they call someone a home owner when the state and county are the ones that own the property since they can take it from you after you pay off the bank note if you don't pay your tax. Do you own the mineral rights on your property? This is another entirely important issue.

Finally I want to say this issue has been a driving force in my life to teach others what is wrong with our world. This is the problem in our world!

The wars are funded and started by the money powers. Companies, Families, countries and tribes are destroyed for them on a whim. Every problem our world faces today other than death and sickness could be resolved if we could destroy this system. ( I don't see blockchain as a solution) I see blockchain as another step in a ever encroaching control of our exchange of services by the criminal banksters.

Think deeply and not emotionally about that.........

Lastly interest is not a new thing it has been around for a long time more than 1000s of years and it was mentioned in the Bible many times but it was rightly called USURY funny how the ones who were forbidden to do it against their own tribe now control the world with it? Very Profound!

If you would like to know how I know what I know just ask. But I have watched many videos and read many books on the subject and have a sense of real logic. Creature From Jekyll Island got me started in 1995.

BTW the cartoon is spectacular is it your work?

Excellent additions, thank you!

Part of my mission on Steemit is to slowly recapture my path in understanding the world around me, and so I have to do my best to not let my more recent insights out of the bag yet. This simply allows readers their own chance to 'catch on' - moving from mainstream ideas to the ones hardly ever mentioned (and then beyond).

I agree there are many aspects yet to be looked at, especially in regards to the old bible narrative and 'the players' involved. It also seems to be yet another smoke screen for the powers behind the Vatican and the corporaicinzg of all aspects of life. Have watched many videos on the subject though not read many books, as I am more an audio video guy where I get the benefit of 'feeling out' whatever is presented. I will definitely benefit from your insights over time following your inputs and thoughts on these issues, thanks for the info!

As far as I'm concerned today - I have a hard time seeing how even all the above information in the post is still accurate. As you said, we are not allowed into Fort Knox, and there is ample speculation and investigation into how much gold actually exists on Earth. It might be way more than we are led to believe in order to uphold certain emergency narratives (the ones we are exploring here, which might still be another level of the fairy-tale for those who looked further).

The crash has been overdue for about 5-10 years, and I get the feeling it will not happen as it should, simply because the mechanisms have quietly been changed behind the scenes (again). Couldn't have done it without Griffon's work for sure.

I wish the video was mine but it's a project by two Americans that goes a while back. It's the best way I know of to relay these things to people new to the subject, as it is entertaining and yet loaded with good information (though as you hinted at not the whole story of course). Been in contact with the creator of the comic for a possible translation but then I started this project which takes up all of my free time now.

Thanks for dropping your thoughts here stan. No need to read part 2, this here was solely focussed on the FED and debt aspect of the machine, the other parts go into the seldom questioned mechanism of free markets and what the profit incentive will do to societies if it is left to run as it will. There are many flaws gravely overlooked by free market proponents, and turning to communism or coll.ectivism within the same scarcity environment is equally inacceptable as an answer.

All the best to you and your family man

Also, I am looking at blockchains very critically. We have to remain vigilant and pay attention. While many tout it as the new fortune to be made, I will make use of it to invest into a place to live in nature. If it came down to the question one day - I would always side with nature as opposed to thought-up and mandatory systems of social organization. We don't need it. Only to realize how wrong it is. In that all these things really do service humanity - offering us a chance to see that we DO NOT WANT go that way.

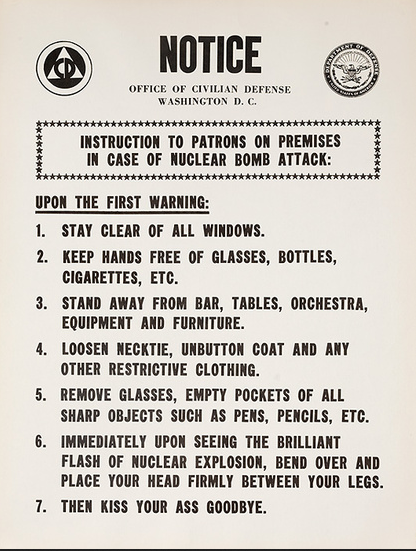

You never cease to amaze me with your thoughtful replies to my questions or thoughts. Things to do in case of a Nuclear Explosion.

Things to do in case of a Nuclear Explosion.

I also agree with you that the banksters have figured out how to crash everything without completely destroying their system.

I think it is because for the USD sake they are milking us completely dry this time. This time they are not only destroying our currency and finance system they also want to completely destroy the American Capitalist system. They are communist at the core but not totally communist because they have only one master they love and follow. GREED.

When they have destroyed the entire world perspective about capitalism, freedom and the ability to think for yourself.

