Why YOU maybe should overthink your asset-strategy on stock market - Part #3

Here comes the continuation of the two previous posts about the current market situation.

Another important reason for the divergence of the S & P 500 and the "FANG" adjusted is the current situation in the retail sector. In the United States, the Amazon effect is clearly noticeable. The country has never experienced such a tsunami-like wave of store closures in its history. In Europe, the extent is still far from visible. Only in May 2017, 80,000 people lost their job in retail sector. Even the situation in the Depression of 2008-2009 was not so bad.

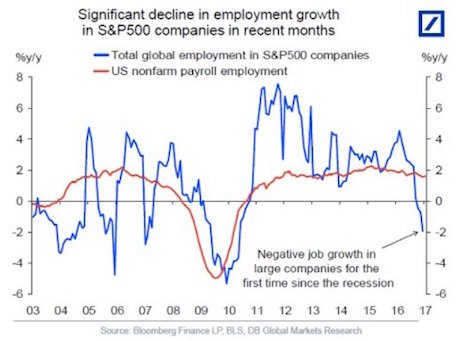

Indicator: Job growth

The following chart (Sorry, I coudn´t find one for 2018) shows the negative job growth since 2016. The relation to 2008/2009 comes very clear.

The resulting lack of jobs and lack of prospects leads to declining tax revenues of the states and to loans that can no longer be served due to this situation. What a large number of bad loans can bring to the economy, we saw very clearly in the real estate bubble.

Indicator: small indices

An interesting development just before a major correction or crash comes, we can see on small indices. In the German financial sector, for example, it is the MDAX or the SDAX. While the DAX gained about 17% in the last year before its peak at around 13,500 points, the small numbers rose by more than 30%. Similar things could be seen before 2008. The current political situation does not even flow into the considerations. The announced trade war between the US and China would only work as an additional accelerator.

The current market environment is artificially inflated and manipulated by the interest rate and money pressure policies of the states and central banks. The current ratio of central bank consolidated total assets to the global bond and stock market is 1:15. That's absolutely sick.

They say: Invest when blood flows on the streets. And that's exactly what I want to tell you. Find out about your current investments, if you are invested. Are you not invested? then inquire how you can earn on an (possibly) upcoming bear market. The biggest index in German Stock Exchange is already in its correction and dropped 15% only this year.

I´m not a financial advisor nor will I give any advices. If you´re interested and INVESTED, inform yourself about the current situation.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

Congratulations @mickal! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard: