# Knock Knock, Who`s there? The Mother of All Bubbles!

I will try my best to keep it as simple as possible for non-economists to digest completely, this should give us a fast and summarized idea of global upcoming economy so we might choose how to act accordingly and to be prepared.

Kindly note, although this is based on facts and charts, it remains within my own prediction and doesn`t mean concrete reality.

Intro

Throughout history, there have been many known financial bubbles, started with Tulip bubble in Netherlands during 17th century, where one tulip was costing almost a month wage, continued periodically until current times. However, what is noticeable is the shortening of the periods separating bubbles mainly due to the new monetary systems.

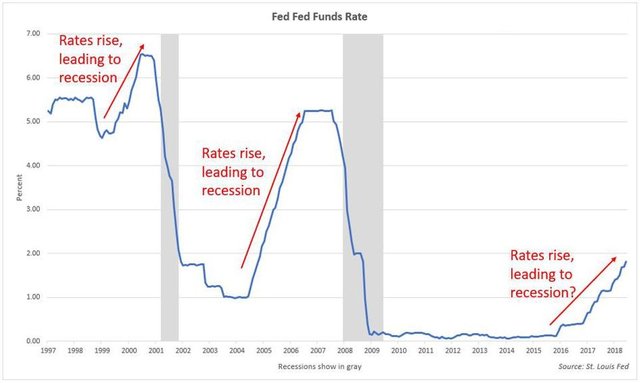

We all remember the 2008 housing bubble. It is so fresh that we still have it in mind, and some might believe we still living its consequences. What caused it is mainly overpriced houses that was built based on loans mainly, then the correction moves came and bubble burst. So, central banks and federal reserves tried to uplift the economy and moving it by lowering the interests mainly, and this is very related to what we are about to see.

USA

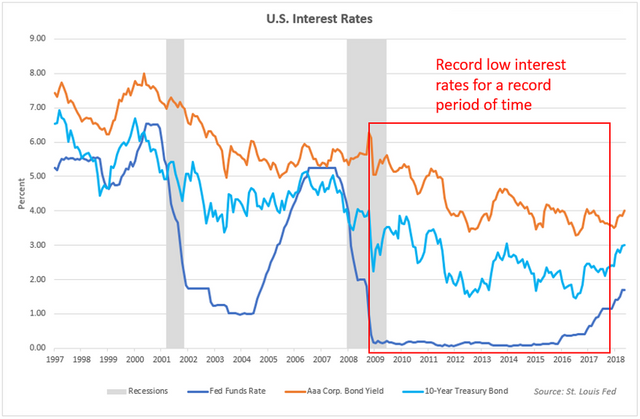

From 2009 to 2016, the interest rates were very low in order to push for the economy, what does that mean, is that it was easy and less worrying to take a big loan to do businesses, buy houses, stocks etc. So, basically buying things with money you don`t own with ease.

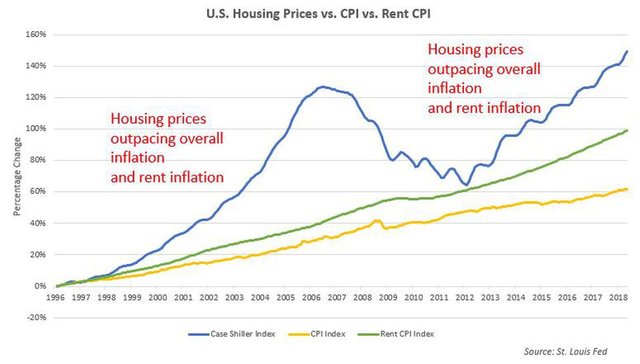

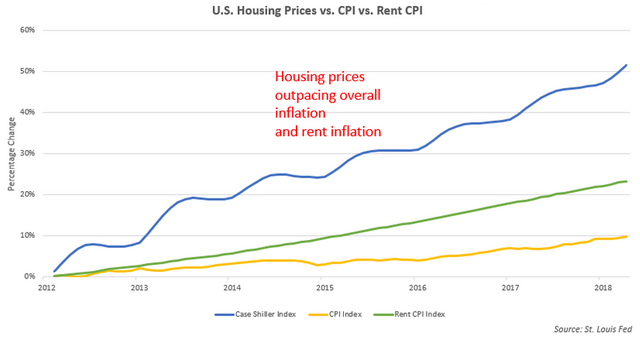

This push for the loans was translated into inflation of housing prices, where it is now matching the prices at 2006. While this increase does not match the inflation in either rent or general costs.

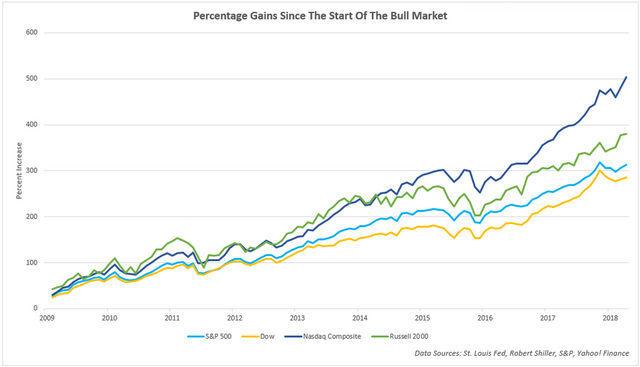

Another main aspect that the loans translated to is the stock market and corporate debt. It became the trend to loan money at such cheap rates and invest it by buying and holding to stocks. Let us look at some charts for the S&P 500 (Top 500 companies in USA) and how the rise in stock value looks like since the last bubble.

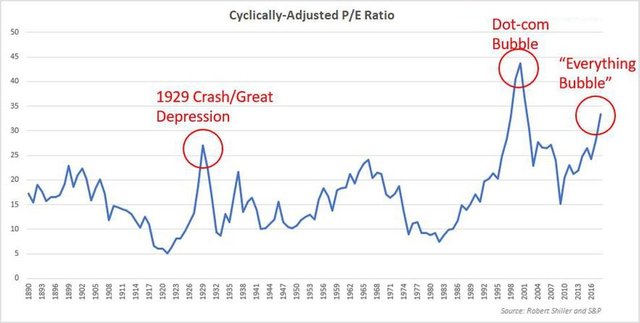

The value is much higher than even what is known as Dot-Com Bubble (the internet bubble at early 2000s). Dow and Nasdaq are high & even higher in their gain percentages

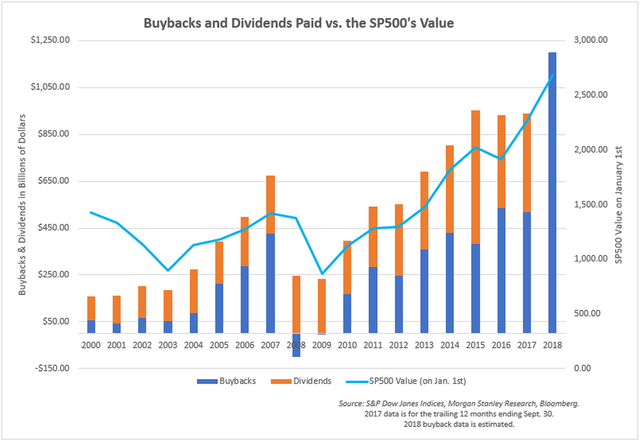

All of these data bill an alarm as this is mostly loaned money, many of the companies were even buying their own shares for different reasons (buybacks), as the following chart shows

also, dividends (amount rewarded per share for holders) were increased substantially, Any similarities with 2007 rise?

That low interests caused the total outstanding nonfinancial U.S. corporate debt to be surged by 40% from its peak at 2008 & caused total outstanding U.S. corporate debt to rise to over 45% of GDP.

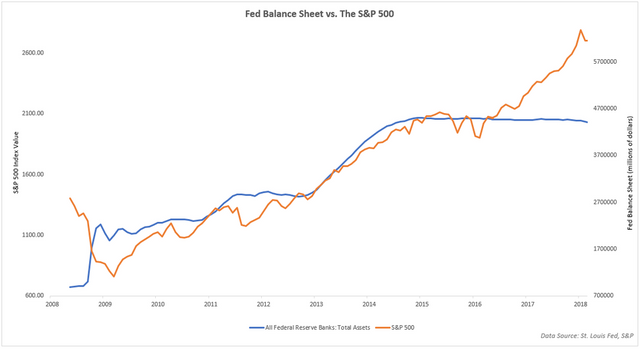

Not only lowering the interest rates, but the Federal Reserve created systemically since 2009 money out of air in digital form (Quantitative Easing – QE), and used it to buy treasury bonds & other assets. Which of course increases the bond prices and lowers bond yields (amount of return an investor realizes on bond).

As this can not go on forever, and in order to protect the currency of US Dollar, Central bank & Federal Reserve started to counteract by increasing the interest rates seven times in the past 22 months and is expected to increase it 5 more times in upcoming 15 months. Also making Quantitative Tightening (QT) by shrinking their balance sheet by 40$ each month. That is one of reasons why US $ has been on continuous rise lately.

What does this mean? It means that it will be more difficult to get new loans. It means that the conditions that created the current bubble are not anymore there and most likely will lead to its burst. Let`s see how did that work before and compare it to now:

If you believe history repeats itself, and it does usually, then you will get the point here. However, we expect to have flatting liner before the dip.

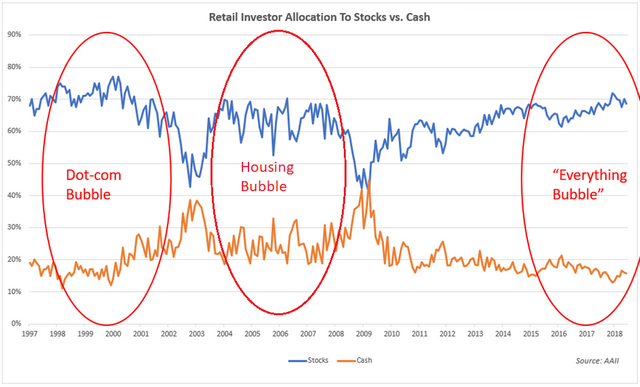

To explain more about the dangerous trend, we can look at the allocation of investors toward stocks vs the cash holdings.

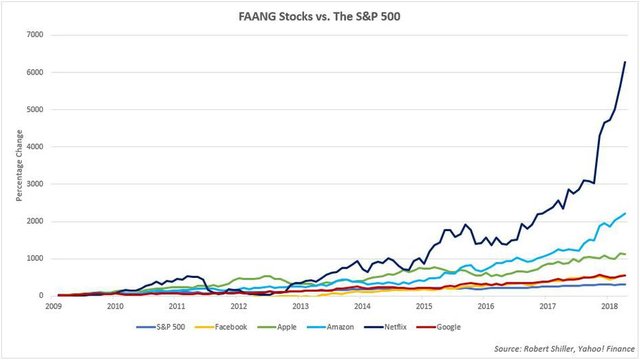

This might indicate the repeat of crash in stock market of internet companies at early 2000s, but this time, it will not be limited to the internet companies, let`s take a look at the rise in top five companies known as FAANG:

This is 1000% indicator. I.e. companies such as Netflix has grown by 6000% since 2009. The question remains when it is expected to happen? Until now it is in warning phase. The following indicator predicted accurately each bubble bursts happened earlier

It is unknown how it will start or what will start it, is it the housing or the stock market? Is it something else? Will it start in the US or outside and the US will follow? Most probably the current US government will try its best to keep it steady until the next elections.

What it means?

If someone is having a house valued 200,000$, all the sudden he might lose big % of that money and the same house he owns might become 120,000$ (as examples). If the investor is holding a million in stocks, and these stocks lose half of its price (as example), then he is half his fortune and half the amount he can spend or invest. Not to mention that the loan will still be running and needs to be paid. Those who took loans to make housing projects will be forced to reduce the prices and sell it just to meet the loans. Same goes for the stock, and some of those investors will be investing in both. In general, there will be less money to be spent on almost everything. That`s why it is predicted to be everything bubble, it combines the previous bubbles (stocks and housings), and can extend to many other aspects related directly or indirectly to them, which is almost everything.

Canada

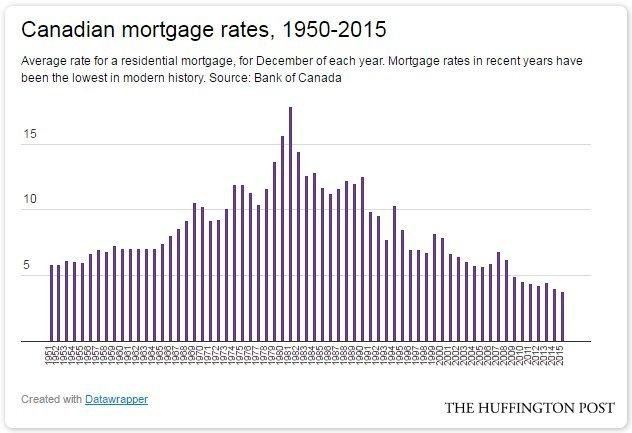

In 2008, Canada was not that much affected as the debt and housing loans were very minimal, however now, it is not the case anymore.

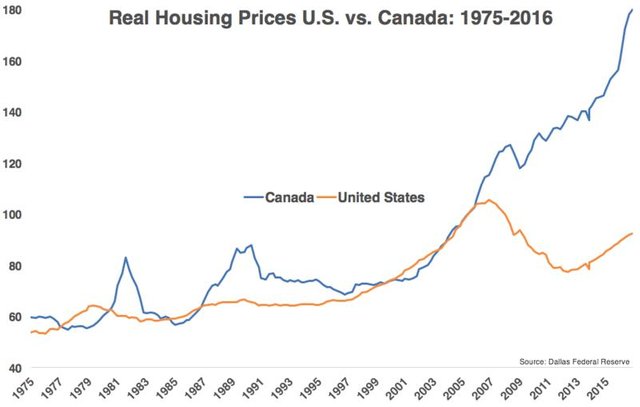

The previous low rates for years in Canada made the housing prices to boost steadily way more than the US.

Unlike US, Canada has 5 years debt balloon system (I.e.) rates can be adjusted for current loans. Canada recently increased the interest rates and probably will continue to, and the housing prices already are higher than the capabilities of most people. Prices are currently starting to fall in Toronto and Vancouver. Unlike 2008, Canada will probably hit by harder bubble than the US (at least in the housing sector)

Europe

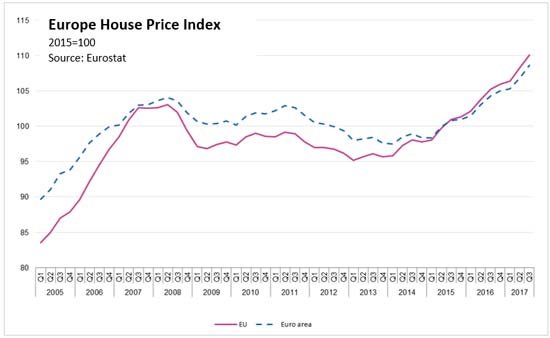

European Central Bank (ECB) policy kept the interest rates low, this led to increase in prices of houses especially in north and west Europe. Since 2013 the population has grown by 2%, consumer goods by 3.4% while housing by 16%. When housing prices are grown 5 & 8 times more than the other two, this is an indication of bubble forming.

Not only ECB lowered interests, but also made negative interests (penalties) on liquidity at banks, in order to boost economy, which pushed all companies to reinvest their money, or buying assets etc. that`s why the companies did not run for loans.