Then they will start the final push, World Government with the seat of that government in Jerusalem. At that point there will be no place to hide. Prepping will be for naught because they will destroy everything in order to obtain that control over everything. The resisters will all be dead first, then the late learners that realize they have been duped.

Its not going to be pretty. I had a poster when I was in elementary school that sums it up.

Source

I think it is good for everything that is coming today even if it is not a nuke. Just sayin!

I will resist and be one of the early causalities. I hope I can raise my sons to lead and not succumb as well. I could say so much more about what I know is going to happen, but it would be fruitless.

The end of life as we know it is nearer everyday.

I hope we have 50-1000 more years.

The biggest measure of that is how fast it will happen..... everyone will slide into unbelief of any thing that is good, pure or sacred. The love of many will wax cold.

When people can easily kill each other by blind obedience to a war machine.

We are so close to that day when no one stands up for his fellow man.

Like rats in a cave with snakes at the exit, will you eat the other rats or be eaten by the snake?

That's the thing - we can't be quite certain that their tools for fearmongering are actually existant. I am referring to the myriad of plausible and unanswered questions to do with nukes at all.

I see many problems with the commonly held narrative and since digiing I do not see nukes as much an issue anymore. And I say this living in a place where the "allies" have allegedly parked hundreds of nukes.

Are you familiar with the lectures of Galen Winsor?

We are headed towards some major climax for sure. I'm just not certain that it will mean the end for freedom on Earth. Guess it comes back to cosmology and worldview - After thousands of years of slavery, artificial scarcity and control systems I would definitely grant myself and my kids 1000 years of peace on Earth. Sitting in yet another prison is not an experience to grow from, considering all we have been through as humanity already.

I know myself - I make things hard but I always make them worth it.

Guess it comes down to the question: Who am I?

I think we can only take along with us the ones you are already looking. I feel sad for the others who probably need that slavery experience because they do not yet dare to look further than the mainstream narrative. And we are running out of time, definitely.

One more thing did you read this https://www.zerohedge.com/news/2018-04-09/indias-big-brother-fingerprint-and-eye-scans-required-food-and-medicine

Coming to a DMV near you, the micro chip will be the final ID.

Looks like the Indian people are being used right now as the world bankers Guinea pigs.

BTW this was paid for/started in India by U.S.A.I.D.

Oh boy.

They banned some of the most commonly used rupi bills last year and now this. It's so odd that this would work in India and especially China - considering the history of insight and things like Zen.

But then, universe seeks balance, so maybe they have to go down that horrible pit now - getting totally involved in the personhood view of it all.

A friend of mine went to India last year and he said it was rather horrible. Spiritual cornerstone of world history and totally and utterly screwed up today...

I never really fully grasped this concept until I watched the movie ETHOS narrated by Woody Harrelson. I understood the concept of fractional reserve banking but not at the level I do now. It has been one of the things I can easily work into a conversation that I am not met with rolling eyes and shaking heads as is common with some of my other "Conspiratorial" views. I guess talking about the full-on lunacy and the completely criminal concept that was set up in this country in the early 1900's is easier for people to believe and accept than some of my other knowledge of what the people that rule over us inundate us with on a daily basis.

What is hard to do is convince people to live within their means. And, to their defense, I understand because at least in this country it is difficult to live outside this system of debt. But if you don't agree with something than you have to find a way to not play into it. Sadly so many are already caught up in it at a level that it would take them the rest of their lives to be free from it.

All someone like that can do is make the choice to pay down their debt and choose to live in a way that meets their needs and is patient for the things that they want. Sometimes when we are patient in the things we want they either come to us in different ways or even better the concept of being patient leads us down the path of re-evaluating what it is that we want; what is really important to our life.

I am convinced that the greatest things in life are free. Life itself is free and precious beyond measure and perhaps we have the ability to fractionally reserve our lives by giving out more goodness than we take in. I can sit back and imagine a world where everyone does that or I can choose simply to live that way everyday and hope it catches on. Sorry if this concept seems a bit vague and I promise one day I am going to sit down and write a blog on the attitude of giving; so much more than a financially minded sense of giving.

No need to apologize, I see your point completely. I have experienced what it's like and it's true. The best things in life are free, and there is always another way to them than the classic path.

I find it important to take little steps towards less and less dependence on the system. And that does take time. I figure: Better a long runup full of detours, than a short runup with no solid backing for arriving... hmmm... hard to put into words right now ;)

Really excited for your post, I feel a lot of people will learn a lot from your inishgt and experience.

Much love

As we speak, I have to move my entire life across the country and postpone a project I love. Why? High-interest debt. Until the system is transformed none of us will be totally free, but trying to live as independently as possible (as well as pushing the use of legitimate cryptocurrency) is a start.

