Flattening yield curve and WHY you should PAY ATTENTION to it

For your consideration.

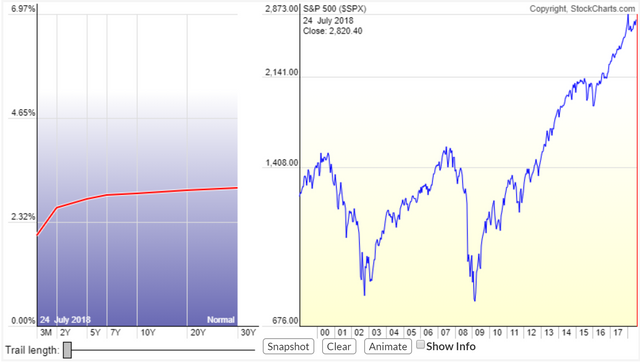

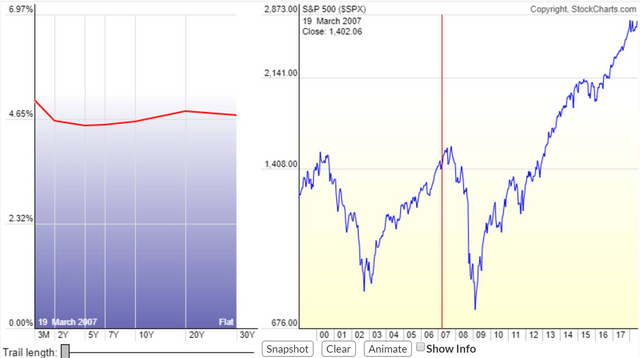

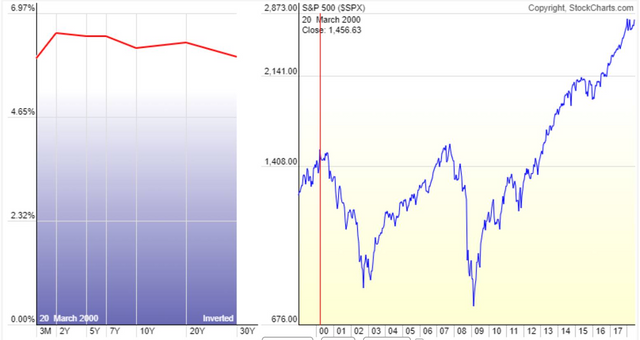

These three charts are the yield curve today (2018), 2007, and 2000. Look closer. Really close.

- The yield curve between the 10yr and 30yr US Treasury is flattening in all three charts.

- The 2000 and 2007 yield curve inverted each within a year of a major financial crisis.

- The 2000 yield curve inverted at rates between 5% and 7%

- The 2007 yield curve inverted at rates between 4% and 5%

- The current yield curve has not inverted yet. If it does, it will invert at rates between 2.5% to 4%.

- The yield rates of each inversion gets lower each proceeding economic crisis

- There will be little room for the U.S administration to lower interest rates in order to protect against some monetary hiccup should something occur. The prior two U.S. administrations (Bush and Obama) lowered interest rates after each financial crisis they inherited.

- What’s left after 0% is negative interest rates and then more quantitative easing.

- The current debt load of the U.S. government is $21 Trillion Dollars.

- The current U.S. unfunded liabilities is $113 Trillion Dollars.

- Let's be real for a moment. How the are they going to pay for this in the face of rising interest rates?

- Who really knows what economic moment will cause a problem or will be a problem at all. However...It is my opinion that it is long overdue for each of us to vacate the slumbering voices and trees among us and instead turn our conversations toward the sober and vigilant.

“The rich ruleth over the poor, and the borrower is servant to the lender..”

Proverbs 22:7

Thank you for reading. I welcome all thoughtful opinions and rebuttals. Please look at the charts.

Congratulations @moneyuncensored! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!