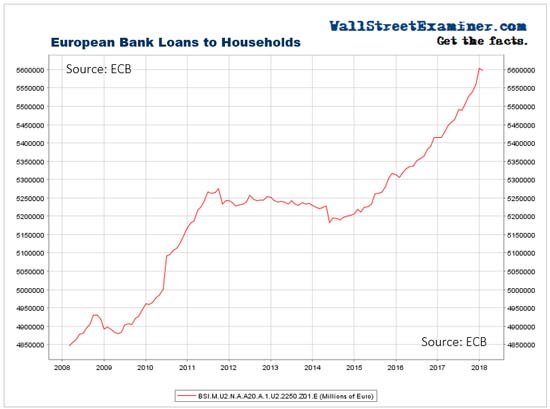

Unlike households’ market, which is total opposite:

It also introduced (QE) system to boost liquidity.

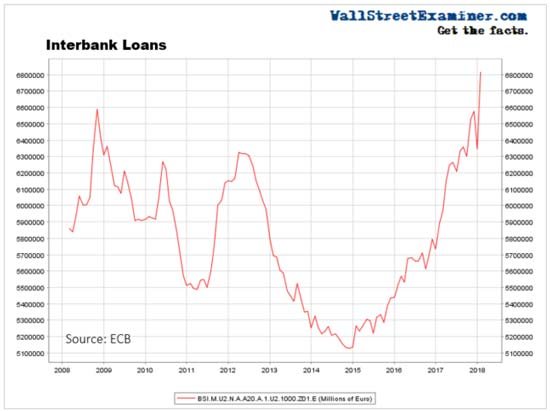

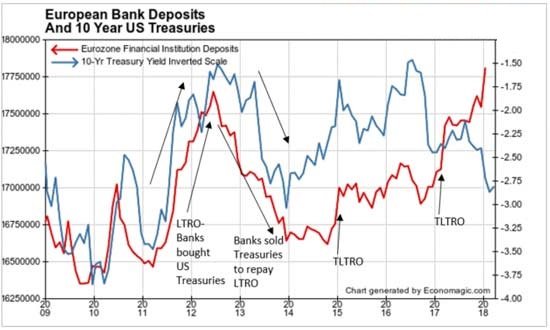

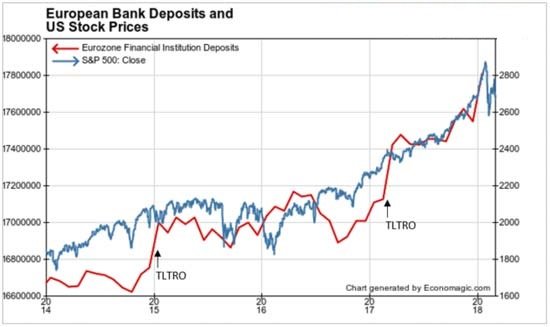

Meanwhile, it created a program called TLTRO in 2016, which gave incentives for the banks to take loans from ECB & loan it back to others. Since the companies are not so interested in loans, the banks found a way to do it, they lent each other!

Almost with Trillion $ last year in loans. And what they will do with this money they loaned? They bought mostly US treasury bonds (remember the US segment above?).

Now the ECB will increase the rates soon, and the banks started paying back the TLTRO loans few months ago, and ECB is draining liquidity with an average of 50 billion Euro per month. All of this will lead mostly to the anticipated decrease & bubble burst of housing inflation, while forming a loop with bubble burst in US and its stocks which will affect directly on the banks of Europe, which will push the ECB for drastic measures. This could lead to stressful situation for the governments and their spending. However, I expect this to take longer time as the increase in interest rates has just started.

China

China & Hong Kong has been growing and expanding aggressively during last decades, with housing built and boomed to match with economical growth. For example, by end of last year, the median price per square in china is 38% higher than that in US (according to SouFun Holdings Ltd 100 cities price index). At the same time, the median per capita income is higher by more than 700% in US.