Well I wish you well on your journey and that there shall always be enough for you to do what you want to do. Have often thought about what will happen with the debt. Many people I know have so much debt, but I could see it being slashed just like that when the system can't compensate anymore.

The deeper task seems to be whether we as societies learn from past mistakes before we give consent to a new system with the same mechanisms of slavery. If we do I fear it will be the last round.

Agreed, let's find those legitimate ones. And never stop asking those pesky questions ;)

Cheers for sharing your pain. Followed to see what life has in store for ya ;)

Good luck <3

:) These documentrys planted a seed in my head and changed my whole way of living. I have a lot of respect for this information, that must have been a long post to write up man! Well worth a resteem. Im happy they on the blockchain saved :) Most dont realise that a history that isnt just "his-story" from one side can be saved and publicly open for all. It interests me about the Mandella effect and if its real then its great that we can save documenterys online.. No burning of the books possible!! :)

Fully agreed. I would be nowhere without the Z documentaries and my time doing activism for a resource-based economy. That said, I have found many of my fellow activists to be very dogmatic in their own way about issues that became very important to me.

Eventually I had to make a choice... and left the movement. One of the best choices ever. Despite all the movement's grasp on so many fundamental issues, there are certain routes essential for me to walk that most Zeitgeist crews won't, because of ideology.

I wish all movement crews well and am really happy they are still doing their thing. That said, my journey has greatly continued ever since and I barely recognize my views about reality from back then because of further research and experience.

The Mandela effect hypothesis is a great example. While I can imagine many in the movement having noticed these ideas, I can tell you that it does not fit the worldview presented and will hence not be adopted by the mainstream within the movement. Which is ok, until we have actual proof. Then the matter always becomes what prestiguous journal has said that it is proof. If no such journal or outlet has said so - it isn't. Which to me is in stark contradiction to the mindset of an actual scientist. But that's all for another chapter at the end of the series.

I still find TZM's system analysis and radical approach to rethinking life on Earth to be extremely valuable for a better understanding of our situation. I just constantly advise people to not get stuck there for too long. Reality - whatever it is - is much crazier than any of us had assumed. And there is a myriad of solid evidence for it.

Thanks for dropping your feedback dude, it means a lot!

Impressive story about the history of money. I think the fractional reserve banking system is one of the most impressive developements in modern times, that and double entry book-keeping. It has literally made some of us extremely wealthy and has created an army of somewhat well paid bureaucrats. Certainty beats susistance agriculture.

There simply isn't enough gold or silver to go around for everyone. I don't think cryptocurrencies are the solution either, new ones will be created and there are constant forks. Eitherway, I like me some physical metals along with income producing assets to hedge against inflation.

Upvoted and followed

I agree, "crypto" in itself will not address these issues. Especially as long as the dollar is held to be a stable entity. While I would go for precious metals, the smartest option to me at this time seems to be to invest crypto in some land and a sustainable place to live - then become fully self-sustainable and build networks of people and skills.

Glad you reached out, followed you back because I like free thinkers a lot.

Thanks for dropping your thoughts.

Very well thought out and thorough article. One thing I should mention is that during my research I found that it appears that there is no fractional reserve requirement so it really shouldn't even be called fractional reserve.

I now just call it debt based money.

Check out the sources and youtube video in this article:

https://steemit.com/politics/@canadianrenegade/oszi10wr

Hmm. It appears that my second source, Money Creation in the Modern Economy has been memory holed.

Excellent comments. I really gotta say that something seems completely off after all these years. We have technically been overdue for the crash of the dollar for - what - 6-8 years. And though we allegedly come close to economic collapse now and then, everyhting is still going. Seeing how all numbers are lastly numbers in a computer, I do not put it beyond the people in "control" that they have long found another mechanism for keeping the system going.

So it only seems likely that the reserve would have to go entirely eventually ^^

Great to hear - when information blatantly disappears it's always a good sign. I shall dig, thanks!

I had some other sources that were pretty good that I did not include in the article. I will see if I can still find them jotted down somewhere.

No need for extra work. I have a feeling reality is actually different than even these ideas here. Since most money is digital nowadays and since we can not know for certain how much gold exists on Earth, we really don't know anything.

These explanations in the post are but one step further from what people in the mainstream believe to be true. It may just turn out to be another story to keep the ones pacified who looked further than the evening news. Which I will get to in the near future with my blog.

much love!

You may be right, it could all just be BS and they could just put whatever they want in a computer. Anyway I did find the article. It is from the Bank of England. So if you are looking for a primary source document.

https://www.monetary.org/wp-content/uploads/2016/03/money-creation-in-the-modern-economy.pdf

Curated for #informationwar (by @wakeupnd)

Relevance: Sharing the truth

thanks <3