The government tried to intervene by late 2016 to counter the rapid rise in houses by introducing major changes, such as tightening the loans and unoccupied property taxes, which slowed it down. However, it is still high prices compared to income and rents (estimated at 1.5% of value)

Due to the rapid expansion, and with the possible trade wars on global economic system, it is expected for china to face hard bubble in housing. I wouldn`t be surprised if the mother of all bubbles started form China houses and continued its chain worldwide.

Turkey

Due to many factors including political penalties, the Turkish economy has been struggling lately. Where the housing bubble have been bursting slowly even before mainly due to the huge number of projects built by loans. The Turkish giant companies favored the loan approach in most of their activities. That is why it became more difficult for them once the Lira fell down.

I expect the housing to be affected more if the mother of all bubble bursts, although in less extent due to the current slow in that segment recently.

Countries such as Syria and Iraq, once stabilized politically, can be good import market for Turkish products which should boost the economy at that time. Recently the finance minister declared new reforming plans for next three years which sounds reasonable. Although, it is ridiculous to assume that the economy will heal magically in a short time.

Prediction

As with all previous bubbles, and taking into consideration the strength of this one, it is expected to have mainly shortage in financial powers at individual (and possibly corporate) levels. The person or entity having a worth of “X” will in short time have less value if it was invested in affected areas.

The famous strong currencies will start to fall down as the economy will slow, the value of storing assets such as gold and silver will mostly rise in price accordingly. The same is expected for cryptocurrencies as well, as more and more affected people will lose trust in classic fiat system.

I predict for this bubble to be compared to great depression more than the previous two. However, with such wreckage comes opportunity. It can form an interesting time for ready investors to grab a real good and promising deals. Industries dealing with basic needs such as food and health will be less affected compared to luxurious ones.

Last but not Least

The point was to give brief expectations based on facts and charts. Still, this falls in prediction stage and might not happen at all, although I believe it will mostly do. These prediction didn`t consider unusual events, such as failure of Brexit which will accelerate the bubble in UK & Europe. Wars if any (may God forbid) and so on.

This is not meant to discourage any one, it is more about being realistic so we can prepare and plan accordingly. I believe bubble times are the best times to invest and to prepare for the post bubble stage.

Disclaimer: This is just personal prediction and opinion and is not meant to be seen as professional economical advice, therefore no liability in any form should be held by the owner for any consequences what so ever related to this article.

References:

https://www.forbes.com/sites/jessecolombo/2018/09/05/disaster-is-inevitable-when-americas-stock-market-bubble-bursts/#104084cb1b82

https://www.forbes.com/sites/jessecolombo/2018/08/29/the-u-s-is-experiencing-a-dangerous-corporate-debt-bubble/#1d909a99600e

https://www.forbes.com/sites/investor/2018/08/10/investors-watch-out-for-the-real-bubble/#4e0b60d5d024

Most of charts and its comments in the US section are courtesy of https://realinvestmentadvice.com/

https://seekingalpha.com/article/4187505-forget-united-states-real-housing-bubble-canada?page=4

https://seekingalpha.com/article/4197056-8-measures-say-crash-coming-time?page=5

https://suremoneyinvestor.com/2018/03/heres-how-europes-housing-bubble-could-kill-your-portfolio/

https://www.globalpropertyguide.com/Asia/China/Price-History

https://www.bloomberg.com/view/articles/2018-06-24/why-china-can-t-fix-its-housing-bubble

https://www.cnbc.com/2018/09/20/dick-bove-theres-a-global-currency-crisis.html

@nidalion, I gave you a vote!

If you follow me, I will also follow you in return!

I upvoted your post.

Keep steeming for a better tomorrow.

@Acknowledgement - God Bless

Posted using https://Steeming.com condenser site.

Hi

What do you think of Steem now? Do you think it has bottomed?

Do you think Bitcoin bottomed?

Thanks